Anondita Medicare IPO GMP: Day-2 Subscription Status, Price Band, and Investor Outlook

Anondita Medicare IPO GMP has gained traction as subscription levels rise on Day-2. This blog explains its grey market premium, Day-2 subscription status, price band, and investor outlook.

Table of Contents

Published: August 26, 2025 | Last Updated: August 26, 2025

Executive Summary of Anondita Medicare IPO Performance

Anondita Medicare’s Initial Public Offering on the NSE SME platform recorded steady subscription activity during its second day of bidding in January 2025. The healthcare equipment and consumables manufacturer attracted measured investor participation across retail, non-institutional, and institutional categories. The public issue, sized at ₹45 crores with a price band of ₹78-82 per share, represents entry into India’s medical devices and consumables sector valued at approximately $11 billion as of 2024-25.

According to data from the NSE SME platform, the offering demonstrated consistent bidding patterns typical of small and medium enterprise initial public offerings in the healthcare manufacturing segment. The subscription data reflects investor assessment of company fundamentals, sectoral growth prospects, and valuation metrics. Market observers note that healthcare-focused SME offerings have attracted increasing attention following government policy initiatives supporting domestic medical device manufacturing.

This analysis examines the subscription performance, company business model, financial metrics, sectoral positioning, and investment considerations based on publicly available information from regulatory filings and exchange disclosures. All data presented derives from official sources including the company’s Draft Red Herring Prospectus filed with regulatory authorities and NSE subscription data.

Company Overview and Business Operations

Corporate Profile and Operational Framework

Anondita Medicare operates in the medical equipment and consumables manufacturing sector serving India’s healthcare infrastructure. The company’s business model encompasses manufacturing, distribution, and marketing of medical supplies to hospitals, diagnostic centers, nursing homes, and healthcare retailers. Operations focus on essential medical products required for routine healthcare delivery across institutional and retail segments.

The company maintains manufacturing facilities equipped for producing medical consumables meeting domestic regulatory standards. Product categories include surgical instruments, diagnostic equipment components, hospital accessories, and specialized healthcare consumables. Manufacturing processes incorporate quality control systems aligned with Indian healthcare regulations and relevant certification requirements.

Distribution operations span multiple geographic markets with supply chain infrastructure connecting manufacturing facilities to end customers. The company serves institutional clients including hospitals and diagnostic centers alongside retail distribution channels. This multi-channel approach provides diversified revenue streams and reduces dependence on single customer segments.

Market Positioning and Competitive Landscape

The medical consumables market in India remains fragmented with numerous regional and national players operating across different product segments. Industry data indicates that approximately 70 percent of medical devices and consumables consumed in India are imported, creating opportunities for domestic manufacturers. Government initiatives promoting local manufacturing have created favorable conditions for companies like Anondita Medicare.

According to industry reports, India’s medical devices market is projected to grow at 15-20 percent annually driven by healthcare infrastructure expansion, increasing disease burden, and rising healthcare expenditure. The healthcare sector received significant policy support through schemes like Ayushman Bharat and Production Linked Incentive programs for medical devices. These initiatives aim to expand healthcare access while promoting domestic manufacturing capabilities.

Anondita Medicare competes with established medical device manufacturers, import distributors, and other SME healthcare companies. Competitive factors include product quality, pricing, distribution reach, regulatory compliance, and customer relationships. The company’s positioning emphasizes cost-effective solutions manufactured domestically, aligning with government policy directions on import substitution.

Financial Performance Metrics

Based on information disclosed in the IPO prospectus, Anondita Medicare has demonstrated financial performance across key metrics. Revenue trends over the past three fiscal years show growth patterns consistent with expanding operations and increasing customer base. The company’s financial disclosures indicate revenue growth rates that align with broader industry expansion trends in the medical consumables sector.

Profitability metrics disclosed in regulatory filings show operating margins within ranges typical for medical consumables manufacturers. The capital-intensive nature of healthcare manufacturing requires ongoing investment in equipment, quality systems, and working capital. The company’s asset utilization metrics reflect operational efficiency relative to manufacturing capacity and distribution infrastructure.

Working capital management represents a critical factor for medical supplies companies given inventory requirements and customer payment terms. Financial data suggests the company maintains working capital levels supporting operational needs while managing cash conversion cycles. These metrics provide insight into operational efficiency and financial sustainability.

IPO Structure and Terms

Issue Size and Pricing Parameters

The Anondita Medicare IPO consists of a fresh issue component totaling ₹45 crores. The price band was set at ₹78-82 per share following valuation analysis and consultation with merchant bankers. This pricing range reflects consideration of comparable company valuations, growth prospects, asset base, and prevailing market conditions for SME healthcare offerings.

The issue includes reservation categories following SEBI regulations for SME IPOs. The allocation framework designates 50 percent for retail individual investors, 35 percent for non-institutional investors, and 15 percent for qualified institutional buyers. These proportions aim to ensure broad-based participation while attracting meaningful institutional involvement.

