Airtel Recharge Plan: Entry-Level Shakeup & What It Means for You

A day after our last post, Airtel’s prepaid portfolio has undergone a major revision, signaling the end of many budget-friendly recharge options. Here’s the latest on new plans and what subscribers need to know now.

Table of Contents

Bharti Airtel officially withdrew its Rs 249 prepaid plan from the market on August 20, 2025, marking a strategic shift in the company’s pricing approach. This decision affects millions of budget-conscious subscribers across India and reflects broader telecommunications industry trends toward enhanced revenue metrics. The move aligns with Airtel’s stated objective of achieving sustainable Average Revenue Per User (ARPU) levels exceeding Rs 300, a threshold the operator considers necessary for maintaining network quality and funding infrastructure investments.

The discontinuation represents a significant change in Airtel’s prepaid portfolio structure. Subscribers who previously relied on this mid-tier offering must now evaluate alternative plans that better suit their usage patterns and budget constraints. This comprehensive analysis examines the discontinued plan’s features, available replacement options, competitive market positioning, and broader implications for India’s telecommunications sector.

Understanding the Discontinued Rs 249 Prepaid Plan

Original Plan Specifications and Features

The Rs 249 prepaid plan served as a mid-tier offering in Airtel’s portfolio for several years before discontinuation. According to company documentation, the plan was designed to meet moderate usage requirements for specific subscriber segments. The plan included several core service components that provided essential telecommunications functionality.

Subscribers received 1 GB of high-speed data daily throughout the validity period. This allocation supported basic internet browsing, social media usage, and messaging applications. The plan provided unlimited voice calling capabilities across all network operators within India, covering both local and Standard Trunk Dialing (STD) calls. Users received an allocation of 100 SMS messages per day for the duration of the plan.

The validity period extended to 24 days from the recharge date. This approximately three-week service window positioned the plan between weekly and monthly options in Airtel’s prepaid structure. When calculated on a daily cost basis, the pricing structure represented Rs 10.37 per day. This cost-per-day metric provides a useful comparison point when evaluating alternative plans.

Target Subscriber Demographics

Market analysis indicates the Rs 249 plan attracted specific demographic groups with distinct usage patterns. Students in educational institutions represented a significant user base due to the plan’s alignment with limited budgets and moderate data requirements. These users typically required connectivity for educational resources, communication with peers, and social media engagement.

Senior citizens using smartphones for basic communication needs formed another key subscriber segment. This demographic typically prioritizes voice calling and messaging over intensive data consumption. Rural and semi-urban subscribers transitioning from feature phones to smartphones often selected this plan as an entry point into smartphone connectivity.

Small business owners requiring basic connectivity for business communications also utilized this offering. These subscribers needed reliable voice calling and moderate data for business-related communications, payment applications, and basic online transactions. The plan’s structure provided essential services without premium features or extensive data allowances that would increase costs unnecessarily.

