HBL Engineering Share Price Soars on Strong Q1 Performance

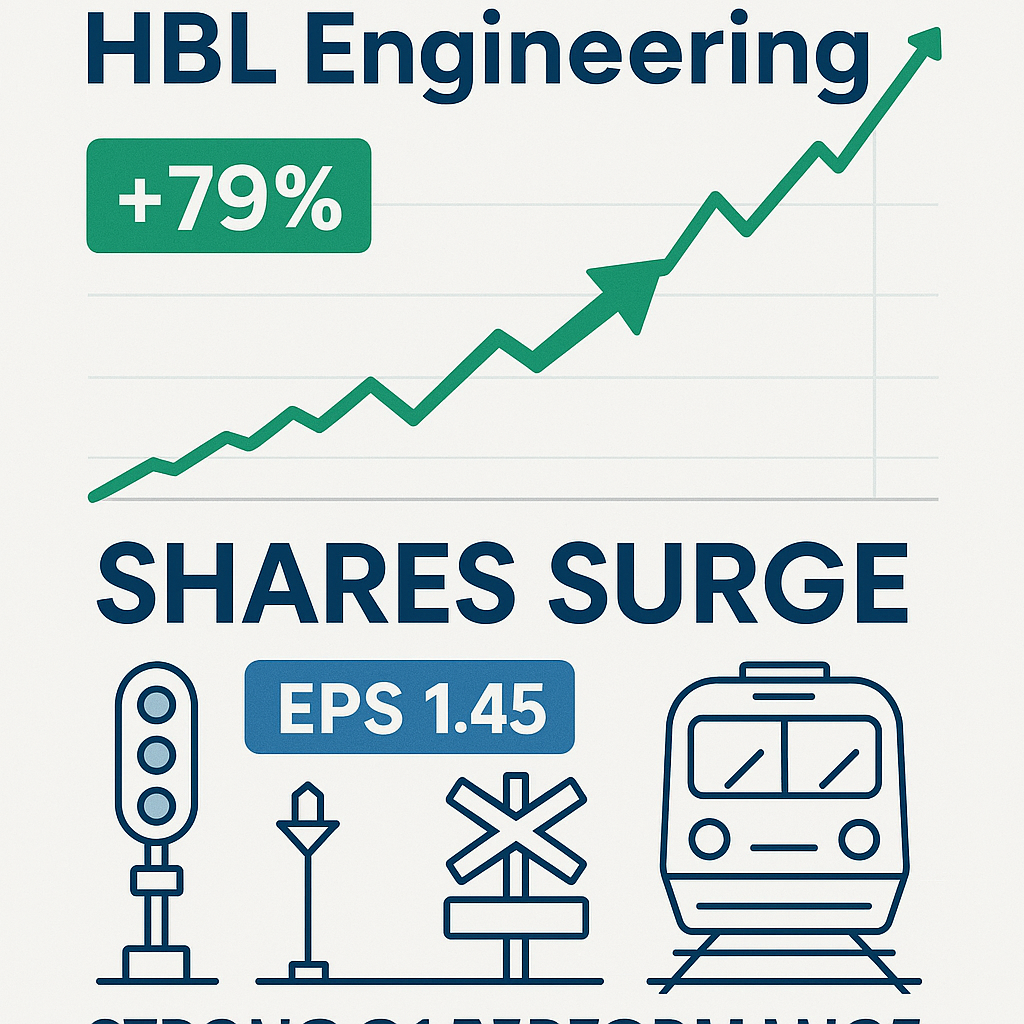

HBL Engineering share price surged over 13% following a 79% jump in Q1 net profit. Discover what’s driving the rally and whether the momentum can sustain.

Table of Contents

Market Overview: Single-Day Rally Reflects Quarterly Performance

HBL Engineering Ltd experienced significant stock price appreciation on August 11, 2025, with shares advancing 13.4% during intraday trading on the Bombay Stock Exchange. The stock reached Rs 678.9 during the session, responding to the company’s first-quarter financial results for fiscal year 2026.

The engineering services company reported net profit of Rs 143.27 crore for the quarter ended June 30, 2025, representing year-on-year growth of 78.9% compared to Rs 80.09 crore in the corresponding period of fiscal year 2025. Revenue from operations increased 15.7% to Rs 601.77 crore from Rs 520.11 crore in the year-ago quarter.

The market reaction occurred while the benchmark Sensex index remained relatively unchanged during the same trading session. This divergence indicates sector-specific and company-specific factors drove investor interest in HBL Engineering shares rather than broader market momentum.

