Reliance AGM 2025: Key Announcements and Impact on RIL Share Price

The Reliance AGM 2025 has once again captured investor attention with major announcements impacting telecom, retail, and energy. Here’s a detailed analysis of its highlights and the effect on RIL share price.

Table of Contents

Overview of Reliance Industries 48th Annual General Meeting

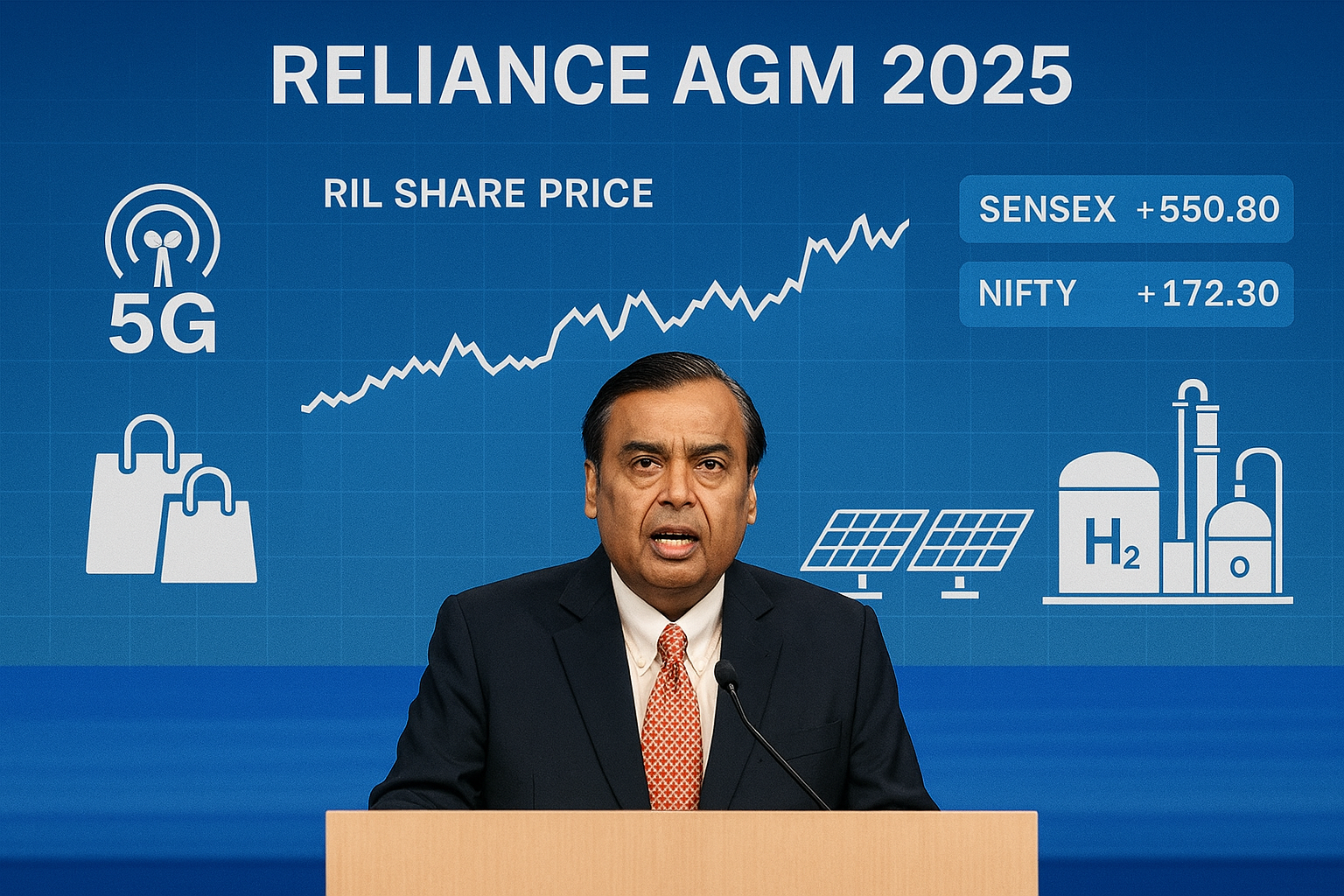

On August 29, 2025, Reliance Industries Limited (RIL) conducted its 48th Annual General Meeting at the Jio World Convention Centre in Mumbai. The event attracted participation from over 3.2 million shareholders through virtual and in-person attendance. Chairman Mukesh Ambani presented strategic plans spanning telecommunications infrastructure, renewable energy initiatives, retail sector expansion, and technology integration.

