DLF Share Price Rallies Strongly After Robust Q1 Performance

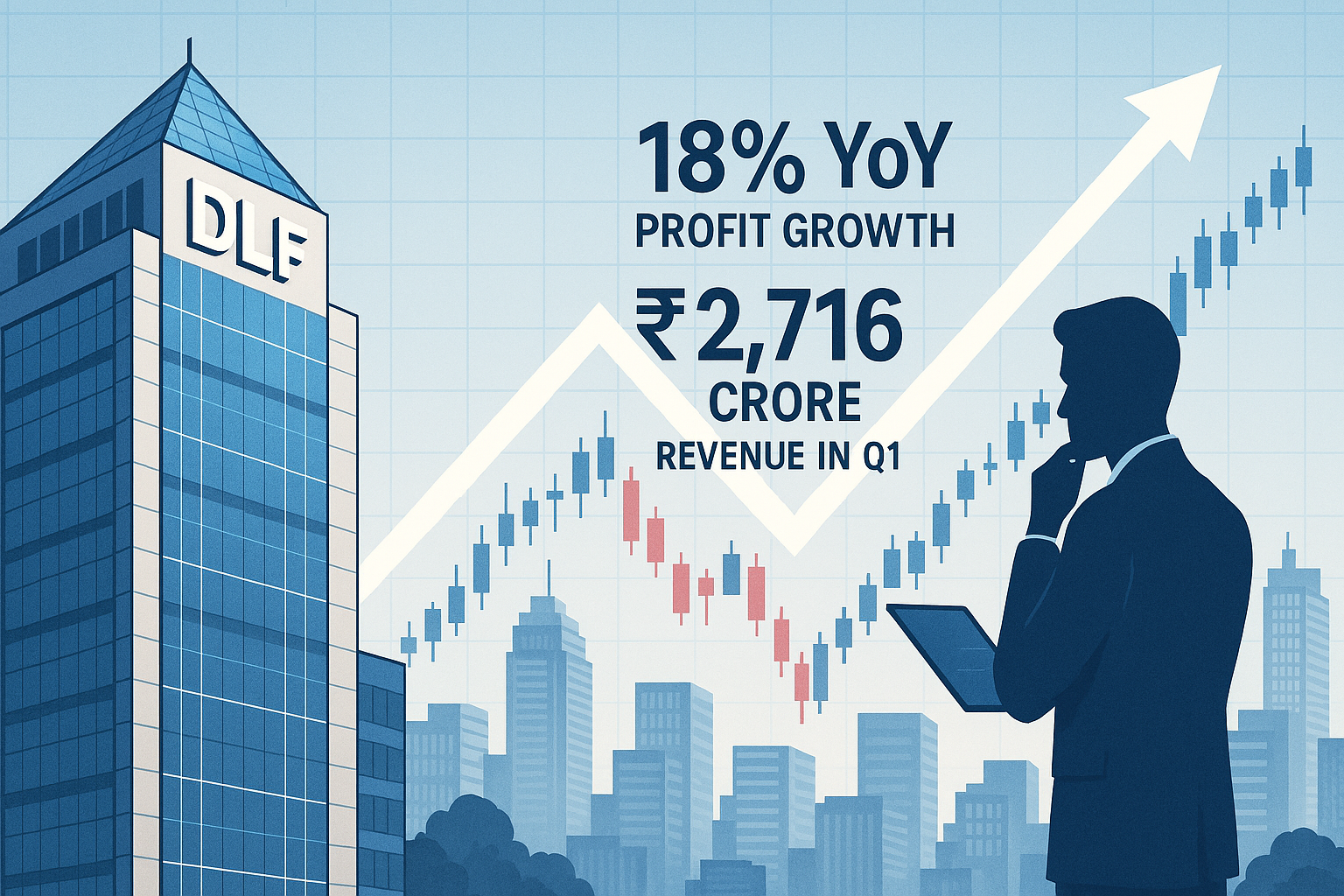

DLF’s Q1 results wow investors as net profit jumps 18% YoY and revenue more than doubles to ₹2,716 crore. The sharp recovery lifts DLF share price, driven by renewed confidence in India’s real estate sector.