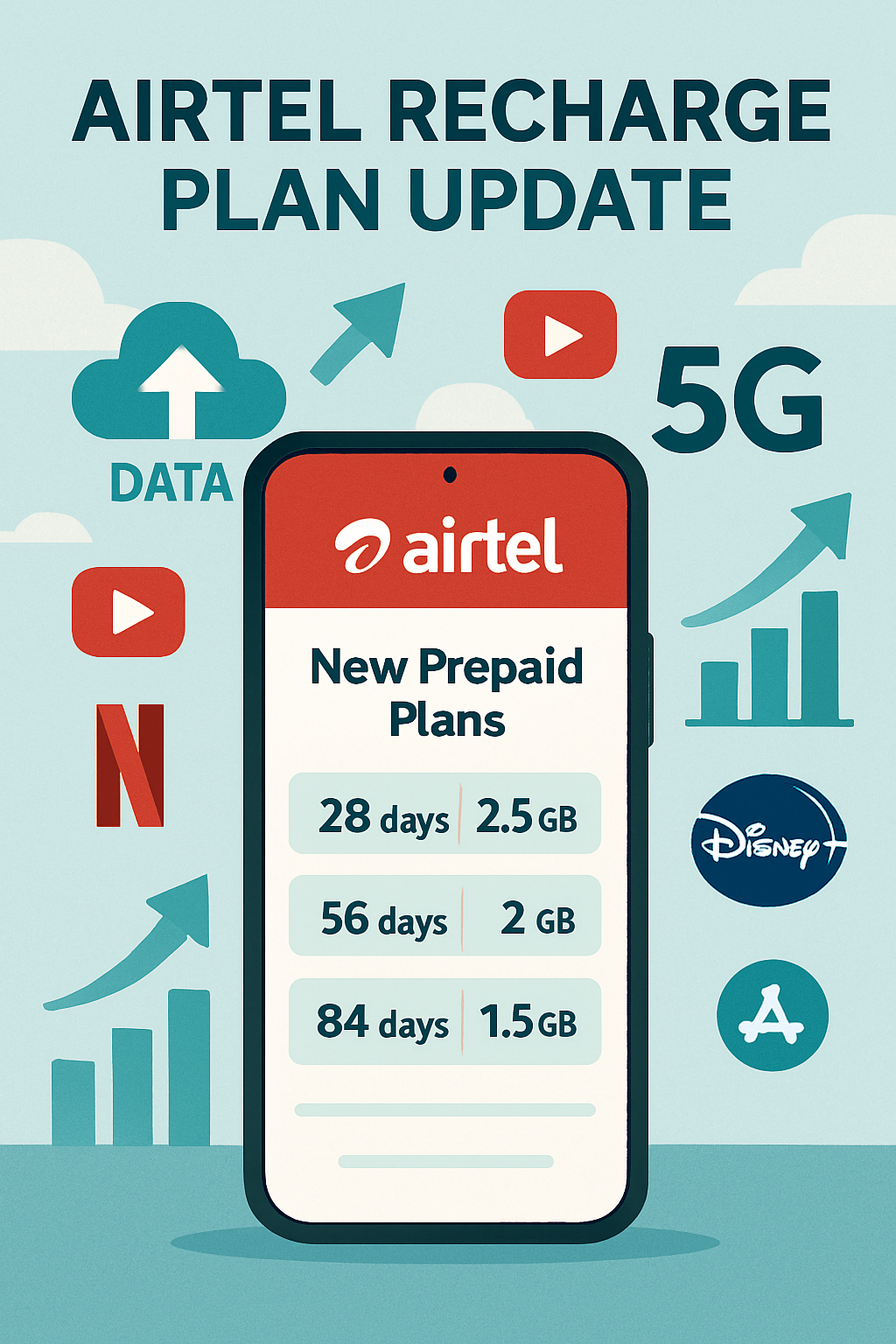

Airtel’s Revised Prepaid Plan Structure

Rs 299 Plan: New Entry-Level Offering

The Rs 299 prepaid plan now functions as Airtel’s baseline entry-level option following the Rs 249 discontinuation. This represents an absolute increase of Rs 50 from the previous plan, translating to a 20.08% price adjustment. Understanding this plan’s features helps subscribers evaluate whether it meets their requirements.

The plan provides 1 GB of high-speed data per day for the validity period. Unlimited voice calling across all networks remains included, maintaining continuity with the discontinued plan’s calling features. Users receive 100 SMS messages daily, matching the previous allocation. The validity extends to 28 days, providing four additional days compared to the Rs 249 plan.

When calculated on a daily basis, the Rs 299 plan costs Rs 10.68 per day compared to Rs 10.37 for the previous offering. The extended validity partially offsets the higher absolute price through longer service continuity, reducing recharge frequency. Subscribers gain access to Airtel’s basic digital services package as part of the plan, adding value beyond core telecommunications features.

Rs 349 Plan: Enhanced Data Allocation

The Rs 349 plan occupies the mid-tier position in Airtel’s revised prepaid structure. This offering targets users requiring higher daily data allocations while maintaining relative affordability compared to premium plans. Understanding this plan’s value proposition helps subscribers with moderate to high data consumption requirements.

Daily data allocation increases to 1.5 GB, representing a 50% enhancement over the baseline Rs 299 plan. Unlimited voice calling across all networks continues as a standard feature, ensuring comprehensive calling capabilities. The SMS allocation remains at 100 messages per day, consistent with other plans in the portfolio. Validity extends to 28 days, matching the Rs 299 plan’s duration.