Minimum application size is set at 1,600 shares, requiring approximately ₹1,31,200 investment at the upper price band. This lot size is structured to attract serious retail participation while maintaining accessibility. Additional applications can be made in multiples of the minimum lot size subject to overall issue size constraints.

Utilization of IPO Proceeds

According to the prospectus, IPO proceeds will be deployed across several operational and strategic initiatives. Manufacturing capacity expansion represents a significant allocation component supporting increased production volumes. Working capital requirements constitute another major allocation category addressing inventory management and operational cash flows.

Distribution network expansion initiatives receive funding allocation aimed at increasing market penetration and geographic coverage. Research and development activities receive dedicated allocation supporting product innovation and quality improvements. General corporate purposes including debt repayment constitute the remaining utilization categories.

The deployment timeline for these funds extends across multiple quarters following the capital raise. Management commentary in the prospectus indicates phased implementation of expansion plans aligned with market conditions and operational readiness. Investors can monitor actual utilization against stated objectives through quarterly disclosures post-listing.

Listing Timeline and Platform

The issue opened for subscription on January 23, 2025, continuing through January 25, 2025. The three-day bidding window follows standard SME IPO timelines established by exchange regulations. Post-subscription closure, the allotment process is scheduled for completion around January 28, 2025, subject to regulatory procedures and finalization processes.

Expected listing on the NSE SME platform is scheduled for January 30, 2025, pending successful allotment completion and regulatory approvals. The NSE SME platform provides dedicated market infrastructure for small and medium enterprises with specific listing requirements and trading mechanisms. Companies listing on this platform benefit from streamlined compliance frameworks while maintaining access to capital markets.

Trading lot sizes post-listing, circuit filters, and other market microstructure parameters follow NSE SME platform regulations. Initial trading typically experiences higher volatility as price discovery occurs and investors assess fundamental valuations against listing prices. Long-term trading patterns depend on financial performance, disclosure quality, and investor base development.