The company’s stock experienced trading volatility on August 29, 2025, with an intraday price movement of 3.7% before closing 1.9% higher. Trading volumes reached 180% of the monthly average, indicating heightened investor interest in the announcements. As of August 2025, Reliance Industries maintained a market capitalization exceeding ₹19 lakh crore, positioning it as India’s largest private sector enterprise by market value.

This analysis examines the major announcements from the AGM, their implications for various business segments, financial performance indicators, and potential market impact. All information presented is based on company disclosures, regulatory filings, and verified market data as of November 2025.

Background: Reliance Industries Corporate Profile and Market Position

Reliance Industries Limited operates as a diversified conglomerate with business interests in petrochemicals, refining, oil and gas exploration, telecommunications, and retail. The company was founded in 1966 as a textile manufacturer and has evolved through strategic expansions and acquisitions to become a major player across multiple sectors.

Business Segment Overview

Oil-to-Chemicals (O2C) Segment: This segment includes petroleum refining, petrochemical manufacturing, and oil and gas exploration operations. The company operates refining facilities in Jamnagar, Gujarat, with significant processing capacity and petrochemical integration.

Digital Services (Jio Platforms): Launched commercially in 2016, Reliance Jio provides telecommunications services including mobile connectivity, broadband, and digital applications. As of June 2025, the platform reported approximately 480 million subscribers across India.

Retail Operations (Reliance Retail): The retail segment operates over 18,500 stores across various formats including grocery, electronics, fashion, and specialty retail. The division has expanded through both organic growth and strategic partnerships with international brands.

New Energy: This emerging segment focuses on renewable energy projects including solar manufacturing, green hydrogen production, and battery storage systems, representing the company’s strategic pivot toward sustainable energy solutions.

Financial Performance Context

For the fiscal year 2024-25 (ended March 31, 2025), Reliance Industries reported consolidated revenues across all segments. The O2C segment contributed approximately ₹6 lakh crore, while Jio Platforms generated ₹1,14,500 crore, and Reliance Retail achieved ₹3,15,000 crore in revenues. Operating cash flows for FY2024-25 reached ₹1,45,000 crore, supporting capital expenditure programs across business divisions.

The company maintained a net debt position of ₹1,25,000 crore as of June 30, 2025, representing a net debt-to-equity ratio of 0.18x. This conservative leverage profile provides financial flexibility for growth investments while maintaining investment-grade credit ratings from major agencies.

Major Announcement: Jio 5G Network Expansion Plan

One of the primary announcements concerned the expansion of Jio’s 5G telecommunications network. The company stated plans to extend 5G coverage to 1,000 Indian cities by December 31, 2025, expanding from approximately 700 cities covered as of August 2025.

Infrastructure Investment Details

The expansion involves deploying over 100,000 additional 5G base stations across tier-2 and tier-3 cities. Capital expenditure for this expansion in the second half of 2025 is estimated at ₹35,000 crore. The network utilizes standalone 5G architecture, which operates independently from legacy 4G infrastructure.

Technical specifications indicate average speeds of 500 Mbps with latency under 20 milliseconds. The deployment strategy focuses on cities with populations between 100,000 to 1 million residents, where smartphone penetration has exceeded 65% but advanced network infrastructure remains limited.

Market Share and Revenue Projections

Financial analysts have revised revenue forecasts for the telecommunications segment following this announcement. Projections indicate potential revenue growth from ₹1,14,500 crore in FY2024-25 to approximately ₹1,35,000 crore in FY2025-26, representing 18% year-on-year growth.

Market analysis suggests Jio could achieve over 45% market share in the 5G segment by March 2026. Average revenue per user (ARPU), which stood at ₹195 in Q1 2025-26, is projected to increase to ₹215 as subscribers migrate to higher-value data plans.

The expansion creates infrastructure for enterprise applications including smart city solutions, industrial IoT implementations, and cloud gaming platforms. The low-latency network enables deployment of AI-powered services, telemedicine platforms, and augmented reality applications across the Jio ecosystem.

Competitive Landscape Analysis

The telecommunications market in India features Reliance Jio and Bharti Airtel as primary competitors following industry consolidation. Jio’s expansion plan targets 1,000 cities compared to Airtel’s reported target of 700 cities by the same timeframe.

Subscriber metrics as of June 2025 show Jio with 480 million customers versus Airtel’s 395 million. Monthly subscriber additions average 7-8 million for Jio compared to 4-5 million for Airtel. Customer churn rates stand at 1.8% for Jio versus 2.4% for Airtel, indicating relative customer satisfaction levels.

EBITDA margins differ slightly between competitors, with Jio reporting 49% and Airtel achieving 52%. The margin differential reflects different customer mix compositions, with Airtel maintaining strength in postpaid and enterprise segments that generate higher per-user revenues.