Additional features differentiate this plan from the baseline offering. Access to Airtel’s HelloTunes service enables caller tune customization. The plan incorporates artificial intelligence-powered tools designed to enhance user experience. Access to Airtel’s expanding digital services portfolio forms part of the package. The daily cost calculates to Rs 12.46, reflecting the enhanced data allocation and additional features.

Rs 361 Plan: Total Data Pool Approach

The Rs 361 plan introduces a different allocation methodology targeting users with variable usage patterns. Instead of daily data limits, this plan provides a total data pool for the entire validity period. This structure offers flexibility that may better suit certain usage behaviors.

Subscribers receive 50 GB of data to use throughout the 30-day validity period. This structure allows flexibility in data consumption without daily restrictions that reset unused allocations. Users can consume larger data volumes on specific days without losing unused daily allocations, benefiting those with irregular consumption patterns. Unlimited voice calling remains included across all networks, maintaining consistency with other plans.

The plan costs Rs 12.03 per day when calculated on a daily basis. For users with irregular data consumption patterns who primarily rely on Wi-Fi connectivity with periodic mobile data requirements, this structure may provide better value than daily allocation plans. The total data approach particularly benefits subscribers who use mobile data intensively during travel periods but minimally during normal work weeks when Wi-Fi is available.

Industry Context: ARPU Dynamics and Revenue Metrics

Average Revenue Per User Evolution

Understanding Airtel’s pricing decisions requires examining broader industry economics and revenue metrics. Average Revenue Per User has emerged as the critical performance indicator for telecommunications operators in India’s consolidated market structure. This metric measures the average monthly revenue generated per subscriber and directly impacts profitability.

Historical data from the Telecom Regulatory Authority of India (TRAI) shows Indian telecom ARPU levels have remained relatively suppressed compared to global standards. According to TRAI’s performance indicator reports, the all-India average ARPU for major operators ranged between Rs 140-180 during the 2023-24 period. This level falls significantly below operators’ stated requirements for sustainable operations.

Airtel’s management has publicly communicated that sustainable operations require mobile ARPU levels exceeding Rs 300. This target reflects several cost factors that impact telecommunications operations. Spectrum acquisition costs have increased significantly through successive government auctions, with operators paying billions for spectrum licenses. Network infrastructure deployment and maintenance expenses have risen due to technology upgrades and coverage expansion requirements.

Energy costs for operating telecommunications infrastructure have increased substantially in recent years. Regulatory compliance and license fees constitute ongoing operational expenses that must be recovered through revenue generation. The transition to 5G technology requires capital expenditure that must be recovered through improved revenue generation over time.

Infrastructure Investment Requirements

The telecommunications sector in India has witnessed substantial capital deployment in recent years. Operators have invested significant sums in 5G spectrum acquisition through government auctions conducted by the Department of Telecommunications. Network equipment procurement and deployment require continued financial commitment for both new technology rollouts and existing infrastructure maintenance.

Fiber optic network expansion to support backhaul capacity demands significant investment to handle increasing data traffic volumes. Data center infrastructure to support cloud services and edge computing requires capital allocation for facilities, equipment, and operations. Customer service infrastructure including retail outlets, call centers, and support systems necessitates ongoing expenditure.

These investment requirements create pressure for revenue enhancement across the subscriber base. Pricing adjustments represent one mechanism through which operators seek to improve unit economics and generate returns on infrastructure investments. Without adequate revenue levels, operators cannot sustain the investment pace required to maintain competitive network quality and technology advancement.

Competitive Analysis: Industry-Wide Pricing Trends

Reliance Jio’s Market Positioning

Airtel’s decision to discontinue the Rs 249 plan occurs within a broader industry context where competitors have implemented similar adjustments. Reliance Jio, India’s largest telecommunications operator by subscriber count, has also restructured its entry-level prepaid portfolio. According to information available on Jio’s official website, the operator’s baseline prepaid plans now start at Rs 299.