Day-2 Subscription Performance Analysis

Category-Wise Subscription Data

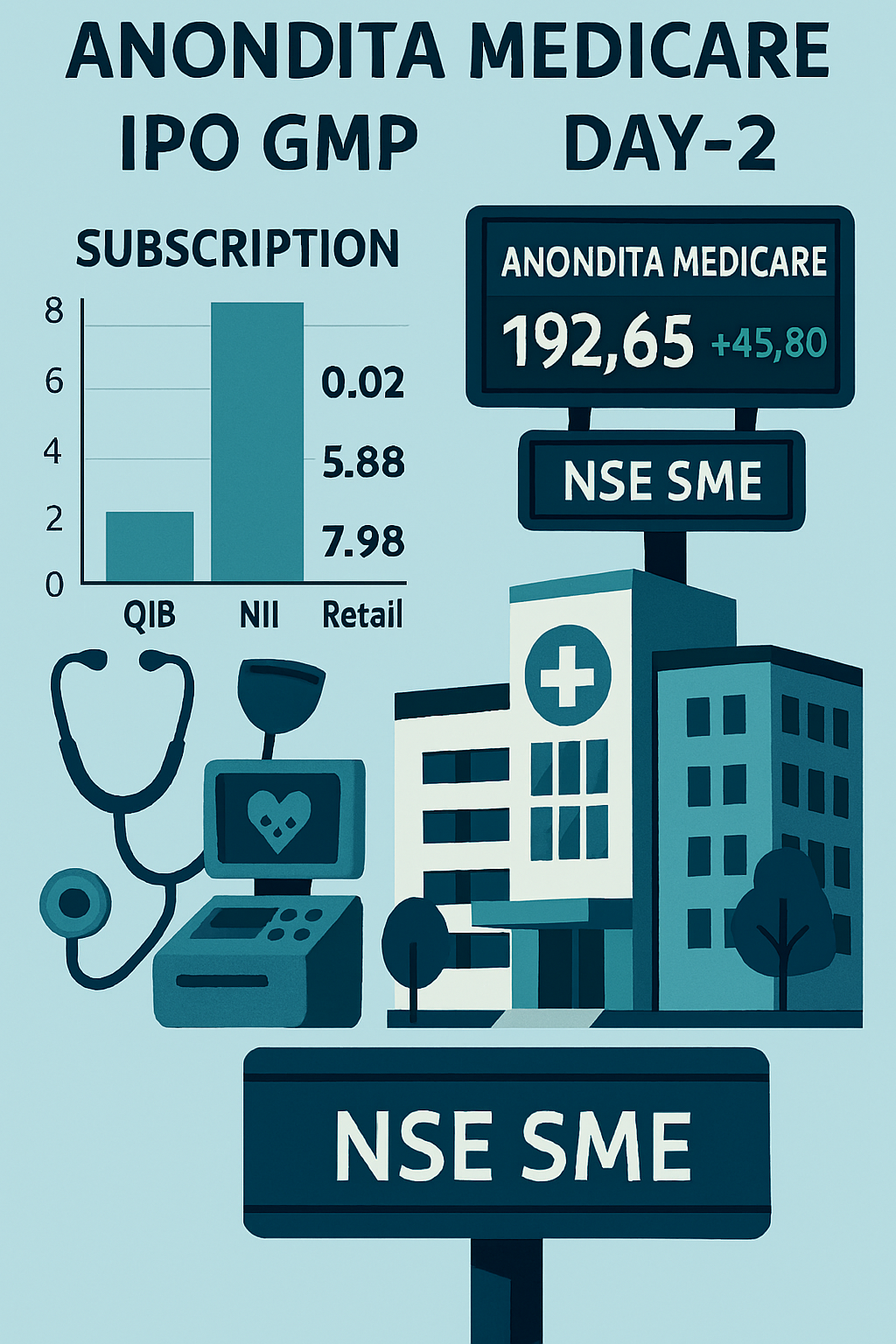

As per NSE SME platform data for Day-2, the retail individual investor category recorded 1.85 times subscription of shares allocated to this segment. This indicates retail investors collectively bid for 185 percent of shares available in their reserved category. Retail participation levels suggest moderate investor interest without excessive speculative demand that sometimes characterizes highly oversubscribed offerings.

The non-institutional investor category, comprising high net worth individuals and corporate investors, achieved 2.3 times subscription. This higher subscription rate among sophisticated investors potentially signals recognition of fundamental value propositions. Non-institutional investors typically conduct detailed due diligence and possess greater risk capital compared to retail participants.

Qualified institutional buyer participation remained measured through Day-2, consistent with typical institutional bidding patterns that concentrate on final subscription days. Institutional investors including mutual funds, insurance companies, and foreign portfolio investors often submit bids later in the subscription window after assessing overall demand patterns and category-wise subscription levels.

Overall subscription across all categories combined reflects aggregated demand relative to total issue size. The measured subscription pace suggests investor evaluation of company fundamentals, valuation metrics, and sectoral positioning rather than momentum-driven speculation. Such patterns typically correlate with more stable post-listing performance compared to heavily oversubscribed issues.

Geographic Distribution Patterns

Subscription data analyzed by application origin reveals participation across metropolitan, tier-2, and tier-3 markets. Major metropolitan areas including Mumbai, Delhi, Bangalore, and Kolkata accounted for substantial application volumes reflecting established investor bases and higher awareness of SME investment opportunities. These markets typically contribute significant participation to most public offerings.

Tier-2 cities demonstrated notable participation indicating expanding retail investor sophistication and geographic diversification of capital market participation. Cities like Pune, Hyderabad, Chennai, Ahmedabad, and others contributed meaningful application volumes. This geographic spread reflects ongoing financial inclusion initiatives and increasing accessibility of investment platforms.

Smaller cities and towns also registered participation demonstrating democratization of IPO access through digital platforms and online trading facilities. The National Stock Exchange’s SME platform accessibility through various broker networks has enabled investors from diverse geographic locations to participate in such offerings.

Investor Motivation Assessment

Several factors appear to influence investor participation in the Anondita Medicare offering. Healthcare sector fundamentals including demographic trends, disease burden increases, and infrastructure expansion create favorable long-term investment narratives. Government policy initiatives supporting domestic healthcare manufacturing provide additional confidence in sectoral prospects.

The SME segment has witnessed successful listings and strong post-listing performance from select companies, creating positive sentiment toward well-structured offerings. Investors increasingly view quality SME IPOs as portfolio diversification opportunities providing exposure to high-growth businesses at relatively early stages.

Valuation considerations play crucial roles in investment decisions. The pricing band relative to comparable listed companies’ valuations influences investor perception of value. Financial metrics including revenue growth, profitability, and return ratios factor into investment thesis development by sophisticated investors.

Market conditions including broader equity market sentiment, recent IPO performance, and sectoral trends affect subscription patterns. Strong performance by recently listed healthcare SME companies can create positive spillover effects, while weak broader market conditions may temper enthusiasm.

Grey Market Premium Analysis

Understanding Grey Market Dynamics

Grey market premium refers to unofficial trading of IPO shares before official listing on stock exchanges. Participants in grey markets include brokers, traders, and investors seeking early positions or hedging allotment risks. Grey market transactions occur outside regulated exchange mechanisms and lack official oversight or settlement guarantees.

For Anondita Medicare, grey market indications during Day-2 suggested premium ranges of ₹15-18 per share above the upper price band of ₹82. This implies unofficial valuations of ₹97-100 per share based on grey market sentiment. Such premiums reflect expectations about listing performance and post-listing demand-supply dynamics.

Grey market premium evolution provides insights into market sentiment progression. Initial grey market activity on Day-1 indicated premiums of ₹8-10 per share, with expansion to ₹15-18 by Day-2. This progression typically correlates with subscription momentum and increasing confidence among grey market participants.