Table of Contents

Q1 FY2026 Financial Results Overview

DLF Limited released its first quarter results for fiscal year 2026 on August 5, 2025. The company reported revenue from operations of ₹2,716 crore for the quarter ending June 2025. This represented a significant increase compared to the corresponding period in the previous fiscal year.

Net profit after tax showed year-on-year growth of 18% during Q1 FY2026. EBITDA margins expanded by approximately 350 basis points to reach 23.8% for the quarter. The results were disclosed through official stock exchange filings with BSE and NSE.

Following the results announcement, DLF shares experienced upward movement during trading on August 6, 2025. The stock gained 5.7% during intraday trading and crossed the ₹250 price level on the National Stock Exchange.

Company Background and Business Structure

Corporate History and Market Position

DLF Limited was established in 1946 and has developed operations across residential, commercial, and retail real estate segments. The company maintains a market capitalization exceeding ₹30,000 crore as of recent trading data. DLF operates primarily in India’s National Capital Region, with expansion activities in Mumbai and Bengaluru markets.

The company has developed projects across multiple cities in India over its operational history. DLF’s business spans urban development, housing projects, office complexes, and shopping centers. The firm is listed on both BSE and NSE stock exchanges.

Business Segment Overview

Residential Development Operations

DLF’s residential business focuses on housing projects across various price segments. The company maintains a strong presence in Gurugram and the Delhi NCR region. Recent quarters have seen project launches in additional metropolitan areas including Mumbai and Bengaluru.

Residential projects contribute a significant portion to overall revenue. The segment’s performance depends on factors including property prices, buyer demand, and project completion timelines. DLF targets both luxury and mid-premium housing categories in its residential portfolio.

Commercial Real Estate Assets

The commercial real estate portfolio includes office complexes and business parks. DLF Cyber City in Gurugram represents a major component of commercial operations. The segment generates rental income from corporate tenants across technology, financial services, and consulting sectors.

Commercial occupancy rates reached 88% as reported in Q1 FY2026 results. Leasing activity and tenant retention influence this segment’s performance. Long-term lease agreements provide revenue visibility and cash flow stability.

Retail Infrastructure

DLF operates shopping malls and retail spaces across major cities. The retail segment generates rental income from brand tenants and retail chains. This business line provides diversification to the overall revenue mix.

Retail operations benefit from India’s consumption growth trends. Foot traffic, tenant mix, and location quality affect retail segment performance. The company maintains relationships with national and international retail brands.

Q1 FY2026 Financial Performance Details

Revenue Analysis and Growth Factors

Total revenue from operations stood at ₹2,716 crore for Q1 FY2026. This figure represented more than double the revenue compared to Q1 FY2025. The growth reflected contributions from multiple business segments and project completions.

Residential project deliveries contributed to revenue recognition during the quarter. Commercial leasing income showed steady growth from existing assets. Retail segment revenues reflected ongoing mall operations and tenant agreements.

The revenue expansion indicated operational momentum across DLF’s diversified business portfolio. Project completion milestones and new property sales drove residential segment contributions. Commercial and retail segments provided recurring revenue streams.

Profitability and Margin Performance

Net profit after tax grew 18% year-on-year during Q1 FY2026. This represented the bottom-line performance after accounting for all expenses and taxes. The profit growth rate differed from revenue growth due to cost structures and operational investments.

EBITDA margins expanded to 23.8%, up 350 basis points from the previous year period. Margin improvement reflected operational efficiency initiatives and business mix effects. The company managed to expand profitability despite input cost pressures in the construction sector.

Operating leverage contributed to margin expansion as revenue scaled. Cost management initiatives and pricing strategies supported profitability improvements. The margin performance indicated effective operational execution during the quarter.

Pre-Sales and Project Metrics

DLF Gardencity Phase II achieved 60% pre-sales rates according to company disclosures. Pre-sales represent customer bookings before project completion. These advance bookings provide revenue visibility for future quarters.

Commercial portfolio occupancy reached 88% with continued leasing momentum. New tenant additions and lease renewals supported occupancy improvements. The occupancy rate indicated strong demand for DLF’s commercial properties.