Q1 FY26 Financial Results: Revenue and Profitability Analysis

Quarterly Revenue Performance

HBL Engineering reported consolidated revenue from operations of Rs 601.77 crore for the April-June 2025 quarter. This figure represents an increase of Rs 81.66 crore or 15.7% compared to Rs 520.11 crore recorded in Q1 FY25.

The revenue growth occurred across the company’s engineering services portfolio. Industry sources indicate demand remained stable in infrastructure-related segments during the quarter. The company’s diversified client base across multiple sectors contributed to sustained revenue generation.

Quarterly revenue performance provides insight into order execution capabilities and project pipeline conversion. The double-digit topline growth suggests effective project management and timely completion of ongoing contracts during the three-month period.

Net Profit Growth and Margin Expansion

Net profit for Q1 FY26 reached Rs 143.27 crore compared to Rs 80.09 crore in the corresponding quarter of the previous fiscal year. This represents absolute growth of Rs 63.18 crore or 78.9% on a year-on-year basis.

The profit growth rate significantly exceeded revenue growth, indicating margin improvement during the quarter. This operational leverage suggests enhanced project profitability, effective cost management, or favorable changes in revenue mix toward higher-margin services.

Margin expansion typically results from improved operational efficiency, better resource utilization, or successful execution of premium-priced contracts. The financial metrics indicate management’s ability to convert revenue growth into disproportionate bottom-line expansion.

Dividend Declaration and Capital Allocation

The company’s board declared a dividend of Rs 1 per share with the record date set for September 12, 2025. Shareholders registered on this date will be eligible to receive the dividend payment.

Based on the current trading price around Rs 682, the declared dividend represents an approximate yield of 0.15%. While modest in percentage terms, the dividend declaration demonstrates positive cash flow generation and management’s willingness to share profits with equity holders.

Capital allocation decisions reflect management’s assessment of cash generation capabilities and investment requirements. The simultaneous payment of dividends while pursuing business growth indicates confidence in maintaining adequate liquidity for operational needs.

Stock Price Movement: Intraday Trading Patterns

Opening Session and Price Discovery

Trading data from August 11, 2025, shows HBL Engineering shares opened with substantial buying interest. The stock advanced approximately 12% to Rs 670.5 by 9:37 AM, indicating strong demand from market participants during early trading hours.

The rapid price appreciation following market opening suggests pre-opening order accumulation and immediate post-announcement buying. Such patterns typically indicate institutional participation alongside retail investor interest in response to the quarterly results.

Volume analysis during the opening session would provide additional context regarding the breadth of market participation. Higher-than-average volumes accompanying price gains generally suggest sustainable momentum rather than thin-market volatility.

Intraday Peak and Price Consolidation

The stock reached an intraday high of Rs 678.9 during the August 11 session. This level represented the session’s peak before potential profit-booking or consolidation occurred later in the trading day.

Intraday price patterns following earnings announcements often show initial spikes followed by consolidation as market participants reassess valuation levels. The ability to maintain gains near session highs indicates sustained positive sentiment rather than speculative trading.

Price behavior in subsequent trading sessions would determine whether the post-results rally represents a sustainable revaluation or temporary enthusiasm. Continued strength with volume support would suggest fundamental reassessment by market participants.

Technical Analysis: Price Positioning and Trend Assessment

52-Week Trading Range Context

According to market data from Screener, HBL Engineering shares currently trade around Rs 682, positioning the stock near its 52-week high of Rs 740. The 52-week low stands at Rs 404, indicating the stock has appreciated substantially over the past year.

The current price represents approximately 92% of the 52-week high and 69% above the 52-week low. This positioning suggests strong underlying momentum and sustained investor interest over multiple quarters.

Distance from 52-week lows provides context for assessing rally sustainability. Stocks trading near annual highs often face resistance, while those with significant room to previous peaks may have additional upside potential.

Moving Average and Trend Analysis

Technical analysis typically evaluates stock positioning relative to various moving averages including 50-day, 100-day, and 200-day periods. These indicators help identify trend strength and potential reversal points.

Stocks trading above key moving averages generally indicate established uptrends, while those breaking below such levels may signal trend exhaustion. The sustained price appreciation over recent months suggests HBL Engineering likely trades above major moving averages.

Volume-weighted average prices provide additional technical perspective by incorporating trading volume into price calculations. Stocks trading above volume-weighted averages with rising volume trends typically demonstrate strong technical foundations.