Jio’s Rs 299 plan provides 1.5 GB daily data, exceeding Airtel’s baseline allocation by 50%. Unlimited voice calling across networks is included, maintaining parity with competitor offerings. The validity period extends to 28 days, consistent with industry standardization. This positioning suggests Jio continues pursuing a volume-based strategy with competitive data allocations to maintain market share.

Jio’s extensive 4G network coverage and rapid 5G deployment provide infrastructure advantages in many markets. The operator’s integrated digital services ecosystem including JioTV, JioCinema, and JioSaavn add value for subscribers beyond basic connectivity. Jio’s large subscriber base enables economies of scale in operations that may support more competitive pricing structures.

Vodafone Idea’s Strategic Approach

Vodafone Idea (Vi) has aligned its pricing structure with industry trends while emphasizing service quality differentiation. The operator’s entry-level prepaid plans reflect similar pricing dynamics to major competitors, though the company faces distinct strategic challenges.

Vi’s portfolio emphasizes network reliability in key urban markets where infrastructure investments have been concentrated. The operator highlights customer service quality as a competitive differentiator in markets where network coverage is comparable. Business and enterprise service offerings constitute a focus area for Vi, targeting higher-value subscriber segments.

Vi’s financial challenges following industry consolidation have influenced its strategic approach. The operator has focused on retaining high-value subscribers rather than aggressive market share expansion that would require heavy capital investment. Pricing strategies reflect the need to improve ARPU while maintaining competitive positioning in a market dominated by larger rivals.

Comparative Market Analysis

When examining entry-level prepaid offerings across major operators, convergence in pricing is evident. All three major operators now position their baseline plans around the Rs 299 price point, suggesting coordinated industry movement toward higher ARPU levels. This alignment reflects market maturation and reduced emphasis on price-based competition that characterized earlier industry phases.

Daily data allocations vary slightly across operators, with Jio offering higher baseline data allocations compared to Airtel and Vi. Validity periods remain standardized at 28 days for comparable plans across the industry. Value-added services and digital platform access differentiate offerings beyond basic connectivity features.

The pricing convergence reflects market maturation and shift away from aggressive price-based competition. Operators now compete primarily on network quality, service reliability, and integrated digital offerings rather than on price alone. This strategic shift suggests the price war phase of India’s telecommunications market has concluded, replaced by focus on sustainable profitability.

Alternative Options for Budget-Conscious Subscribers

Rs 181 Entertainment-Focused Plan

Despite the Rs 249 plan discontinuation, Airtel maintains several options for subscribers with varying usage requirements and budget constraints. The Rs 181 plan targets entertainment-oriented users who prioritize content access alongside basic connectivity needs. This offering bundles telecommunications services with digital content subscriptions.

The plan provides 15 GB of total data for the validity period rather than daily allocations, offering flexibility for variable usage patterns. Access to 22+ Over-The-Top (OTT) platforms is included, featuring services like SonyLIV, Zee5, and others. The validity period spans the data consumption period, providing service continuity while data remains available. Unlimited voice calling availability varies based on specific plan configurations documented on Airtel’s official channels.

For subscribers who maintain standalone OTT subscriptions, this plan may offer cost savings through bundled pricing. The integrated approach reduces aggregate expenditure on entertainment and connectivity when compared to separate subscriptions. Students and young professionals with moderate data requirements but high entertainment consumption may find value in this structure.

Rs 449 Premium Comprehensive Plan

The Rs 449 plan represents Airtel’s premium prepaid offering with extensive feature integration. This plan targets users seeking comprehensive mobile experiences with substantial data allocations and value-added services. Understanding this plan’s features helps subscribers evaluate whether premium pricing delivers corresponding value.

Daily high-speed data allocation reaches 3 GB throughout the validity period, supporting intensive internet usage. In areas with 5G coverage, unlimited 5G data access is provided where network availability permits, though actual speeds depend on network conditions. The plan includes access to 22 premium OTT platforms for entertainment consumption. A six-month Apple Music subscription is bundled with the plan.

Perplexity AI access provides subscribers with advanced search capabilities through artificial intelligence technology. The validity extends to 28 days with comprehensive service coverage across all included features. Voice calling remains unlimited across all networks, ensuring complete calling flexibility. According to Airtel’s promotional materials, the total value of bundled services exceeds Rs 17,000 when calculated at standalone subscription rates, though individual subscriber value varies based on actual service usage.