Green Energy Initiatives: Renewable Power and Hydrogen Production

The AGM included substantial announcements regarding renewable energy investments, representing a strategic diversification from traditional hydrocarbon-based businesses. The green energy segment encompasses solar manufacturing, green hydrogen production, and battery storage systems.

Solar Manufacturing Capacity Development

Reliance announced the commissioning of an integrated solar photovoltaic manufacturing facility in Jamnagar, Gujarat, scheduled to begin production in January 2026. The facility will have initial annual capacity of 10 gigawatts, producing solar modules, cells, wafers, and polysilicon.

Capital investment in this facility exceeds ₹75,000 crore. The vertical integration across the solar manufacturing value chain aims to achieve production costs 15-20% lower than international competitors through automation and operational integration. Capacity expansion to 20 gigawatts by 2028 is part of the stated roadmap.

India’s solar energy targets require adding 280 gigawatts of capacity by 2030, creating domestic demand for approximately 50 gigawatts of annual module production. Domestic manufacturing capacity addresses current dependency on imported solar equipment while supporting government initiatives for local production.

Green Hydrogen Production Plans

Green hydrogen production received emphasis as a strategic focus area, with targets to become a cost-competitive producer by 2027. Investment allocation of ₹80,000 crore over three years covers electrolyzer manufacturing, renewable energy integration, and distribution infrastructure development.

Production targets aim for 1 million tonnes annually by 2030, primarily for internal consumption in refinery and petrochemical operations. This substitution would reduce carbon emissions by approximately 10 million tonnes annually while potentially providing cost advantages as carbon pricing mechanisms evolve.

Partnerships with European industrial groups and shipping companies were announced to develop hydrogen applications in sectors where emission reduction remains technically challenging. Management projections suggest potential export revenues exceeding $5 billion annually by 2030 from hydrogen-related activities.

Battery Energy Storage Systems

Battery manufacturing plans include development of lithium-ion battery cells and battery management systems. Annual capacity of 50 gigawatt-hours targets the growing electric vehicle market and grid-scale storage requirements.

Lithium supply agreements with Australian mining companies have been secured to support production requirements. Research facilities are developing proprietary battery chemistry to optimize performance characteristics and production costs.

The battery manufacturing initiative creates potential synergies with renewable energy operations and positions the company for potential entry into electric mobility solutions in future periods.

Financial Implications and Valuation Considerations

The renewable energy initiatives require substantial capital investment with longer gestation periods compared to traditional business segments. While near-term revenue contributions remain minimal, projections suggest the segment could generate ₹75,000-1,00,000 crore in annual revenues by FY2029-30.

Valuation analysis by research firms estimates the green energy business value at ₹2.5 to 4 lakh crore based on comparable global renewable energy companies and discounted cash flow projections. This value represents future potential rather than current earnings contributions.

The capital-intensive nature of these investments raises questions about optimal capital allocation and return timelines. Management emphasizes that strong operating cash flows from existing businesses provide funding capacity without requiring significant leverage increases.

Retail Sector Expansion and FMCG Entry Strategy

Reliance Retail announced plans to expand its product portfolio and strengthen its position in India’s consumer goods market. The initiatives include private label product launches, digital commerce platform enhancements, and fashion retail expansion.

Private Label FMCG Product Development

Plans to launch over 700 private label products across food, personal care, home care, and grocery categories by March 2026 were announced. These products will be positioned to offer 20-30% price advantages compared to branded alternatives while maintaining quality standards.

Investment of ₹12,000 crore in food processing facilities, warehousing infrastructure, and quality testing facilities supports this backward integration strategy. Private label products typically generate 400-500 basis points higher margins than third-party branded products due to elimination of brand marketing costs and direct manufacturing control.

India’s FMCG market, valued at $110 billion in 2025 with 12% annual growth, represents a significant opportunity. Market share projections suggest potential capture of 6-8% within three years, generating incremental revenues of approximately ₹50,000 crore.

The strategy leverages Reliance Retail’s existing distribution network of 18,500+ stores, providing immediate shelf space and customer access that new FMCG entrants typically require years to develop.

JioMart Digital Commerce Evolution

The JioMart platform, serving 15 million monthly active users as of August 2025, targets expansion to 100 million users by December 2026. Planned enhancements include improved user interface, faster delivery networks, and deeper inventory integration with physical stores.

A “new retail” model allows customers to order online for store pickup within 90 minutes, or browse in-store with home delivery within three hours. This hybrid approach utilizes the extensive store network as fulfillment centers, reducing last-mile delivery costs by 40% compared to pure e-commerce models.