Support and Resistance Levels

Recent price action establishes support levels where buying interest previously emerged and resistance zones where selling pressure appeared. The Rs 670-680 range may now serve as support following the post-results rally.

Previous resistance levels, once broken, often become new support zones as market psychology shifts. The stock’s ability to maintain levels above Rs 670 in subsequent sessions would confirm this technical pattern.

Overhead resistance appears around the Rs 740 level based on the 52-week high. Breaking above this level would require renewed fundamental catalysts or continued positive momentum from business developments.

Business Operations: Engineering Services Portfolio

Core Service Offerings and Capabilities

HBL Engineering operates in the engineering services sector, providing specialized technical solutions across multiple industrial segments. The company’s capabilities include design engineering, project execution, system integration, and maintenance services.

The engineering services business model typically involves contract-based revenue generation with varying project durations. Some contracts span multiple quarters or years, providing revenue visibility while requiring effective project management to maintain profitability.

Technical expertise in specialized areas enables companies to command premium pricing and maintain customer relationships. HBL Engineering’s ability to secure repeat business and expand existing client relationships would support sustainable revenue growth.

Railway Sector Positioning

Industry sources indicate HBL Engineering has established presence in railway safety systems and related infrastructure applications. The Indian Railways represents a significant customer segment pursuing modernization and safety enhancement initiatives.

Government-sponsored railway infrastructure investment provides long-term growth opportunities for engineering services companies with appropriate technical capabilities. Safety-critical applications often require specialized certifications and proven track records.

Contract awards in the railway sector typically follow competitive bidding processes evaluating technical capabilities, pricing, and execution track records. Successful contract wins demonstrate competitive positioning and client confidence in delivery capabilities.

Geographic Presence and Market Diversification

Diversification across geographic markets and industry sectors reduces concentration risk while enabling companies to capitalize on varying regional growth opportunities. Multiple revenue sources provide stability during sector-specific downturns.

Engineering services companies serving pan-India markets benefit from regional infrastructure development programs and industrial expansion. Geographic presence near major industrial clusters reduces project execution costs and improves service delivery.

International expansion, when pursued, requires adaptation to different regulatory frameworks, technical standards, and competitive environments. Domestic market opportunities may currently provide sufficient growth runway without international complexity.

Industry Context: Engineering Services Sector Dynamics

Infrastructure Development and Government Initiatives

India’s infrastructure development programs create sustained demand for engineering services across transportation, energy, industrial, and urban development sectors. Government capital expenditure allocations support multi-year project pipelines.

National infrastructure pipeline initiatives identify planned investments across various sectors. Engineering services companies positioned in growing segments benefit from increased project activity and bidding opportunities.

Policy frameworks including Make in India, Atmanirbhar Bharat, and sector-specific initiatives influence domestic manufacturing and infrastructure development. These programs create favorable operating environments for capable engineering services providers.

Competitive Landscape and Market Structure

The Indian engineering services sector includes established players across various specializations, ranging from large diversified firms to focused niche providers. Market structure varies by technical complexity, capital requirements, and regulatory considerations.

Competition intensity differs across segment specializations. Commodity services face pricing pressure, while specialized technical capabilities command premium positioning. Customer relationships and proven execution track records provide competitive advantages.

Barriers to entry vary by technical complexity and capital requirements. Safety-critical applications and regulated sectors typically feature higher entry barriers, while general engineering services face more open competition.

Emerging Opportunities and Technology Trends

Digitalization and automation create new service opportunities for engineering companies with appropriate technical capabilities. Industrial Internet of Things, predictive maintenance, and smart infrastructure systems represent growth areas.

Sustainability requirements and environmental compliance drive demand for specialized engineering services. Companies with expertise in green technologies, energy efficiency, and environmental engineering benefit from these trends.

Electric vehicle infrastructure, renewable energy systems, and smart city applications represent newer growth segments. Engineering services companies adapting capabilities to these areas position themselves for emerging opportunities beyond traditional sectors.

Financial Performance Analysis: Profitability and Efficiency Metrics

Operating Margin and Profitability Ratios

The substantial profit growth relative to revenue expansion indicates improved operating margins during Q1 FY26. Operating leverage occurs when fixed cost absorption improves as revenue increases, or when variable cost management enhances gross margins.

Net profit margin calculation (net profit divided by revenue) shows the percentage of revenue converted to bottom-line earnings. Higher margins indicate greater efficiency and pricing power, while margin expansion suggests improving competitive positioning.