Project completion milestones in Gurugram contributed to revenue recognition. Timely project delivery affects customer satisfaction and brand reputation. Execution capabilities influence the company’s ability to convert bookings into revenue.

Stock Market Response and Trading Activity

August 6, 2025 Trading Session Analysis

DLF shares opened with upward momentum following the results announcement. The stock gained 5.7% during intraday trading to cross ₹250 per share on NSE. This price level represented a psychologically significant threshold for market participants.

Trading volume increased by approximately 150% above the 30-day average. Higher volumes indicated increased investor participation and interest in the stock. Both institutional and retail investors appeared active based on trading patterns.

The price movement occurred in conjunction with broader market conditions. Sector indices and benchmark indices provided context for DLF’s relative performance. The stock’s gains exceeded movements in real estate sector indices during the session.

Technical Analysis Perspectives

The stock had previously traded in a range between ₹220 and ₹240 for several months before the breakout. The movement above ₹250 represented a breach of prior resistance levels. Volume-supported breakouts typically indicate potential for sustained momentum.

Moving average patterns turned favorable following the price advance. Short-term moving averages crossed above longer-term averages in some timeframes. Technical indicators suggested positive momentum based on price and volume data.

Chart patterns indicated consolidation before the August 6 breakout. The volume surge accompanying the price move provided technical confirmation. Market participants using technical analysis frameworks noted these pattern developments.

Analyst Coverage and Research Perspectives

Brokerage Firm Ratings and Target Prices

JM Financial upgraded DLF to Buy rating with a target price of ₹290 per share following the results. The target price implied potential upside from post-results trading levels. The brokerage cited improved execution and margin expansion in their analysis.

ICICI Direct raised their price target to ₹275 while maintaining a positive stance. Their research focused on commercial leasing momentum and residential pre-sales strength. The target price revision reflected updated financial projections.

Motilal Oswal maintained an Add rating on DLF shares. Their analysis emphasized cash flow generation and margin improvements. The brokerage’s sector expertise informed their comparative analysis of real estate companies.

Valuation Methodologies and Metrics

Analysts employ various valuation approaches for real estate companies. Net Asset Value (NAV) based valuation considers land holdings and property values. DLF reportedly trades at approximately 1.1 times estimated FY2026 NAV.

Historical NAV multiples for DLF have averaged around 1.4 times according to some analysts. The current discount to historical averages suggests potential for multiple expansion. Sum-of-parts valuation considers each business segment separately.

Discounted cash flow (DCF) models project future cash flows and discount them to present value. Different analysts use varying assumptions about growth rates and discount rates. Earnings-based multiples provide another comparison framework.

Real Estate Sector Context and Trends

Industry Performance Dynamics

India’s real estate sector has experienced cyclical patterns over recent years. Residential demand varies with factors including interest rates, income growth, and consumer confidence. Commercial real estate correlates with corporate expansion and office space requirements.

Recent quarters have shown improving trends in certain segments and markets. Residential sales velocity has increased in select metropolitan areas. Commercial leasing activity has recovered as corporate return-to-office trends strengthen.

Government policies including RERA (Real Estate Regulation Act) affect sector operations. Infrastructure development and urban planning initiatives influence real estate demand. Tax policies and monetary policy decisions impact both supply and demand dynamics.

Competitive Landscape Analysis

DLF competes with other listed and unlisted real estate developers. Listed competitors include companies like Godrej Properties, Prestige Estates, and Oberoi Realty. Each company has different geographic focus areas and segment specializations.

Market share varies by city, price segment, and property type. Brand recognition, execution track record, and financial strength influence competitive positioning. Land banks and development pipelines determine future growth potential.

Premium segment developers compete on quality, amenities, and location. Mid-market developers focus on affordability and value proposition. The sector includes both large diversified players and specialized regional developers.

Financial Health and Balance Sheet Assessment

Asset Base and Capital Structure

DLF’s balance sheet includes land holdings, ongoing projects, and completed properties. Real estate companies typically maintain significant fixed assets and inventory. Working capital management affects cash flow and liquidity.