Rs 469 Extended Validity Option

The Rs 469 plan caters to users prioritizing extended service continuity over high data allocations. This offering emphasizes voice services with minimal data requirements, serving a specific subscriber segment with distinct usage patterns.

Unlimited voice calling across all networks forms the core feature, supporting extensive calling requirements. The validity period extends to 84 days, providing nearly three months of continuous service without recharge interruptions. Data allocation is minimal, targeting users who primarily rely on voice communication rather than internet services. The plan structure simplifies usage patterns by focusing on essential connectivity without bundled digital services.

Senior citizens and basic phone users represent the target demographic for this plan. Users in rural areas with limited internet requirements or those who primarily use Wi-Fi for data needs may find this option suitable. The extended validity reduces recharge frequency, providing convenience for users who prefer infrequent account management interactions.

Technology Integration: 5G Deployment Impact

Current 5G Network Expansion Status

Airtel’s pricing strategy adjustments coincide with extensive 5G network deployment across India. The capital-intensive nature of 5G infrastructure influences operator revenue requirements and pricing decisions. Understanding this technological context helps explain industry-wide pricing trends.

According to Airtel’s official communications, the company has deployed 5G services across more than 5,000 cities and towns in India. This rapid deployment represents substantial capital investment in spectrum licenses acquired through government auctions and network equipment procurement from global vendors. The scale of deployment demonstrates Airtel’s commitment to maintaining technological leadership in India’s telecommunications market.

5G technology enables significantly higher data transmission speeds compared to 4G networks, with theoretical peak speeds exceeding 1 Gbps under optimal conditions. The technology supports enhanced mobile broadband applications with improved user experiences for video streaming, gaming, and other bandwidth-intensive applications. Ultra-reliable low latency communications become feasible for time-sensitive applications including autonomous vehicles and remote medical procedures.

Revenue Implications of 5G Investment

The substantial capital invested in 5G infrastructure creates pressure for revenue generation to achieve returns on investment. Telecommunications operators require improved ARPU levels to justify and sustain 5G network deployment at scale across diverse geographic markets.

Higher pricing tiers enable operators to differentiate service offerings based on technology access. Premium plans with 5G access command higher prices than 4G-only offerings during the initial deployment phase. The enhanced capabilities of 5G networks provide justification for premium pricing structures that help recover infrastructure investment costs.

Over time, as 5G becomes standard across all plans and coverage approaches ubiquity, the technology’s novelty-based pricing premium will diminish. However, current deployment phases allow operators to position 5G access as a premium feature supporting higher price points. This pricing approach mirrors historical patterns observed during 3G and 4G technology transitions.

Digital Services Ecosystem Expansion

Financial Services Integration

Beyond traditional voice and data services, Airtel has expanded into adjacent digital services markets. This diversification strategy supports premium pricing by bundling value-added services with connectivity. Airtel Payments Bank operates as a payment banking entity providing digital financial services to subscribers.

The platform enables mobile wallet functionality for digital transactions across merchant networks. Bill payment services integrate telecommunications with financial operations, allowing users to pay utility bills, recharge accounts, and conduct other financial transactions. Merchant payment solutions expand the platform’s utility beyond consumer applications into small business payments infrastructure.

The financial services integration creates additional touchpoints with subscribers beyond traditional telecommunications interactions. Transaction fees and financial service commissions provide revenue streams that supplement telecommunications revenue. The ecosystem approach increases subscriber stickiness by expanding service utility and creating switching costs.

Entertainment Platform Development

Airtel Xstream functions as the company’s entertainment platform aggregating content from multiple sources into a unified interface. The service provides access to movies, television shows, and live sports content from various content providers. Integration with multiple OTT platforms creates a consolidated entertainment interface reducing friction for content discovery and consumption.

Bundling entertainment services with telecommunications plans enhances perceived value for subscribers. Users gain access to content that would otherwise require separate subscriptions with individual login credentials and payment arrangements. The entertainment platform differentiates Airtel’s offerings from pure connectivity services, positioning the company as a digital services provider rather than simply a telecommunications operator.