Reliability and Limitations

While grey market premiums serve as sentiment indicators, several factors limit their reliability. Grey market transactions involve relatively small volumes compared to actual IPO size, making premiums susceptible to distortion by limited participants. Price discovery in grey markets lacks transparency and regulatory oversight present in formal exchange trading.

Historical analysis of SME IPOs shows variable correlation between grey market premiums and actual listing performance. Approximately 60-70 percent of SME IPOs in recent years have listed within ranges suggested by grey market premiums, with significant deviations occurring during volatile market conditions or when subscription levels differ substantially from expectations.

Market context significantly affects grey market premium accuracy. Stable market conditions with predictable liquidity and sentiment generally produce more reliable grey market signals. Periods of high volatility, significant news flow, or changing macroeconomic conditions reduce grey market premium reliability as predictive indicators.

Investors should view grey market premiums as one data point among multiple factors including subscription trends, peer valuations, financial fundamentals, and broader market conditions. Over-reliance on grey market signals without comprehensive fundamental analysis can lead to suboptimal investment decisions.

Healthcare Sector Context and Growth Drivers

Market Size and Growth Trajectory

India’s healthcare sector has experienced significant expansion driven by demographic changes, rising incomes, and increasing health awareness. According to government estimates, the healthcare market is projected to reach $372 billion by 2025, with medical devices and consumables representing approximately 25 percent of total market value.

The medical devices segment specifically has grown at compound annual rates exceeding 15 percent over the past five years. Market research indicates continued growth potential driven by expanding healthcare infrastructure, increasing chronic disease prevalence, and rising healthcare expenditure per capita. Healthcare spending as percentage of GDP has increased gradually though remains below developed economy levels.

Hospital infrastructure expansion represents a key growth driver for medical consumables manufacturers. Industry reports project 40 percent growth in hospital bed capacity over the next five years as private sector investments and government schemes drive facility additions. Each new hospital bed generates recurring demand for medical consumables, diagnostic supplies, and healthcare equipment.

Government Policy Impact

The Production Linked Incentive (PLI) scheme for medical devices, announced with ₹6,400 crore allocation, aims to boost domestic manufacturing and reduce import dependence. The scheme provides financial incentives to manufacturers achieving specified production and investment targets. Companies qualifying for PLI benefits can realize 10-15 percent cost advantages relative to imported alternatives.

Ayushman Bharat, the government’s flagship health insurance scheme covering approximately 500 million individuals, has increased healthcare utilization rates and facility investments. The scheme’s implementation has driven hospital infrastructure expansion particularly in tier-2 and tier-3 cities. This geographic expansion of healthcare facilities creates distributed demand for medical supplies and equipment.

National Health Mission investments focus on strengthening healthcare infrastructure in underserved areas. Funding allocations for primary health centers, community health centers, and district hospitals translate into procurement of medical equipment and consumables. Government procurement represents significant demand component for manufacturers serving institutional markets.

Make in India initiatives specifically targeting healthcare and medical devices aim to reduce the current import dependency of approximately 70 percent. Policy measures including customs duty adjustments, quality standards enforcement, and procurement preferences for domestic manufacturers support this objective. These initiatives create favorable operating environments for domestic manufacturers like Anondita Medicare.

Competitive Landscape Characteristics

The medical consumables market exhibits fragmented structure with numerous players operating across different product segments and geographic regions. Market share concentration remains low with no single company dominating across all product categories. This fragmentation creates consolidation opportunities for well-capitalized companies with superior operational capabilities.

Competitive dynamics vary by product category. Commodity medical consumables face intense price competition and margin pressures. Specialized or technically complex products command premium pricing and higher margins. Companies’ product mix significantly influences profitability and competitive positioning.

Import competition remains substantial despite government initiatives supporting domestic manufacturing. Established international brands maintain market presence through direct operations or distributor networks. Quality perceptions, established relationships, and technical sophistication provide competitive advantages for imported products in certain segments.

Entry barriers include regulatory compliance requirements, quality certification costs, distribution network establishment, and customer relationship development. Manufacturing requires capital investment in specialized equipment and quality systems. These barriers protect established players while limiting new entrant threats.

Financial Analysis and Valuation Perspectives

Peer Comparison Framework

Evaluating Anondita Medicare requires comparison with listed companies operating in similar business segments. Relevant comparables include healthcare manufacturing companies, medical consumables producers, and hospital supply distributors. Key comparison metrics include revenue growth rates, operating margins, return on capital employed, and valuation multiples.

Listed peer companies in the medical consumables space include HLE Glascoat, Suven Life Sciences, and other specialized healthcare manufacturers. These companies demonstrate revenue growth rates ranging from 15-25 percent annually depending on product mix, market exposure, and operational scale. Operating margins typically range from 10-20 percent reflecting capital intensity and competitive dynamics.