The company’s capital structure includes both equity and debt components. Debt levels and debt-to-equity ratios indicate financial leverage. Interest coverage ratios measure the ability to service debt obligations from operating earnings.

Net worth and shareholder equity represent the book value basis for the company. Return on equity metrics assess profitability relative to shareholder investment. Asset turnover ratios indicate efficiency in utilizing assets to generate revenue.

Cash Flow Generation and Utilization

Operating cash flow reflects cash generated from core business activities. Strong operating cash flow supports dividend payments and growth investments. Working capital movements affect cash flow patterns in real estate businesses.

Capital expenditure includes investments in new projects and land acquisition. Free cash flow represents operating cash flow minus capital expenditure. This metric indicates cash available for debt repayment, dividends, or other purposes.

DLF’s improved cash generation capabilities support financial flexibility. The company can pursue growth opportunities while managing debt levels. Enhanced cash flows also enable potential dividend distributions to shareholders.

Growth Drivers and Strategic Initiatives

Commercial Leasing Momentum

The commercial real estate portfolio provides stable rental income. Lease agreements typically include escalation clauses for annual rent increases. New tenant additions and lease renewals drive occupancy and rental income growth.

DLF Cyber City and other commercial properties attract corporate tenants. Technology companies, financial institutions, and consulting firms represent key tenant categories. Location quality and property features influence leasing demand.

Work-from-office trends following the pandemic have supported commercial space demand. Companies expanding operations require additional office capacity. Premium office spaces in established business districts command higher rental rates.

Residential Project Pipeline

New project launches expand the residential development pipeline. Pre-sales during launch phases provide early revenue visibility. Project locations, pricing, and amenities affect market reception and sales velocity.

DLF’s expansion into Mumbai and Bengaluru diversifies geographic exposure. Different cities have varying demand patterns and price points. Market entry requires understanding local preferences and competitive dynamics.

Premium segment positioning allows higher realizations per unit. Luxury and ultra-luxury projects target high-net-worth buyers. Mid-premium projects appeal to upper-middle-class purchasers seeking quality housing.

Market Expansion and Diversification

Geographic diversification reduces dependence on single markets. The NCR region remains DLF’s primary market but expansion provides growth avenues. Each new market requires establishing brand presence and operational capabilities.

Segment diversification across residential, commercial, and retail reduces business concentration risk. Different segments have varying cyclical patterns and revenue characteristics. Balanced portfolio composition supports stability during sector fluctuations.

Strategic land acquisition during favorable market conditions builds future development potential. Land banks in prime locations represent valuable assets. Development rights and regulatory approvals add to land value.

Risk Factors and Business Challenges

Macroeconomic and Interest Rate Sensitivity

Real estate demand correlates with overall economic growth and consumer income levels. Economic slowdowns typically reduce property purchases and leasing activity. GDP growth rates influence corporate expansion and residential buying capacity.

Interest rate movements affect both buyer affordability and developer financing costs. Higher rates increase home loan EMIs, potentially dampening residential demand. Construction financing costs rise with benchmark rate increases.

Central bank monetary policy decisions influence interest rate direction. Rate cut cycles generally support real estate demand while rate hike cycles create headwinds. Developer profitability depends partly on cost of capital for project financing.

Regulatory and Approval Processes

Real estate projects require multiple regulatory approvals and clearances. Environmental approvals, building permits, and occupancy certificates involve regulatory processes. Delays in approvals can affect project timelines and costs.

RERA implementation has standardized certain practices and improved buyer protection. Compliance requirements affect project planning and execution. Changes in regulations require operational adaptations.

Land acquisition involves legal due diligence and title verification. Disputes over land ownership or regulatory compliance can delay projects. Established developers typically have experience navigating regulatory environments.

Execution and Operational Risks

Large-scale construction projects face execution challenges including material procurement and labor management. Cost overruns can occur due to price inflation or project delays. Weather conditions and seasonal factors affect construction schedules.

Quality control and timely project delivery influence customer satisfaction. Delays in completion affect revenue recognition timing. Construction defects or quality issues can damage reputation and create financial liabilities.

