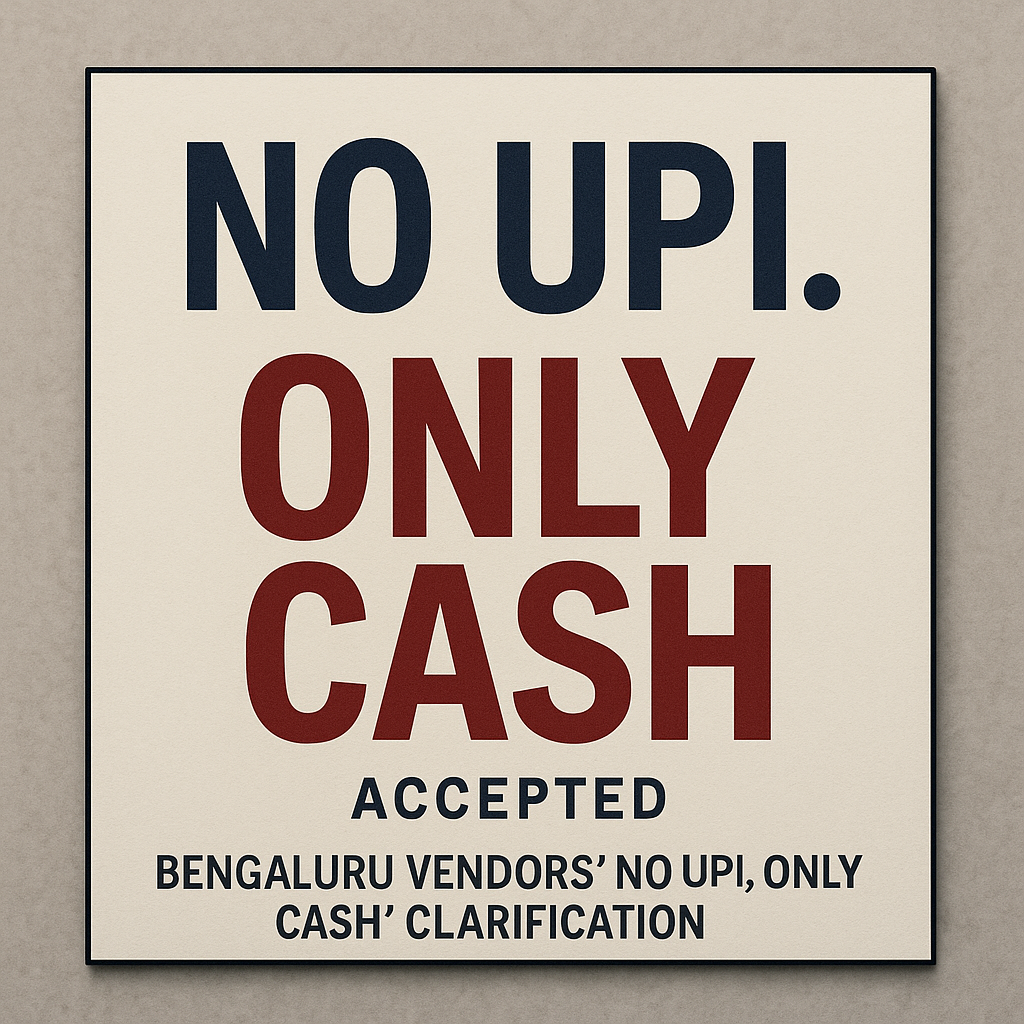

GST Payment Clarifications: Why Bengaluru Vendors Say “No UPI, Only Cash”

Bengaluru vendors displaying “No UPI, Only Cash” boards have triggered confusion on GST applicability. The tax department clarified the legal and compliance aspects today.

Table of Contents

Introduction

India’s GST regime, since its introduction in 2017, has streamlined indirect tax processes. However, recent developments in Bengaluru markets, where many vendors put up “No UPI, Only Cash” signs, raised questions on GST payment, digital transactions, and tax enforcement.

This article explains:

What is GST payment and its legal framework?

Why vendors prefer cash over UPI?

Tax department clarification on digital payments.

The overall impact on consumers and small businesses.

What is GST Payment?

GST Framework in India

GST (Goods and Services Tax) is a unified indirect tax levied on the supply of goods and services. It replaced multiple cascading taxes, simplifying compliance for businesses.

GST Components

CGST (Central GST): Collected by the Centre on intra-state sales.

SGST (State GST): Collected by the State on intra-state sales.

IGST (Integrated GST): Collected by the Centre on inter-state sales.

Who Should Pay GST?

Businesses with annual turnover above the threshold limit of Rs 20 lakh (Rs 10 lakh for NE and hill states) must register for GST and pay tax as per applicable slabs.

Bengaluru Vendors’ “No UPI, Only Cash” Issue

What Happened?

several fruit and vegetable vendors in Bengaluru started displaying boards stating:

“No UPI. Only Cash accepted.”

Why Did Vendors Avoid UPI Payments?

The primary reasons:

Fear of GST enforcement: Many small vendors operate below the GST threshold but worry that UPI payments will bring them under tax scrutiny.

Compliance concerns: Lack of awareness about GST registration exemptions for businesses below turnover thresholds.

Misinformation: Rumours suggesting digital payments automatically attract GST, regardless of registration status.

Tax Department Clarification

The Central Board of Indirect Taxes and Customs (CBIC) clarified:

GST is payable based on turnover and supply nature, not payment mode.

Receiving payments through UPI does not create GST liability if the business is unregistered and below the exemption limit.

Businesses already under GST must report UPI transactions in their returns as they do for cash sales.

Impact on Consumers

Reduced Digital Payment Acceptance

Consumers face inconvenience when small vendors refuse UPI. This also contradicts the government’s push for Digital India and cashless economy initiatives.

Loss of Transparency

Cash-only transactions, while convenient for unregistered vendors, reduce transparency in tax compliance and financial reporting.

GST Payment Process for Registered Businesses

Step-by-Step Guide

Calculate tax liability based on sales and input credits.

Generate GST Challan (Form PMT-06) on the GST portal.

Make payment through:

Net banking

NEFT/RTGS

Over the counter (OTC) for amounts below Rs 10,000

File GSTR-3B monthly return to offset the paid tax against liabilities.

Due Dates for GST Payment

Monthly returns (GSTR-3B): 20th of the following month.

Quarterly filers (QRMP scheme): 22nd or 24th depending on state.

GST on Digital Payments – The Reality

No Additional GST on UPI Payments

Using UPI or card to pay does not incur extra GST charges. GST is calculated on the value of goods/services, not the payment mode.

Digital Payment Benefits for Businesses

Easy reconciliation

Increased transparency

Builds customer trust

Faster settlements

FAQ

Is GST applicable on UPI payments for unregistered vendors?

No. If a vendor’s turnover is below the GST threshold, accepting UPI payments does not create GST liability.

Why do vendors refuse UPI payments?

Due to misconceptions that digital transactions automatically lead to GST registration and scrutiny.

How to pay GST online?

Registered businesses can pay GST via net banking, NEFT/RTGS, or OTC using challans generated on the GST portal.

Is there a penalty for not accepting UPI payments?

Currently, no direct penalty exists, but refusal contradicts the government’s digital economy push.

Helpful Resources

Conclusion

The Bengaluru “No UPI, Only Cash” controversy highlights gaps in GST awareness among small vendors. While their fear stems from misinformation, the tax department’s clarification that payment mode does not create GST liability for unregistered vendors brings relief. Moving towards digital payments remains crucial for transparency, ease, and India’s economic digitisation goals.

Latest Posts

Explore these recent financial and results updates:

Post Comment