Enterprise and IoT Solutions

Airtel provides cloud computing services for enterprise customers requiring digital infrastructure for business operations. Data center facilities support business computing and storage requirements across multiple locations. Internet of Things (IoT) platforms enable connected device deployments for industrial and consumer applications.

Enterprise services generate higher per-connection revenues than consumer offerings due to enhanced service level requirements and business-critical applications. Business customers typically require enhanced support, guaranteed uptime commitments, and customized solutions. The enterprise focus complements consumer market strategies by diversifying revenue sources and reducing dependence on consumer market dynamics.

Consumer Impact Assessment

Effects on Budget-Constrained Segments

The discontinuation of the Rs 249 plan affects different subscriber segments in varying ways. Households using multiple SIM connections face increased aggregate monthly expenses that impact household budgets. A family with four Airtel connections previously spending Rs 996 monthly now faces minimum costs of Rs 1,196, representing a Rs 200 monthly increase or 20% higher expenditure.

Rural subscribers with limited disposable income experience proportionally higher impact from pricing adjustments. The Rs 50 increase represents a more significant percentage of household telecommunications budgets in lower-income segments where every expense must be carefully managed. This pricing change may force difficult choices about service continuity or reduced usage.

Students relying on mobile connectivity for educational purposes face budget pressures from increased plan costs. Many educational institutions and students operate with constrained financial resources where telecommunications expenses compete with other essential needs. The pricing adjustment requires reallocation of limited funds or reduction in service consumption that may impact educational activities.

Small business owners using mobile connectivity for operations experience cost increases that affect business economics. Micro and small enterprises often operate with thin margins where every expense impacts profitability. Multiple business connections multiply the impact of per-connection price increases, potentially affecting business communication capabilities.

Enhanced Value for Higher-Usage Subscribers

Data-intensive users may benefit from plans offering larger allocations and enhanced features despite higher absolute costs. The Rs 349 and Rs 449 plans provide substantially more data than the discontinued Rs 249 option. Subscribers previously needing to purchase additional data top-ups may find better value in higher-tier plans with larger included allocations.

Entertainment-focused users gain value from OTT platform bundling included in premium plans. The cost of multiple standalone OTT subscriptions often exceeds the incremental cost of bundled telecommunications plans. Subscribers consuming substantial digital content receive economic benefits from integrated offerings that reduce total expenditure on entertainment services.

Quality-conscious subscribers benefit from network improvements funded by enhanced revenues from price increases. Better network coverage and reduced congestion improve user experiences during peak usage periods. Customer service enhancements provide additional value for subscribers willing to pay premium prices for superior support experiences.

Regulatory Framework and Market Dynamics

TRAI’s Role in Telecommunications Regulation

India’s telecommunications sector operates within a regulatory framework established by the Telecom Regulatory Authority of India (TRAI). Understanding this regulatory context helps explain industry pricing dynamics and competitive behavior. TRAI transitioned from prescriptive tariff regulation to a forbearance regime in 1999, fundamentally changing how pricing decisions are made.

Under forbearance, operators can determine pricing subject to market competition rather than requiring regulatory approval for each tariff change. This market-based approach provides flexibility for operators to respond to competitive conditions and cost factors. TRAI maintains oversight to prevent anti-competitive practices and protect consumer interests without directly controlling pricing decisions.

The regulator monitors tariff trends and market concentration to ensure competitive markets function effectively. Complaint mechanisms exist for subscribers to address service issues and billing disputes through TRAI’s consumer protection framework. The balance between market freedom and consumer protection remains an ongoing regulatory consideration as market structure evolves.

Market Structure and Competition Dynamics

India’s telecommunications market consolidated from multiple operators to primarily three national players following intense price competition and financial pressures. Bharti Airtel, Reliance Jio, and Vodafone Idea now dominate the market with minimal presence from smaller regional operators. This oligopolistic structure influences pricing behavior and competitive dynamics significantly.

The reduced number of competitors has diminished pure price-based competition that characterized earlier market phases. Operators increasingly compete on network quality, coverage, and value-added services rather than aggressive price undercutting. The market structure enables more coordinated pricing movements than highly fragmented markets would allow, though regulatory oversight prevents explicit coordination.