Operating profit margins (EBITDA or EBIT margins) provide insights before interest and tax considerations. These metrics isolate operational performance from capital structure and tax factors, enabling cleaner period-to-period comparisons.

Return Metrics and Asset Utilization

Return on equity (ROE) measures profit generation relative to shareholder equity. Higher ROE indicates more efficient use of equity capital and creates greater shareholder value per rupee of invested equity.

Return on assets (ROA) evaluates profit generation relative to total asset base. This metric assesses how effectively management deploys all capital resources, regardless of funding source, to generate earnings.

Asset turnover ratios measure revenue generation per rupee of assets deployed. Higher asset turnover indicates more efficient asset utilization, though appropriate levels vary by business model and capital intensity.

Working Capital and Cash Flow Considerations

Engineering services businesses often experience working capital fluctuations based on project payment terms and execution cycles. Advance payments from customers reduce working capital requirements, while extended receivables increase capital needs.

Project-based businesses may show lumpy cash flow patterns as large contracts progress through execution phases and reach payment milestones. Consistent cash generation despite project timing variations indicates effective working capital management.

The dividend declaration suggests adequate cash generation and liquidity to support both shareholder distributions and operational requirements. Positive operating cash flow enables companies to fund growth while maintaining financial flexibility.

Risk Factors: Business and Market Considerations

Project Execution and Contract Performance

Engineering services companies face execution risk from project delays, cost overruns, or technical challenges. Effective project management, realistic bidding, and adequate contingency planning mitigate these operational risks.

Client satisfaction and repeat business depend on timely delivery, quality standards, and budget adherence. Execution problems damage customer relationships and limit future business opportunities with affected clients.

Large project concentrations create revenue volatility if significant contracts face delays or cancellations. Diversified project portfolios with varying sizes and completion timelines reduce concentration risk.

Customer Concentration and Market Dependencies

Revenue concentration among few customers creates vulnerability to client-specific issues or spending reductions. Diversified customer bases across multiple sectors provide greater stability and reduce single-client dependencies.

Government and public sector clients represent significant opportunities in infrastructure-related segments. However, policy changes, budget reallocations, or administrative delays can impact project timelines and payment schedules.

Private sector clients face business cycle sensitivities affecting capital expenditure decisions. Economic downturns or sector-specific challenges may reduce project activity and engineering services demand.

Competitive Pressures and Margin Sustainability

Competitive bidding for contracts creates pricing pressure that affects project margins. Companies must balance winning bids with maintaining adequate profitability on executed projects.

Market entry by new competitors or capacity expansion by existing players increases competition intensity. Differentiation through technical capabilities, execution track record, and client relationships helps maintain competitive positioning.

Margin sustainability depends on continuous efficiency improvements, cost management, and value-added service offerings. Companies unable to maintain operational efficiency face profitability pressure in competitive markets.

Valuation Considerations: Investment Assessment Framework

Price-to-Earnings and Growth Metrics

Current price-to-earnings ratios provide valuation context relative to current earnings levels. Investors should consider both trailing twelve-month earnings and forward earnings estimates when assessing valuation reasonableness.

PEG ratio (price-to-earnings divided by growth rate) incorporates growth expectations into valuation assessment. Lower PEG ratios suggest stocks may be undervalued relative to growth prospects, though appropriate levels vary by sector and growth consistency.

Earnings growth sustainability depends on order pipeline visibility, market opportunity size, and competitive positioning. One-quarter results provide limited visibility, requiring assessment of longer-term earnings potential.

Peer Comparison and Relative Valuation

Comparing valuation multiples against industry peers provides relative valuation context. Companies with superior growth, margins, or competitive advantages typically trade at premium multiples to sector averages.

Peer selection should consider business model similarities, size comparability, and market positioning. Direct competitors provide closest comparisons, while broader industry players offer general sector context.

Relative valuation analysis helps identify potentially undervalued or overvalued stocks within sectors. However, company-specific factors may justify premium or discount valuations versus peers.

Market Capitalization and Liquidity Factors

Market capitalization influences stock liquidity, institutional ownership eligibility, and analyst coverage. Mid-cap stocks often offer growth potential with reasonable liquidity for most investors.

Trading volumes indicate market depth and ease of position entry or exit. Higher average volumes provide better liquidity, while thin trading can create execution challenges for larger position sizes.

Float considerations affect supply-demand dynamics. Higher promoter holdings reduce freely tradable shares, potentially amplifying price movements on modest volume changes.