Plans to onboard 10 million small businesses, neighborhood stores, and local merchants onto the JioMart Partner platform by March 2027 create a B2B ecosystem. Services include inventory financing, logistics support, and digital payment infrastructure.

Fashion and Lifestyle Segment Growth

Reliance Brands, operating premium international fashion labels in India, announced partnerships with 15 additional global brands. Plans include opening 200 exclusive brand outlets across 50 cities by March 2027, targeting India’s expanding affluent consumer segment.

The fashion vertical contributed ₹35,000 crore to retail revenues in FY2024-25 and is projected to grow at 25% annually as discretionary spending on branded apparel and lifestyle products increases among Indian consumers.

Retail Segment Financial Performance

Reliance Retail reported consolidated revenues of ₹3,15,000 crore for FY2024-25, representing 27% year-on-year growth. EBITDA margin of 8.2% is expected to expand to 9.5% by FY2026-27 as private label penetration increases and operational efficiencies materialize.

The retail segment provides stable cash flows with asset-light expansion opportunities through franchising arrangements. Industry comparisons show Reliance Retail trading at approximately 1.8x price-to-sales, representing a discount to global retail and e-commerce comparable companies.

Capital Allocation and Shareholder Value Initiatives

The AGM addressed capital allocation policies, dividend distributions, and potential share buyback programs. These announcements carry implications for investor returns and market sentiment.

Dividend Policy Update

Reliance announced a final dividend of ₹10 per share for FY2024-25, bringing total dividends to ₹18 per share for the year. This represents a 12.5% increase from the previous year’s dividend distribution.

Based on the August 2025 share price, the dividend yield approximates 0.6%. While modest compared to some large-cap companies, the consistency and growth in absolute dividend amounts reflect cash generation capabilities across business segments.

Management indicated that dividend payouts would continue growing in line with earnings, providing income-focused investors with predictable returns over time.

Share Buyback Consideration

The board’s decision to evaluate a share buyback program for potential execution in FY2025-26 generated significant market attention. While specific amounts and timelines were not disclosed, the announcement signals management consideration of capital return mechanisms beyond dividends.

Market participants estimate a potential buyback of ₹30,000 to 50,000 crore as feasible given the company’s financial position, representing 1.5-2.5% of market capitalization. Such a program would provide price support while improving return on equity metrics.

Historically, Reliance has allocated capital primarily toward growth initiatives rather than buybacks. The consideration of a buyback program may reflect management assessment that current market valuations do not fully reflect intrinsic business value.

Balance Sheet Strength

The AGM presentation highlighted net debt of ₹1,25,000 crore as of June 30, 2025, representing a net debt-to-equity ratio of 0.18x. This conservative leverage provides substantial capacity for funding growth initiatives while maintaining financial flexibility.

Operating cash flows of ₹1,45,000 crore in FY2024-25 comfortably covered capital expenditures of ₹95,000 crore across all business segments. The strong cash generation enables funding of green energy projects without requiring significant leverage increases.

Credit ratings remain at AAA/Stable from domestic agencies, enabling access to low-cost capital. Recent international bond issuances at spreads of 80-90 basis points over US Treasuries reflect global investor confidence in the credit profile.

Artificial Intelligence Integration Strategy

AI technology integration across business operations represented a forward-looking element of the AGM announcements. The strategy encompasses telecommunications network optimization, retail personalization, and energy sector applications.

Jio Brain AI Platform Development

The “Jio Brain” initiative develops a comprehensive AI platform to power applications from network optimization to customer service automation. The platform leverages data from 480 million subscriber interactions to train language models customized for Indian languages and contexts.

Investment of ₹18,000 crore in AI infrastructure over two years includes data centers with GPU clusters for computational processing. This infrastructure supports internal applications while potentially enabling AI-as-a-service offerings to enterprise customers.

Network applications include predictive maintenance reducing downtime by 60%, personalized content recommendations increasing engagement, and fraud detection systems enhancing security. These implementations deliver cost savings and service quality improvements.

Retail AI Applications

AI strategy in retail focuses on personalization, inventory optimization, and supply chain efficiency. Computer vision systems deployed across stores enable automated checkout experiences, reducing wait times and labor costs.

The AI-powered recommendation engine on JioMart analyzes purchase histories and browsing behavior to suggest products, achieving conversion rates 3x higher than generic recommendations. As the user base scales, network effects increase platform value for consumers and merchants.

Demand forecasting models incorporating AI have reduced inventory carrying costs by 15% while improving product availability by 20%, directly impacting working capital efficiency and customer satisfaction.