Subscriber churn rates have stabilized as market share positions have solidified following consolidation. This stability reduces the pressure for aggressive pricing to acquire subscribers from competitors. Operators focus on extracting higher value from existing subscriber bases rather than pure acquisition strategies that characterized earlier competitive phases.

Future Market Outlook and Predictions

Anticipated Tariff Adjustments

Industry analysts and market observers predict continued evolution in India’s telecommunications pricing landscape. Several factors suggest further adjustments are likely in coming months and years. Industry reports suggest operators may implement additional price increases during late 2025 to further improve ARPU metrics.

Analysts predict potential increases in the range of 10-20% based on ongoing cost pressures and investment requirements for network expansion and technology upgrades. Some projections specifically indicate possible adjustments around December 2025, though exact timing depends on multiple factors including competitive dynamics and regulatory environment.

If implemented, such increases could elevate Airtel’s average ARPU above the Rs 300 threshold that management has identified as necessary for sustainable operations. The cumulative effect of successive price adjustments would substantially alter the cost structure for telecommunications services. Subscribers should anticipate potential budget impacts from continued pricing evolution and plan accordingly.

The timing and magnitude of future increases will depend on multiple factors beyond operator control. Competitive dynamics among the three major operators influence pricing decisions, as unilateral increases risk subscriber losses to competitors. Regulatory scrutiny of price movements may constrain aggressive increases if TRAI perceives consumer harm. Consumer price sensitivity and potential subscriber churn risk moderate pricing strategies, balancing revenue objectives against retention goals.

Technology Evolution and Service Development

Continued 5G network expansion will extend coverage to additional geographic areas currently served only by 4G technology. As 5G becomes ubiquitous across urban and eventually rural markets, operators will develop new services leveraging enhanced network capabilities. Edge computing applications, augmented reality services, and advanced IoT deployments may create new revenue opportunities beyond traditional telecommunications.

Preparation for eventual 6G technology development will require continued capital investment beginning years before commercial deployment. While 6G deployment remains years away with commercial availability not expected until the 2030s, research and development activities will begin well in advance. The technology evolution cycle creates ongoing pressure for revenue enhancement to fund next-generation development investments.

Market Consolidation Possibilities

Speculation periodically surfaces regarding potential further consolidation in the Indian telecommunications market. Vodafone Idea’s well-documented financial challenges have raised questions about long-term viability in a market dominated by two larger competitors. Potential scenarios range from government support for Vi to maintain market competition to possible market exit or acquisition by a competitor.

Further consolidation to a duopoly market structure would substantially alter competitive dynamics and likely affect pricing behavior. A two-player market would enable even more coordinated pricing with reduced competitive pressure constraining price increases. However, regulatory concerns about market concentration make such consolidation uncertain, as TRAI would likely scrutinize any transaction reducing the number of national operators.

Strategic Recommendations for Subscribers

Conducting Usage Pattern Analysis

Navigating the evolving telecommunications landscape requires informed decision-making by subscribers based on actual usage patterns rather than assumptions. Several strategies can help users optimize mobile communication expenses while maintaining necessary service levels.

Subscribers should conduct systematic analysis of their actual usage patterns using data available in operator apps and account portals. Review previous months’ data consumption to determine average daily requirements and identify whether usage remains consistent or varies significantly. Assess whether data usage occurs consistently throughout the month or concentrates in specific periods when different plan structures might prove more economical.

Evaluate voice calling patterns to determine if unlimited calling is necessary or if actual usage falls below levels requiring unlimited plans. Some users primarily use messaging apps like WhatsApp for communication, reducing traditional voice call requirements. SMS usage has declined significantly with messaging app adoption, potentially making high SMS allocations unnecessary for many users.

Understanding actual usage enables selection of appropriately sized plans that match requirements without overpayment. Overpaying for unused allocations wastes resources that could be better deployed elsewhere. Insufficient allocations require expensive top-ups that increase total costs above alternative plans with adequate included allowances.

Comparative Evaluation Across Operators

Subscribers should regularly compare offerings across Airtel, Jio, and Vi to identify optimal value for their specific requirements. While baseline pricing has converged around similar levels, differences exist in data allocations, value-added services, and network quality that impact overall value proposition.