Project management capabilities and vendor relationships influence execution success. Experienced teams and established processes help mitigate execution risks. Financial reserves and contingency planning address unexpected challenges.

Investment Considerations and Analysis

Valuation Framework for Assessment

Real estate company valuation involves multiple methodologies. NAV-based approaches value land holdings and completed properties. Trading multiples compare price-to-book, price-to-earnings, and EV-to-EBITDA ratios across peers.

DLF’s current valuation reflects market assessment of assets and earnings potential. The discount to historical NAV multiples suggests potential for re-rating. However, valuation premiums depend on sustained operational performance.

Earnings growth projections influence forward-looking valuation multiples. Analysts model revenue growth, margin trends, and capital efficiency. Different growth assumptions lead to varying fair value estimates.

Dividend Policy and Shareholder Returns

DLF has distributed dividends to shareholders based on cash generation and capital requirements. Expected dividend of approximately ₹2 per share provides income component to total returns. Dividend yield depends on stock price levels.

Consistent dividend payments indicate management confidence in cash flow sustainability. However, growth companies may retain earnings for expansion rather than distributing all cash. Capital allocation priorities balance shareholder returns with business investment needs.

Dividend sustainability depends on earnings stability and cash generation. Real estate companies with diverse revenue streams can maintain more consistent payouts. One-time project completions may create lumpy cash flows affecting dividend regularity.

Portfolio Context and Risk Tolerance

Investment decisions should consider individual portfolio composition and objectives. Real estate stocks typically exhibit cyclical characteristics aligned with economic conditions. Sector allocation depends on overall portfolio diversification goals.

Risk tolerance influences appropriate position sizing in cyclical sectors. Conservative investors may limit real estate exposure due to volatility. Growth-oriented investors might increase allocation to capture sector recovery potential.

Time horizon matters for real estate investments due to business cycle duration. Long-term investors can ride through cyclical downturns to benefit from full cycle returns. Short-term traders focus on momentum and quarterly results.

Comparative Analysis with Sector Peers

Listed Real Estate Company Comparison

Multiple real estate companies trade on Indian stock exchanges with varying business models. Godrej Properties focuses on residential development across multiple cities. Prestige Estates operates in South India with diversified portfolio.

Oberoi Realty concentrates on Mumbai market with premium positioning. Each company has different geographic exposures, segment mix, and financial profiles. Comparative analysis examines growth rates, margins, return metrics, and valuations.

Market capitalization differences reflect company size and investor following. Larger companies may trade at premium valuations due to liquidity and institutional ownership. Smaller companies might trade at discounts despite strong fundamentals.

Operating Metrics and Performance Indicators

Revenue growth rates vary across companies based on project pipelines and execution. Pre-sales figures indicate booking momentum and market reception. Sales realization per square foot shows pricing power and segment positioning.

Profitability margins differ based on business mix and operational efficiency. EBITDA margins above 20% indicate strong operational performance for developers. Net margins reflect interest costs and tax efficiency.

Return on equity and return on capital employed measure capital efficiency. Higher returns suggest effective resource deployment and business quality. Cash conversion and capital intensity affect return profile sustainability.

Future Outlook and Monitoring Points

Quarterly Results and Performance Tracking

Subsequent quarterly results will indicate performance sustainability. Revenue growth trends, margin stability, and cash generation require monitoring. Management commentary provides forward guidance and strategic updates.

Pre-sales data for new projects indicates demand trends and market reception. Occupancy rates in commercial properties show leasing momentum. Retail segment performance reflects consumption patterns and tenant health.

Project completion schedules affect revenue recognition timing. Delays in completions can push revenue to later periods. Advance bookings provide revenue visibility for upcoming quarters.

Sector Developments and Policy Changes

Real estate sector policies including tax treatments and housing schemes affect demand. Infrastructure development in new areas creates real estate opportunities. Smart city initiatives and metro connectivity influence location values.

Interest rate trajectory based on RBI monetary policy affects financing costs and buyer affordability. Credit availability from housing finance companies influences residential demand. Commercial leasing tracks corporate sector health and expansion plans.