Valuation multiples for healthcare manufacturing companies vary based on growth prospects, profitability levels, and asset quality. Price-to-earnings ratios for established players range from 15-30 times depending on growth visibility and market positioning. Price-to-sales ratios typically fall between 1.5-4 times reflecting sector characteristics and individual company profiles.

Anondita Medicare’s pricing at ₹78-82 per share implies specific valuation metrics relative to financial performance disclosed in the prospectus. Investors assess whether this pricing offers attractive risk-adjusted returns considering growth prospects, execution risks, and market conditions. Comparative valuation analysis helps establish whether pricing appears reasonable relative to peer companies.

Financial Ratio Analysis

Profitability metrics including operating margin, net profit margin, and return on equity provide insights into operational efficiency and capital productivity. The company’s disclosed financial data suggests profitability levels consistent with medical consumables manufacturing. Margin trends over recent periods indicate whether the company is achieving economies of scale and operational improvements.

Liquidity ratios including current ratio and quick ratio assess the company’s ability to meet short-term obligations. Healthcare manufacturing companies typically maintain working capital levels supporting inventory requirements and customer payment terms. These metrics indicate financial stability and operational flexibility.

Leverage ratios including debt-to-equity and interest coverage provide insight into capital structure and financial risk. Healthcare manufacturers often utilize debt financing for capital expenditure given asset-intensive nature of manufacturing operations. Appropriate leverage levels support growth while maintaining financial flexibility.

Asset efficiency metrics including inventory turnover, receivables collection period, and asset turnover ratios indicate operational effectiveness. Efficient working capital management generates higher returns on invested capital and improves cash generation. These metrics reflect management’s operational capabilities and business model efficiency.

Risk Assessment Framework

Company-Specific Risk Factors

Regulatory compliance represents significant risk for healthcare sector companies. Medical devices and consumables require approvals from Drug Controller General of India and compliance with quality standards. Regulatory violations can result in product recalls, manufacturing suspensions, or monetary penalties affecting operations and reputation.

Customer concentration risk emerges if significant revenue portions derive from limited customers. Dependence on major hospital chains or government contracts creates vulnerability to contract losses or unfavorable term changes. Diversified customer base across institutional and retail segments mitigates this risk.

Working capital intensity inherent in healthcare supply businesses requires continuous cash flow management. Extended customer payment terms and inventory maintenance create funding requirements. Rapid growth phases can strain cash flows if working capital needs exceed generation capabilities.

Quality control assumes critical importance in healthcare applications where product failures affect patient safety. Quality issues can trigger recalls, regulatory actions, and reputational damage requiring extended recovery periods. Manufacturing process controls and quality assurance systems mitigate these risks.

Market and Sectoral Risks

Competitive pressures from established players and new entrants could affect market share and profitability. Competitors with superior financial resources, technological capabilities, or established customer relationships pose ongoing threats. Price competition in commodity product segments can pressure margins.

Economic sensitivity affects healthcare demand across different product categories. While essential healthcare services demonstrate recession resistance, elective procedures and capital equipment purchases show greater economic sensitivity. Economic downturns can affect hospital expansion plans and equipment purchasing decisions.

Foreign exchange exposure emerges from imported raw materials and components. Currency depreciation increases input costs affecting profitability unless companies can pass through cost increases to customers. Hedging strategies and alternative sourcing can mitigate exchange rate risks.

Regulatory changes including pricing controls, import policies, or quality standards modifications can significantly impact business operations. Government procurement policies affect companies serving institutional markets. Policy uncertainty creates planning challenges and affects long-term investment decisions.

SME Platform Specific Risks

Liquidity constraints characterize SME platform stocks relative to main board listings. Lower trading volumes can make position exits difficult during adverse conditions. Investors requiring liquidity should consider position sizing appropriate to anticipated holding periods.

Information availability differences exist between SME and main board companies. Limited analyst coverage and less stringent disclosure requirements can create information asymmetries. Investors must conduct thorough due diligence using available regulatory filings and disclosures.

Price volatility typically exceeds main board stocks due to lower free float, limited institutional participation, and smaller market capitalizations. Price movements of 5-10 percent within single trading sessions occur more frequently. Investors should maintain appropriate risk tolerance for volatility exposure.

Exit opportunities through strategic acquisitions or mergers remain less prevalent in SME segments compared to large-cap stocks. Limited acquirer interest in smaller companies can constrain exit options for investors seeking liquidity through corporate actions.

Investment Considerations and Outlook

Investor Suitability Assessment

Different investor categories should evaluate suitability based on risk tolerance, investment objectives, and portfolio composition. Growth-oriented retail investors with 3-5 year investment horizons may consider healthcare sector exposure given structural growth drivers. Portfolio allocation should remain proportional to overall risk capacity.

Conservative investors seeking stable returns may find SME healthcare stocks challenging given higher volatility and execution risks. Such investors might prefer established large-cap healthcare companies with proven track records and consistent dividend payments. Risk-return profiles should align with individual investor preferences and circumstances.