Energy Sector AI Implementation

In refining and petrochemical operations, AI applications optimize processes, enable predictive maintenance, and improve yields. Estimated energy consumption reductions of 8% across facilities generate annual cost savings exceeding ₹3,500 crore while supporting sustainability objectives.

AI-powered trading algorithms optimize crude procurement, product pricing, and risk management, improving realized margins. While improvements may appear incremental, their cumulative impact on high-revenue business segments creates substantial value.

Strategic Positioning in India’s AI Economy

India’s AI market is projected to reach $17 billion by 2027, growing at over 30% annually. Reliance’s investments position it as both consumer and provider of AI solutions, creating optionality for future revenue streams while improving core business economics.

The AI initiatives represent technological modernization protecting competitive positions and creating operating leverage. While difficult to value in isolation, these capabilities ensure relevance as business models evolve and digital transformation accelerates.

Stock Market Performance and Investor Reaction

The stock market response to the AGM announcements provides insight into investor assessment of the strategic initiatives and their potential value creation.

Trading Activity on August 29, 2025

Reliance Industries stock opened at ₹2,987 on August 29, 2025, representing a 0.8% increase from the previous close of ₹2,963. During trading, the stock reached an intraday low of ₹2,952 at approximately 11:15 AM IST before rallying to an intraday high of ₹3,062 by 2:30 PM IST.

The closing price of ₹3,019 represented a 1.9% gain on trading volume of 42.5 million shares, compared to the 30-day average volume of 23 million shares. Options market activity increased substantially, with the September 3,000 call option volume rising 180%.

Foreign institutional investors were net buyers of ₹1,250 crore worth of shares on August 29, while domestic institutional investors added ₹830 crore, reflecting broad-based positive sentiment.

Analyst Coverage and Rating Updates

Following the AGM, sell-side analysts covering Reliance Industries issued research updates with revised earnings estimates and price targets. Upgrades to earnings estimates ranged from 6-12% for FY2025-26 and FY2026-27, primarily driven by higher growth assumptions for telecommunications and retail segments.

Price target revisions varied from modest increases of ₹50-100 to more substantial upgrades of ₹200-300, reflecting different valuation approaches and assumptions about long-term growth drivers. Most analysts maintained “Buy” or “Overweight” ratings.

Consensus price targets for March 2026 range from ₹3,350 to ₹3,800, implying potential upside of 11-26% from August 2025 levels. The variance reflects different assumptions about valuation multiples, earnings growth rates, and timing of value realization from newer business initiatives.

Institutional Investor Activity

In the week following the AGM, foreign institutional investors purchased ₹3,850 crore worth of Reliance shares, indicating approval of the strategic direction. Long-only funds based in North America and Europe increased positions, while hedge funds established new long positions.

Domestic mutual funds added ₹2,650 crore during the same period, with systematic investment plan (SIP) flows continuing to favor the stock. Reliance remains among the top holdings in most large-cap and diversified equity funds.

Insurance companies and provident funds maintained substantial holdings, viewing Reliance as a core portfolio component providing diversified exposure to India’s growth across multiple sectors.

Comparative Analysis with Industry Competitors

Understanding Reliance’s competitive position requires comparison with peers across its various business segments.

Telecommunications: Jio vs Bharti Airtel

The Indian telecommunications market features Reliance Jio and Bharti Airtel as dominant players following industry consolidation. Jio’s 5G expansion to 1,000 cities by December 2025 exceeds Airtel’s target of 700 cities.

Subscriber base comparisons show Jio with 480 million customers versus Airtel’s 395 million as of June 2025. Monthly subscriber additions average 7-8 million for Jio compared to 4-5 million for Airtel. Customer churn rates of 1.8% for Jio versus 2.4% for Airtel indicate relative customer satisfaction differences.

Airtel maintains advantages in postpaid and enterprise segments, with 35 million postpaid subscribers generating higher average revenues per user. EBITDA margins slightly favor Airtel at 52% versus Jio’s 49%, reflecting customer mix differences.

For investors, Jio represents one component of Reliance’s diversified portfolio, whereas Bharti Airtel remains primarily a telecommunications-focused company. This structural difference affects risk profiles and growth characteristics.

Retail: Reliance Retail vs Avenue Supermarts

India’s organized retail sector features different business models, with Reliance Retail pursuing a multi-format strategy compared to Avenue Supermarts’ (DMart) focused value retail approach.

Revenue scale differs substantially, with Reliance Retail generating ₹3,15,000 crore compared to DMart’s ₹52,000 crore in FY2024-25. EBITDA margins show DMart at 8.8% versus Reliance Retail’s 8.2%, demonstrating profitability of focused execution.