Investment Perspective: Opportunity Assessment

Fundamental Strengths and Growth Drivers

Strong quarterly financial performance demonstrates operational capabilities and current business momentum. Sustained revenue growth with margin expansion indicates effective execution and favorable market positioning.

Infrastructure sector opportunities provide long-term growth potential for engineering services companies with appropriate capabilities. Government spending priorities and private sector investment support multi-year demand visibility.

Established client relationships and proven project execution create competitive advantages difficult for newer entrants to replicate quickly. These intangible assets support sustained business generation and pricing power.

Near-Term Considerations and Monitoring Points

Quarterly result sustainability requires confirmation through subsequent reporting periods. Single-quarter outperformance may reflect project timing or other temporary factors rather than permanent operational improvements.

Order intake and backlog levels provide forward visibility regarding revenue sustainability. Strong order books indicate continued business momentum, while weak bookings suggest potential revenue pressure ahead.

Management commentary on market conditions, competitive dynamics, and strategic priorities offers qualitative insights beyond financial metrics. Guidance revisions or strategic shifts warrant investor attention.

Risk-Adjusted Return Potential

Investment returns depend on both price appreciation potential and dividend income. Current yield remains modest, suggesting total returns primarily depend on capital gains from price appreciation.

Risk considerations include execution challenges, competitive pressures, market dependencies, and macroeconomic factors. Position sizing should reflect individual risk tolerance and portfolio diversification objectives.

Long-term investment horizons better accommodate business cycle fluctuations and project timing variations. Shorter-term positions face greater volatility from quarterly result variations and market sentiment shifts.

Sector Outlook: Engineering Services Industry Prospects

Government Capital Expenditure and Public Projects

Union and state government budget allocations for infrastructure determine public sector project activity. Capital expenditure trends across transportation, energy, and urban development influence engineering services demand.

Multi-year infrastructure plans provide visibility regarding potential project pipelines. However, budget execution rates and administrative efficiencies affect actual project commencement and completion timelines.

Public-private partnership models for infrastructure development create opportunities for engineering services companies supporting both government agencies and private developers. Effective PPP frameworks accelerate project implementation.

Industrial Capital Expenditure Cycles

Private sector capital spending depends on business confidence, capacity utilization rates, and growth expectations. Manufacturing expansion, industrial modernization, and technology upgrades drive engineering services requirements.

Sectoral investment patterns vary based on profitability, regulatory frameworks, and market opportunities. Companies monitoring client sector performance can anticipate demand fluctuations and adjust resource allocation accordingly.

Credit availability and interest rate environments influence capital expenditure decisions. Favorable financing conditions support increased investment, while tight credit or high rates constrain project activity.

Technology Adoption and Service Evolution

Digital transformation initiatives across industries create new service requirements. Engineering services companies adapting capabilities to emerging technologies position themselves for new revenue streams.

Predictive maintenance, remote monitoring, and data analytics applications require integrated engineering and technology expertise. Companies developing these combined capabilities access premium-priced opportunities.

Traditional engineering services face potential commoditization absent differentiation through technology integration or specialized expertise. Continuous capability development maintains competitive relevance and pricing power.

Author Bio Section

About the Author: Independent Financial Markets Analyst of Nueplanet

This analysis was prepared by an independent financial markets research professional with expertise in Indian equity markets, engineering sector dynamics, and fundamental company analysis. The author maintains no financial interest in HBL Engineering Ltd or any covered securities.

Content is based exclusively on publicly available information including company regulatory filings with stock exchanges, official press releases, and verified financial data. All information has been cross-referenced against official sources including BSE/NSE announcements and company investor communications.

The objective of this publication is to provide factual information and balanced analysis to help readers understand corporate developments and market dynamics. This content does not constitute investment advice, stock recommendations, or buy/sell suggestions. Readers should conduct independent research and consult qualified financial advisors before making investment decisions.

Published: August 11, 2025, 2025 Last Updated: August 11, 2025, 2025

Data Sources: BSE/NSE official trading data, company regulatory filings, Screener.in market data, public company announcements

Frequently Asked Questions

What specific factors drove HBL Engineering’s 13.4% stock price increase on August 11, 2025?

The stock price surge directly followed the company’s Q1 FY26 results announcement showing net profit growth of 78.9% year-on-year to Rs 143.27 crore and revenue increase of 15.7% to Rs 601.77 crore. The profit growth significantly exceeded revenue growth, indicating margin expansion that exceeded market expectations. The stock reached an intraday high of Rs 678.9 during the session while broader markets remained flat, demonstrating company-specific positive sentiment.