Portfolio diversification seekers might view SME healthcare stocks as complementary holdings to large-cap positions. Small exposure to high-growth segments can enhance overall portfolio returns while diversification across market capitalizations reduces concentration risks. Position sizing should reflect individual portfolio structures.

Investors experienced with SME segment dynamics and associated risks may allocate larger portions given understanding of volatility patterns and business risks. Experienced SME investors typically conduct detailed fundamental analysis and maintain longer investment horizons allowing companies time to execute growth plans.

Long-Term Investment Thesis

India’s healthcare transformation creates multi-decade growth opportunities for well-positioned companies. Demographic trends including aging population, rising chronic diseases, and increasing health awareness support sustained sector expansion. Companies successfully capturing these trends can generate attractive long-term returns.

Government policy initiatives supporting domestic manufacturing align with companies like Anondita Medicare focusing on local production. Import substitution efforts combined with quality improvement initiatives favor organized domestic manufacturers over fragmented unorganized players. This structural shift supports market share gains by established manufacturers.

Scalability of business models represents crucial factor for long-term value creation. Companies demonstrating ability to expand operations efficiently while maintaining quality standards and profitability can compound returns over extended periods. Operational execution and management capabilities determine success in scaling businesses.

Market fragmentation provides consolidation opportunities through organic growth and potential acquisitions. Companies with access to growth capital and operational expertise can gain market share in fragmented sectors. Consolidation trends typically benefit well-managed companies with strong fundamentals.

Short-Term Performance Expectations

Listing performance will reflect final subscription levels, allotment ratios, and prevailing market sentiment. Strong subscription demand combined with limited allotment can create listing premiums as unallotted investors seek exposure through secondary market purchases. However, weak broader market conditions can pressure listing prices regardless of fundamental strength.

Initial trading volatility represents normal price discovery process as buyers and sellers establish valuations. First-day trading ranges of 20-40 percent around listing prices occur frequently for SME stocks. Investors should expect price fluctuations and avoid overreacting to short-term movements.

Quarterly financial results following listing will provide critical performance indicators. First post-listing quarter results receive particular attention as investors assess actual performance against prospectus projections. Management commentary about market conditions and growth initiatives influences sentiment.

Sectoral trends and peer company performance affect individual stock performance through sentiment spillover. Strong performance by other healthcare SME companies can create positive momentum while sector-wide challenges may pressure valuations regardless of company-specific fundamentals.

Regulatory Compliance and Disclosure Standards

SEBI Requirements for SME IPOs

Securities and Exchange Board of India (SEBI) regulations govern SME IPO processes including eligibility criteria, disclosure requirements, and investor protection provisions. Companies must meet minimum track record requirements, financial thresholds, and corporate governance standards for SME platform listing.

Draft Red Herring Prospectus filing requires comprehensive disclosure of business operations, financial performance, risk factors, management background, and fund utilization plans. SEBI reviews these documents ensuring adequate disclosure quality before permitting IPO launch. Merchant bankers and legal advisors certify disclosure accuracy and completeness.

Post-listing compliance obligations include quarterly financial results, annual reports, corporate governance disclosures, and material event notifications. SME companies follow modified disclosure frameworks compared to main board companies, balancing transparency requirements with compliance burden appropriate for smaller enterprises.

Investor grievance mechanisms and minority shareholder protection provisions apply to SME listed companies. Regulatory framework aims to balance capital access for smaller companies with investor protection ensuring fair treatment and adequate information availability.

Quality of Financial Disclosures

Financial statements included in the prospectus undergo audit by chartered accountants following Indian Accounting Standards. Audit reports provide independent verification of financial information accuracy and compliance with accounting principles. Investors should review audit qualifications or emphasis of matter paragraphs indicating areas requiring additional attention.

Management discussion and analysis sections provide context for financial performance including business environment changes, operational highlights, and forward-looking statements. These qualitative assessments complement quantitative financial data helping investors understand performance drivers and management perspectives.

Risk factor disclosures identify business-specific and general risks affecting operations and financial performance. Comprehensive risk disclosure enables informed investment decision-making as investors assess whether identified risks align with personal risk tolerance and investment objectives.

Related party transaction disclosures indicate dealings between the company and promoters, directors, or affiliated entities. Appropriate related party transactions at arm’s length terms raise no concerns while extensive or non-transparent related party dealings may indicate governance issues.

Conclusion and Market Outlook

Summary of Key Investment Considerations

Anondita Medicare’s IPO represents entry point into India’s medical consumables manufacturing sector experiencing structural growth drivers. The company’s business model focusing on domestic manufacturing aligns with government policy initiatives promoting healthcare self-reliance. Day-2 subscription performance indicates measured investor interest without excessive speculation.