Reliance advantages include omnichannel capabilities, private label development, and integration with Jio’s digital infrastructure. DMart counters with strong execution in value retail, superior inventory turnover, and loyal customer base attracted by consistent pricing strategies.

The FMCG manufacturing entry by Reliance creates potential supplier relationship complexities that could benefit DMart if brands view Reliance as a competitor. Conversely, Reliance’s scale and integrated model provide competitive advantages that smaller competitors cannot easily replicate.

Energy: Integrated Operations vs Specialized Players

In energy, Reliance’s integrated model spanning refining, petrochemicals, and now renewables creates unique positioning versus specialized competitors.

Refining complexity of 21.3 (Nelson Complexity Index) exceeds most global peers, enabling profitable processing of various crude grades. Petrochemical integration captures additional margins by converting refinery outputs into higher-value products.

Green energy announcements position Reliance against companies like Adani Green Energy and Tata Power in renewables. Reliance’s capital resources, execution capabilities, and existing industrial customer base provide advantages in commercializing green hydrogen and solar manufacturing.

The challenge involves managing transition away from hydrocarbon businesses that currently generate substantial cash flows. Specialized renewable energy companies trade at premium valuation multiples (15-20x EV/EBITDA) compared to integrated energy companies, potentially limiting Reliance’s ability to capture full valuation benefits unless business separations occur.

Sector-Level Implications of AGM Announcements

The strategic initiatives announced at the AGM carry implications extending beyond company-specific impacts to affect broader industry dynamics and national development objectives.

Impact on India’s Digital Infrastructure

Jio’s 5G expansion contributes to India’s digital infrastructure development and technological competitiveness. Rapid deployment to 1,000 cities creates foundations for smart city initiatives, industrial automation, and advanced service delivery models.

Government policies favoring 5G adoption in education, agriculture, and governance align with Jio’s expansion, creating synergies between corporate strategy and national priorities. Affordable pricing strategies democratize access to advanced connectivity, generating social benefits alongside commercial returns.

Telecommunications infrastructure investment positions India favorably in global technology competition. Countries with advanced digital infrastructure attract higher-value economic activities, technology talent, and innovation ecosystems. Corporate investments contribute to national competitiveness objectives.

Renewable Energy Transition Acceleration

India has committed to achieving 500 gigawatts of renewable energy capacity by 2030 as part of international climate commitments. Reliance’s announcements represent substantial private sector commitment to this transition.

Solar manufacturing capacity addresses supply chain bottlenecks in renewable deployment. Dependence on imported equipment creates cost unpredictability and vulnerability. Domestic manufacturing capacity of 10-20 gigawatts annually reduces these risks while creating manufacturing employment.

Green hydrogen development tackles decarbonization challenges in heavy industry and long-distance transport. Cost reduction through scale and integration could enable commercial viability earlier than current projections, creating demonstration effects for other industrial groups.

Broader impacts include technology transfer, domestic supply chain development, and encouragement of corporate sustainability initiatives across Indian industry.

Consumer Goods Market Disruption

Reliance Retail’s FMCG manufacturing entry represents potential disruption of India’s consumer goods industry. Established players have dominated through brand equity, distribution networks, and marketing capabilities.

Reliance enters with different advantages: unmatched retail distribution, scale-driven pricing power, and consumer data from millions of customers. Private label strategies, successful globally for major retailers, could reshape Indian competitive dynamics.

However, FMCG success requires capabilities beyond retail and manufacturing. Brand building, product innovation, and consumer trust development require extended timeframes. Execution challenges exist in managing multiple categories simultaneously while maintaining quality standards.

The entry creates opportunities for manufacturers willing to produce for private labels while threatening companies dependent on retail distribution increasingly controlled by Reliance. Industry adjustment and competitive responses will unfold over coming years.

Risk Factors and Implementation Challenges

While the AGM announcements outline ambitious growth strategies, various risks and implementation challenges warrant consideration.

Execution Risks Across Multiple Initiatives

Simultaneous expansion across telecommunications, renewable energy, retail, and technology creates execution complexity. Resource allocation, talent deployment, and management attention must be distributed across diverse initiatives with different timelines and success factors.

Capital intensity of combined programs requires sustained cash flow generation from existing businesses. While current financial position appears strong, prolonged commodity price weakness, regulatory changes, or competitive pressures could affect funding availability.

Technology transitions carry inherent risks. Green hydrogen and advanced battery technologies remain in relatively early commercialization stages. Cost reduction targets may prove challenging if technological progress or scale economies develop slower than anticipated.