How does HBL Engineering’s Q1 FY26 profit margin compare to the previous year?

The Q1 FY26 results show substantial margin expansion based on the divergence between revenue and profit growth rates. Revenue increased 15.7% while net profit grew 78.9%, indicating the net profit margin improved significantly compared to Q1 FY25. The exact margin percentages would require calculation based on the disclosed figures: Q1 FY25 margins were approximately 15.4% (Rs 80.09 crore profit on Rs 520.11 crore revenue) while Q1 FY26 margins expanded to approximately 23.8% (Rs 143.27 crore profit on Rs 601.77 crore revenue).

What is the significance of the Rs 1 per share dividend with September 12, 2025 record date?

The dividend declaration demonstrates positive cash flow generation and management’s willingness to distribute profits to shareholders. Investors registered as shareholders on the record date of September 12, 2025, will be eligible to receive the Rs 1 per share payment. At the current trading price around Rs 682, this represents an approximate dividend yield of 0.15%. The announcement indicates adequate liquidity to support both shareholder returns and operational requirements.

How does HBL Engineering’s current stock price compare to its 52-week trading range?

According to Screener data, HBL Engineering currently trades around Rs 682, positioning near its 52-week high of Rs 740 and significantly above its 52-week low of Rs 404. The current price represents approximately 92% of the annual high and 69% above the annual low. This positioning indicates strong momentum over the past year and suggests the stock has been in sustained uptrend, though proximity to 52-week highs may create near-term resistance.

What are the primary business segments driving HBL Engineering’s growth?

HBL Engineering operates in the engineering services sector with presence in railway safety systems and infrastructure-related applications. The company provides design engineering, project execution, system integration, and maintenance services across multiple industrial segments. Industry sources indicate railway sector contracts and infrastructure development projects contribute significantly to the revenue base. The diversified service portfolio across different clients and sectors provides revenue stability while enabling growth as various segments expand.

How sustainable is the 78.9% profit growth rate demonstrated in Q1 FY26?

The extraordinary profit growth rate primarily reflects margin expansion rather than just revenue growth. Sustainability depends on whether margin improvements result from permanent operational efficiency gains or temporary project mix benefits. Investors should monitor subsequent quarterly results to assess consistency of profitability levels. Management commentary regarding project pipeline profitability and operational initiatives would provide insights into margin sustainability. One quarter of exceptional performance requires confirmation through additional reporting periods before establishing sustainable earnings trends.

What are the key risks investors should consider regarding HBL Engineering?

Primary risks include project execution challenges that could affect profitability, customer concentration that creates revenue vulnerability, competitive bidding pressure on margins, and dependency on government and infrastructure spending that varies with policy priorities and budget execution. Additional considerations include working capital management in project-based businesses, potential cost overruns on fixed-price contracts, and economic cycle sensitivity affecting client capital expenditure decisions. Engineering services businesses also face technical obsolescence requiring continuous capability development to maintain competitive positioning.

How does HBL Engineering’s performance compare to broader market and sector trends?

HBL Engineering’s 13.4% single-day gain significantly outperformed the Sensex, which remained flat during the same session. This divergence indicates company-specific factors drove the rally rather than broader market momentum. The engineering services sector has benefited from infrastructure development initiatives and increased government capital expenditure. However, individual company performance varies based on project execution capabilities, client relationships, and specialization areas. HBL Engineering’s results suggest above-average performance within its operating segments during Q1 FY26.

Disclaimer: This content provides factual information and analysis for educational purposes only. It does not constitute investment advice, stock recommendations, or suggestions to buy or sell securities. Stock markets involve risk, and past performance does not guarantee future results. Investors may lose principal invested. Readers should conduct independent research, assess personal financial circumstances and risk tolerance, and consult qualified financial advisors before making investment decisions. The author and publisher have no financial interest in securities discussed and receive no compensation from companies mentioned.

Helpful Resources

Business Standard: Q1 Earnings and Share Movement (Business Standard)

Business Standard: Financial Summary Table (Business Standard)

Latest Posts

- RGUHS: Installing Anti‑Suicide Devices in Hostel Ceiling Fans After Student Tragedies

- Bajaj Auto Share Price Rises After Q1 Profit Jumps 14%—What It Means for Investors

- PGEL Share Price: Q1 Results Trigger Target Cut and Downgrade

- Independence Day 2025: Heightened Security, Patriotic Spirit, and Nationwide Celebrations

- JSW Cement IPO Subscription Status: Day 3 Update, GMP Trends, and Investor Insights

Post Comment