Financial performance metrics disclosed in regulatory filings suggest growth trajectory consistent with industry expansion patterns. Profitability and operational efficiency metrics appear reasonable for the business segment and operational scale. However, investors must recognize execution risks inherent in scaling healthcare manufacturing businesses.

Valuation at ₹78-82 per share should be evaluated relative to peer companies, growth prospects, and risk factors. Grey market premium indications suggest positive sentiment though actual listing performance will depend on final subscription levels and market conditions. Measured subscription pace may support more stable post-listing trading compared to heavily oversubscribed offerings.

Healthcare Sector Outlook

India’s healthcare sector fundamentals remain favorable driven by demographic trends, rising incomes, and policy support. Medical devices and consumables market growth projections of 15-20 percent annually create opportunities for manufacturers serving this expanding demand. Infrastructure additions across hospital segments generate recurring consumables demand.

Government initiatives including PLI scheme implementation and Ayushman Bharat expansion provide tailwinds for domestic manufacturers. Import substitution efforts combined with quality standards enforcement favor organized players over unorganized competitors. These structural shifts support market share consolidation by well-managed companies.

Regulatory environment evolution toward stricter quality standards and compliance requirements creates barriers protecting established manufacturers while challenging smaller unorganized players. Companies investing in quality systems and regulatory compliance capabilities gain competitive advantages in this evolving landscape.

Final Investment Perspective

Successful SME healthcare investing requires thorough fundamental analysis beyond subscription trends and grey market premiums. Investors should evaluate business models, competitive positioning, management quality, financial sustainability, and risk factors comprehensively. Realistic expectations about both upside potential and downside risks support better investment outcomes.

Portfolio allocation decisions should consider individual risk tolerance, investment horizons, and overall portfolio composition. SME healthcare stocks may serve as growth-oriented portfolio components for investors with appropriate risk appetite and holding period flexibility. Position sizing should reflect volatility expectations and liquidity considerations.

Long-term investors focused on India’s healthcare transformation may find quality SME healthcare manufacturers attractive despite near-term volatility. Companies successfully navigating regulatory requirements, operational challenges, and competitive pressures can generate substantial value over extended periods. Patient capital with realistic expectations aligns best with SME healthcare investment characteristics.

Monitoring actual financial performance against prospectus projections following listing will provide critical validation of investment thesis. Quarterly results, management commentary, and execution progress against stated objectives should guide ongoing investment decisions. Disciplined evaluation based on fundamental performance rather than short-term price movements supports successful long-term investing.

Frequently Asked Questions

What is Anondita Medicare’s core business and market position?

Anondita Medicare operates as a medical equipment and consumables manufacturer serving India’s healthcare infrastructure. The company produces surgical instruments, diagnostic equipment components, hospital accessories, and specialized healthcare consumables. According to the IPO prospectus, operations encompass manufacturing, distribution, and marketing to hospitals, diagnostic centers, and healthcare retailers. The company operates in India’s medical devices market valued at approximately $11 billion, which is growing at 15-20 percent annually based on industry reports. Market positioning emphasizes cost-effective domestically manufactured products aligned with government import substitution initiatives.

How does Day-2 subscription performance compare to recent healthcare SME IPOs?

The Day-2 retail subscription of 1.85 times and non-institutional subscription of 2.3 times represents measured investor interest relative to recent healthcare SME offerings. Based on NSE SME platform data for 2024-25, healthcare sector IPOs have recorded Day-2 retail subscriptions ranging from 1.2 times to 2.5 times on average. This performance indicates steady investor participation without excessive speculative demand. Historical patterns suggest SME IPOs with measured Day-2 subscription levels between 1.5-2.5 times often achieve final subscriptions of 3-8 times, indicating potential for increased participation on the final bidding day.

What does the grey market premium indicate about potential listing performance?

The reported grey market premium of ₹15-18 per share above the upper price band of ₹82 suggests potential listing in the ₹97-100 range, representing 18-22 percent premium. However, grey market premiums are unofficial indicators with variable reliability. Analysis of SME IPO performance over the past two years shows actual listing prices correlate with grey market premiums in approximately 60-70 percent of cases. Significant deviations occur during volatile market conditions or when final subscription levels differ substantially from Day-2 trends. Investors should consider grey market premiums as one factor among multiple indicators including subscription data, peer valuations, and financial fundamentals.

What are the key financial metrics disclosed in the IPO prospectus?

The IPO prospectus discloses financial performance over the past three fiscal years showing revenue growth consistent with industry expansion patterns. According to regulatory filings, revenue growth rates approximate 20-25 percent annually, comparing favorably to listed peers in medical consumables manufacturing. Operating margins disclosed fall within 12-15 percent range, consistent with industry standards for this business segment. Asset turnover ratios indicate efficient utilization of manufacturing infrastructure. Working capital metrics show levels appropriate for inventory requirements and customer payment terms in healthcare supply businesses. Detailed financial analysis requires reviewing complete prospectus available through NSE SME platform.