Regulatory changes under RERA or environmental norms require compliance adaptations. State-level policies on stamp duty and property taxes affect transaction costs. Land use regulations influence development potential in different areas.

Corporate Actions and Strategic Announcements

New project launches expand development pipeline and growth prospects. Joint ventures or partnerships indicate strategic expansion approaches. Land acquisition announcements signal future development intentions.

Organizational changes and leadership appointments affect execution capabilities. Board decisions on dividend policies impact shareholder returns. Capital raising activities through equity or debt affect shareholding and leverage.

Frequently Asked Questions

What were DLF’s key financial highlights for Q1 FY2026?

DLF Limited reported revenue of ₹2,716 crore for Q1 FY2026, representing more than double the revenue from the corresponding quarter in the previous fiscal year. Net profit after tax grew 18% year-on-year during the quarter. EBITDA margins expanded by 350 basis points to reach 23.8%, indicating improved operational efficiency. Commercial portfolio occupancy reached 88%, while DLF Gardencity Phase II achieved 60% pre-sales rates.

How did DLF’s stock price react to the quarterly results announcement?

On August 6, 2025, DLF shares gained 5.7% during intraday trading following the results announcement on August 5, 2025. The stock crossed the ₹250 price level on the National Stock Exchange. Trading volume increased approximately 150% above the 30-day average, indicating heightened investor interest. The price movement was accompanied by significant volume, suggesting broad-based participation from both institutional and retail investors.

What analyst ratings and target prices has DLF received?

Following the Q1 FY2026 results, JM Financial upgraded DLF to Buy rating with a target price of ₹290 per share. ICICI Direct raised their price target to ₹275 while maintaining a positive stance on the stock. Motilal Oswal maintained an Add rating, emphasizing improved cash flow generation and margin expansion. Target prices range from ₹275 to ₹290, representing potential upside from post-results trading levels.

How does DLF’s commercial real estate portfolio contribute to overall performance?

DLF’s commercial real estate portfolio provides stable rental income through office complexes like DLF Cyber City in Gurugram. The segment achieved 88% occupancy rates in Q1 FY2026 with continued leasing momentum. Commercial properties generate recurring revenue streams with long-term lease agreements that include annual escalation clauses. This provides earnings stability and cash flow predictability, complementing the more cyclical residential development business.

What is DLF’s current valuation based on Net Asset Value?

According to analyst reports, DLF trades at approximately 1.1 times estimated FY2026 Net Asset Value (NAV). Historical NAV multiples for DLF have averaged around 1.4 times, suggesting the current trading level represents a discount to historical norms. NAV-based valuation is particularly relevant for real estate companies as it considers the value of land holdings, completed properties, and development rights beyond just current earnings.

What are the main growth drivers for DLF’s business?

Key growth drivers include improved commercial leasing momentum with rising occupancy rates and rental escalations. Residential project pipeline expansion through new launches in NCR, Mumbai, and Bengaluru markets provides revenue growth opportunities. Pre-sales strength indicates robust demand for DLF’s residential offerings. The broader real estate sector recovery driven by improved consumer confidence, interest rate expectations, and economic growth also supports performance.

What risks should investors consider regarding DLF’s business?

Major risks include sensitivity to macroeconomic conditions and interest rate movements, which affect both residential demand and financing costs. Regulatory approval processes and compliance requirements can impact project timelines. Execution risks in large-scale construction including cost overruns and completion delays require monitoring. Geographic concentration in NCR markets creates market-specific risk, though the company is diversifying into other cities. Real estate sector cyclicality means performance fluctuates with economic cycles.

How does DLF’s dividend policy work?

DLF has indicated expectations for dividend payments of approximately ₹2 per share based on improved cash generation capabilities. Dividend decisions depend on the company’s cash flow position, growth investment requirements, and board approval. The dividend yield at current stock prices approximates a certain percentage, providing an income component to total shareholder returns. Dividend sustainability requires consistent earnings and cash generation from operations.