Competitive Response and Market Dynamics

Announced strategies will likely trigger competitive responses. In telecommunications, Bharti Airtel may accelerate its own 5G deployment or differentiate through service quality and customer experience. In retail, established FMCG companies may adjust distribution strategies or increase promotional spending to defend market share.

Renewable energy markets feature well-capitalized competitors including Adani Group, Tata Power, and international players. Competition for talent, resources, and customers could intensify as multiple companies pursue similar opportunities.

Market saturation risks exist in some segments. Telecommunications subscriber growth is maturing as penetration reaches high levels. Retail expansion faces competition from both organized and unorganized retail, with consumer spending growth tied to overall economic conditions.

Regulatory and Policy Uncertainties

Business operations across multiple sectors expose Reliance to diverse regulatory frameworks. Telecommunications regulations govern spectrum allocation, pricing, and service quality standards. Retail operations face state-level policies on trading practices and small business protections. Energy projects require environmental clearances and land acquisition approvals.

Policy changes could affect business economics. Carbon pricing mechanisms, import duties on renewable equipment, or foreign direct investment restrictions in retail could impact planned initiatives. Regulatory developments require ongoing monitoring and adaptive responses.

International operations and partnerships expose the company to geopolitical risks, trade policy changes, and currency fluctuations. Supply chain dependencies, particularly for technology components and raw materials, create vulnerabilities to global disruptions.

Valuation and Market Perception Risks

Market valuations reflect future expectations that may or may not materialize. If execution challenges emerge or timelines extend beyond current projections, stock performance could disappoint despite sound long-term strategy.

The diversified business structure creates complexity in valuation analysis. Different segments warrant different valuation approaches and multiples. Market perception of appropriate overall valuation depends on weightings assigned to various businesses and their individual growth and profitability characteristics.

Capital allocation decisions face scrutiny from different investor constituencies. Growth-focused investors favor reinvestment in expansion opportunities, while value-oriented investors prefer capital returns through dividends or buybacks. Balancing these preferences while maintaining strategic flexibility requires ongoing management judgment.

Frequently Asked Questions (FAQs)

What were the main announcements from Reliance Industries AGM 2025?

The 48th Annual General Meeting held on August 29, 2025, included several major announcements. Jio 5G network expansion to 1,000 cities by December 2025 was announced, requiring ₹35,000 crore capital expenditure. Green energy initiatives included solar manufacturing capacity of 10 gigawatts starting January 2026 with ₹75,000 crore investment, and green hydrogen production targeting 1 million tonnes annually by 2030 with ₹80,000 crore investment. Reliance Retail plans to launch over 700 private label FMCG products by March 2026 following ₹12,000 crore investment in processing facilities. AI integration across businesses with ₹18,000 crore investment was announced. The board also indicated evaluation of a share buyback program for FY2025-26.

How did Reliance stock perform on the AGM day?

On August 29, 2025, Reliance Industries stock opened at ₹2,987, up 0.8% from the previous close of ₹2,963. During trading, the stock experienced volatility with an intraday low of ₹2,952 and high of ₹3,062, representing a 3.7% intraday range. The stock closed at ₹3,019, up 1.9% for the day. Trading volume reached 42.5 million shares, 180% of the 30-day average volume. Foreign institutional investors were net buyers of ₹1,250 crore, while domestic institutional investors purchased ₹830 crore worth of shares, indicating positive investor sentiment toward the announcements.

What is Reliance’s green energy investment plan?

Reliance’s green energy initiatives involve three primary components. Solar manufacturing includes an integrated photovoltaic facility in Jamnagar with 10 gigawatt initial capacity beginning January 2026, requiring investment exceeding ₹75,000 crore, with plans to scale to 20 gigawatts by 2028. Green hydrogen production targets 1 million tonnes annually by 2030 for internal refinery consumption and potential exports, requiring ₹80,000 crore investment in electrolyzer manufacturing and infrastructure. Battery energy storage systems with 50 gigawatt-hour capacity target electric vehicle and grid storage markets. Combined, these initiatives represent over ₹155,000 crore in planned investment over the next three to five years.

How does Jio’s 5G expansion compare with competitors?

Reliance Jio announced plans to expand 5G coverage to 1,000 cities by December 2025, compared to Bharti Airtel’s reported target of 700 cities. As of June 2025, Jio had 480 million subscribers versus Airtel’s 395 million. Monthly subscriber additions average 7-8 million for Jio compared to 4-5 million for Airtel. Customer churn rates show Jio at 1.8% versus Airtel’s 2.4%. EBITDA margins differ slightly, with Jio at 49% and Airtel at 52%, reflecting different customer mix compositions. Average revenue per user (ARPU) for Jio stood at ₹195 in Q1 2025-26 with expectations of growth to ₹215 as 5G adoption increases.