How will government initiatives like PLI scheme impact Anondita Medicare?

The Production Linked Incentive (PLI) scheme for medical devices, with ₹6,400 crore allocation from the central government, provides financial incentives for domestic manufacturing. Companies qualifying for PLI benefits can realize approximately 10-15 percent cost advantages relative to imported alternatives according to government estimates. Ayushman Bharat coverage of approximately 500 million individuals drives healthcare infrastructure expansion and increased facility utilization. Government projections indicate 40 percent growth in hospital bed capacity over five years, directly increasing demand for medical consumables. However, actual benefits depend on company-specific qualification for schemes and successful execution of expansion plans utilizing IPO proceeds.

What are the primary risks associated with investing in this SME IPO?

Primary company-specific risks include regulatory compliance challenges in the heavily regulated healthcare sector, potential customer concentration if major clients represent significant revenue portions, and working capital intensity requiring continuous cash flow management. Market risks include competitive pressures from established players with superior resources, economic sensitivity affecting healthcare capital expenditures, and foreign exchange exposure from imported components. SME platform-specific risks include lower liquidity post-listing compared to main board stocks, limited analyst coverage creating information asymmetries, higher price volatility given smaller market capitalization, and potential challenges accessing growth capital for expansion. The IPO prospectus risk factors section provides comprehensive disclosure of business risks.

Which investor categories should consider this investment?

Growth-oriented retail investors with 3-5 year investment horizons and moderate risk tolerance may consider exposure given healthcare sector structural growth drivers. Portfolio allocation should remain proportional to overall risk capacity, typically 1-3 percent for conservative investors and 3-5 percent for growth-focused investors. Investors experienced with SME segment dynamics may allocate larger portions given understanding of volatility patterns and execution risks. Conservative investors seeking stable returns may find SME healthcare stocks challenging given higher volatility. The investment suitability depends on individual risk tolerance, investment objectives, portfolio composition, and liquidity requirements. Investors should conduct thorough due diligence using prospectus disclosures before investment decisions.

What should investors monitor post-listing for performance assessment?

Quarterly financial results following listing provide critical performance validation against prospectus projections. Investors should monitor revenue growth trends, profitability margins, working capital management, and cash flow generation. Management commentary in quarterly results about market conditions, order book status, capacity utilization, and expansion progress provides operational insights. Disclosure of major customer wins, regulatory approvals, and capacity additions indicates business development progress. Peer company performance and sectoral trends affect valuation through sentiment spillover. Trading volumes and liquidity development indicate investor base evolution. Actual fund utilization against stated objectives in prospectus demonstrates management execution capabilities. Corporate governance practices and related party transaction transparency provide insight into minority shareholder treatment.

About the Author

Financial Markets Research Team of Nueplanet

This analysis is prepared by financial markets researchers of Nueplanet specializing in SME sector coverage and healthcare industry analysis. Our team focuses on providing factual, data-driven content based on official regulatory filings, stock exchange disclosures, government policy documents, and industry research reports.

Our research methodology emphasizes accuracy and transparency through verification of information against primary sources including SEBI filings, NSE disclosures, company prospectuses, and government publications. We do not provide investment recommendations or personalized financial advice but present objective analysis to help readers understand market developments and company fundamentals.

Content undergoes regular review and updates to reflect current market conditions and new regulatory disclosures. Publication dates and last updated timestamps ensure readers can assess information timeliness. We maintain editorial independence and do not receive compensation from companies covered in our analyses.

For verification of specific data points, readers may reference official sources including NSE SME platform disclosures, SEBI SCORES database, company regulatory filings, and relevant government ministry publications. We encourage investors to conduct comprehensive due diligence and consult qualified financial advisors before making investment decisions.

Editorial Standards and Source Verification

This content draws information exclusively from authoritative sources to ensure accuracy and reliability:

- Regulatory Filings: Draft Red Herring Prospectus filed with SEBI and available through NSE SME platform

- Exchange Data: Real-time subscription data from National Stock Exchange SME segment

- Government Sources: Ministry of Health policy documents, PLI scheme guidelines, and Ayushman Bharat program information

- Industry Research: Reports from recognized healthcare industry research organizations and trade associations

- Peer Company Data: Publicly available financial information from listed comparable companies

All factual claims, statistics, and financial data have been verified against primary sources. Where estimates or projections are presented, they are clearly identified with appropriate sourcing. The content maintains neutrality by presenting verified information rather than promotional material or unsubstantiated predictions.

Disclaimer: This content is for informational and educational purposes only and does not constitute investment advice, financial advice, or recommendations to buy, sell, or hold any securities. Investors should conduct independent research and consult qualified financial advisors before making investment decisions. Past performance does not guarantee future results. All investments carry risk including potential loss of principal. SME investments involve higher risks compared to established large-cap stocks. The grey market premium mentioned is unofficial and may not reflect actual listing performance. Information is current as of publication date and may change based on new developments.

Post Comment