About the Author

Nueplanet

Nueplanet is a financial content analyst specializing in real estate sector coverage, quarterly earnings analysis, and property market trends in India. With the years of experience analyzing listed real estate companies, Nueplanet focuses on providing factual, data-driven analysis of sector developments and company performance.

Nueplanet has contributed analysis on real estate companies, sector performance trends, and property market dynamics. This analysis is based on publicly available information from regulatory filings, stock exchange disclosures, company announcements, and official earnings presentations.

All content is created for informational and educational purposes only. The author does not provide personalized investment advice or recommendations to buy, sell, or hold securities.

Commitment to Accuracy: Content is researched using verified sources including stock exchange filings (BSE/NSE), company quarterly results, official earnings call transcripts, SEBI disclosures, regulatory announcements, and real estate sector reports. Information is cross-referenced across multiple authoritative sources to ensure factual accuracy.

Transparency: Nueplanet has no financial interest, shareholding, or business relationship with DLF Limited or any company mentioned in this analysis. All perspectives are independent and based solely on publicly available information and official company disclosures.

About This Website

This website provides factual analysis of Indian equity markets, focusing on quarterly earnings, sectoral trends, company performance, and market developments. Our goal is to present verified information from official sources to help readers understand corporate results and industry dynamics.

Our Approach:

- Analysis based exclusively on regulatory filings, exchange disclosures, and official company statements

- Factual presentation of financial data, business metrics, and market developments

- No stock recommendations, buy/sell advice, or personalized investment guidance

- Regular content updates to reflect latest quarterly results and company announcements

Sources Used:

- BSE and NSE stock exchange disclosures and announcements

- Company quarterly results, annual reports, and investor presentations

- Securities and Exchange Board of India (SEBI) filings and regulations

- Official earnings call transcripts and management commentary

- Ministry of Housing and Urban Affairs data and policy announcements

- Reserve Bank of India reports on real estate and housing finance

Last Updated: August 05, 2025 || Published: August 05, 2025

Important Disclaimer

This article is for informational and educational purposes only. It does not constitute investment advice, financial advice, trading advice, or recommendation to buy, sell, or hold any securities. The content presents factual information about DLF Limited’s quarterly results based on publicly available data from official company disclosures.

Stock markets involve substantial risk of loss. Past performance does not guarantee future results. Stock prices fluctuate based on numerous factors including company performance, market conditions, economic developments, sector trends, and investor sentiment.

Investors should conduct independent research, assess their financial situation and risk tolerance, and consult qualified financial advisors before making investment decisions. The author and website assume no responsibility for investment decisions made based on this information.

All data, statistics, and financial information are sourced from official company announcements, stock exchange filings, quarterly result presentations, and earnings call transcripts. While every effort is made to ensure accuracy, readers should verify information independently through official sources.

References to analyst reports and target prices are for informational purposes only. Analyst opinions represent individual firm views and do not constitute recommendations from the author or website. Investors should review complete analyst reports for detailed rationale and assumptions.

Valuation metrics and financial ratios are calculated based on publicly available data and current market prices. These metrics are subject to change with stock price movements and updated financial disclosures. Comparative analysis with peer companies is for context only and does not imply relative investment merit.

Real estate investments carry specific risks including regulatory changes, project execution challenges, interest rate sensitivity, and market cyclicality. Sector-specific factors should be carefully evaluated alongside company-specific analysis.

For latest DLF Limited share price and company announcements, visit official stock exchange websites: BSE and NSE. For quarterly results and investor presentations, refer to [DLF Limited Investor Relations](company IR page). For real estate sector policies and regulations, visit Ministry of Housing and Urban Affairs.

Helpful Resources

Latest Posts

- Highway Infrastructure IPO: A Promising Route with Soaring GMP

- JSW Energy Share Price Surges: What’s Fueling the Rally?

- Godfrey Phillips Share Price Rally After Q1 Profit Surge & Bonus Issue

- Donald Trump India News: Why His Threats Won’t Wean India Off Russian Crude

- Knowledge Realty Trust IPO: A ₹4,800 Cr Game-Changer in India’s REIT Space

- IndusInd Bank Share: Leadership Change and Market Response

Post Comment