What is Reliance’s current financial position?

As of June 30, 2025, Reliance Industries reported net debt of ₹1,25,000 crore, representing a net debt-to-equity ratio of 0.18x. For fiscal year 2024-25, operating cash flows reached ₹1,45,000 crore, covering capital expenditures of ₹95,000 crore across all business segments. The company maintains AAA/Stable credit ratings from domestic agencies. Recent international bond issuances achieved spreads of 80-90 basis points over US Treasuries. The company announced a final dividend of ₹10 per share for FY2024-25, bringing total annual dividends to ₹18 per share, representing a 12.5% increase from the previous year.

What are analyst price targets for Reliance stock?

Following the AGM 2025, sell-side analysts revised earnings estimates upward by 6-12% for FY2025-26 and FY2026-27, primarily based on higher growth assumptions for telecommunications and retail segments. Consensus price targets for March 2026 range from ₹3,350 to ₹3,800, implying potential upside of 11-26% from August 2025 levels. Most analysts maintain “Buy” or “Overweight” ratings. Target price variance reflects different assumptions about valuation multiples, earnings growth rates, and timing of value realization from newer business initiatives. Note that price targets represent analyst opinions and not guarantees of future performance.

How will Reliance Retail’s FMCG entry affect the market?

Reliance Retail plans to launch over 700 private label products across food, personal care, home care, and grocery categories by March 2026, with ₹12,000 crore investment in processing facilities. Products will be positioned 20-30% below branded alternatives while maintaining quality standards. India’s FMCG market, valued at $110 billion in 2025 with 12% annual growth, presents significant opportunity. Market share projections suggest potential capture of 6-8% within three years, generating incremental revenues of approximately ₹50,000 crore. The entry creates competitive pressure for established FMCG companies while potentially benefiting manufacturers willing to produce private label products. Industry analysts expect a period of adjustment as competitive dynamics evolve.

What is the timeline for Reliance’s new energy projects?

Solar manufacturing facility in Jamnagar is scheduled to begin production in January 2026 with 10 gigawatt initial capacity, expanding to 20 gigawatts by 2028. Green hydrogen production aims to achieve cost-competitive status by 2027, with production target of 1 million tonnes annually by 2030. Battery manufacturing with 50 gigawatt-hour capacity timeline was not specifically disclosed but appears tied to electric vehicle market development over coming years. Management projections suggest the new energy business could generate ₹75,000-1,00,000 crore in annual revenues by FY2029-30, though these represent long-term projections subject to execution risk and market development.

Summary and Key Takeaways

Reliance Industries’ 48th Annual General Meeting on August 29, 2025, outlined strategic initiatives across multiple business segments with significant capital allocation commitments. The telecommunications segment expansion targets 1,000 cities for 5G coverage by year-end 2025, requiring ₹35,000 crore investment and positioning for market share gains.

Green energy initiatives represent the most substantial strategic pivot, with combined investments exceeding ₹155,000 crore in solar manufacturing, green hydrogen production, and battery systems. These capital-intensive projects have extended gestation periods but position Reliance for India’s renewable energy transition valued at $500 billion through 2035.

Retail expansion into FMCG manufacturing and digital commerce enhancement creates competitive dynamics with established consumer goods companies while leveraging existing distribution infrastructure. Private label strategy targets margin expansion and market

About the Author

Nueplanet

International Trade and Economic Policy Analyst

Nueplanet is an international trade and economic policy analyst specializing in U.S.-India commercial relations, global supply chain dynamics, and multilateral trade systems. With over the years of experience analyzing trade policy developments, Nueplanet provides factual assessments based on official government sources, academic research, and verified economic data. Nueplanet expertise includes tariff policy analysis, World Trade Organization dispute mechanisms, and the intersection of trade policy with strategic international relationships. Vikram’s work focuses on delivering accurate, balanced information that helps businesses, policymakers, and readers understand complex trade developments and their practical implications. All content is researched using authoritative sources including U.S. government publications, international organization reports, peer-reviewed economic studies, and official statements from relevant authorities, with regular updates reflecting evolving policy conditions.

Published: August 29, 2025

Last Updated: August 29, 2025

This article is based on publicly available court documents, government sources, economic research, and verified news reports regarding U.S. trade policy and the September 2024 court ruling. Analysis represents factual assessment of documented events and their implications rather than political advocacy or investment advice. Readers should consult official sources and appropriate professional advisors for specific business or legal decisions related to international trade. Content is intended for informational purposes only and does not constitute legal, financial, or policy recommendations.

Post Comment