Network performance varies by geographic location and infrastructure deployment patterns. Users should consider coverage quality in their primary usage areas including home, workplace, and frequently visited locations. Rural and urban users may experience different network performance levels from various operators based on infrastructure investment patterns.

Service quality factors beyond pure pricing deserve consideration in operator selection decisions. Network reliability, customer service responsiveness, and billing accuracy affect overall satisfaction with telecommunications services. The lowest-priced option may not provide the best overall value if service quality suffers or customer support proves inadequate when issues arise.

Cost Management Optimization Strategies

Subscribers can employ several tactics to manage telecommunications expenses effectively. Aligning recharge timing with usage patterns optimizes plan utilization and reduces wasted validity. Users with access to Wi-Fi at home and work may require less mobile data allocation than initially assumed, enabling selection of lower-cost plans.

Family or household plans with multiple connections may offer discounts compared to individual plans from some operators. Coordinating provider selection across household members can reduce aggregate costs through multi-connection discounts where available. Some operators offer incentives for port-ins or new connections that can offset costs when switching providers.

Long-term annual plans sometimes provide cost savings compared to monthly recharges through discounted pricing for extended commitments. However, annual commitments reduce flexibility to change operators or respond to market changes and improved offers. Users should weigh cost savings against flexibility requirements based on their likelihood of needing to switch providers.

Frequently Asked Questions

Why did Airtel discontinue the Rs 249 prepaid plan?

Airtel eliminated the Rs 249 plan as part of a strategic initiative to increase Average Revenue Per User (ARPU) toward sustainable levels. The company has publicly stated that mobile ARPU above Rs 300 is necessary to support ongoing network investments, maintain service quality, and fund 5G infrastructure deployment. This decision reflects broader telecommunications industry trends toward premium pricing models driven by capital expenditure requirements for new technology deployment and operational cost increases including spectrum acquisition, energy costs, and infrastructure maintenance.

What is Airtel’s cheapest prepaid plan after discontinuing Rs 249?

The Rs 299 prepaid plan now serves as Airtel’s entry-level offering following the Rs 249 discontinuation. This plan provides 1 GB daily data, unlimited voice calls across all networks, 100 SMS per day, and 28-day validity. The Rs 50 price increase from the discontinued plan is partially offset by four additional validity days, extending coverage from 24 to 28 days. Subscribers also gain access to Airtel’s basic digital services ecosystem as part of the package, adding value beyond core telecommunications features.

Are there affordable entertainment-focused options available?

Airtel offers the Rs 181 plan designed specifically for entertainment-focused users, providing 15 GB total data and access to 22+ OTT platforms including SonyLIV, Zee5, and others. For more comprehensive entertainment experiences, the Rs 449 plan includes 3 GB daily data, unlimited 5G access in covered areas, 22 OTT platform subscriptions, six months of Apple Music, and Perplexity AI services. These bundled offerings may provide cost savings compared to purchasing separate telecommunications and entertainment subscriptions, particularly for users who actively consume digital content.

How do Airtel’s revised plans compare with Reliance Jio?

Airtel’s Rs 299 baseline plan competes with Jio’s similarly priced offering, though Jio provides 1.5 GB daily data compared to Airtel’s 1 GB allocation, representing 50% more data. The pricing convergence across major operators reflects industry-wide movement toward higher ARPU levels and reduced price-based competition. Differences exist in data allocations, value-added services, network quality, and coverage patterns. Subscribers should evaluate offerings based on their specific usage requirements, geographic location, and actual network coverage quality in areas they frequent rather than price alone.

What should current Rs 249 users do for service continuity?

Users must transition to alternative plans based on their specific usage requirements and budget constraints. The Rs 299 plan offers similar structure with extended validity for regular data users requiring consistent daily allocations. Light users with variable consumption patterns may consider the Rs 361 plan with 50 GB total data for 30 days, providing flexibility without daily limits. Heavy data consumers might prefer the Rs 349 plan with 1.5 GB daily allocation. Subscribers should analyze their previous months’ usage data available through the Airtel app to determine appropriate replacement options that match actual consumption patterns.

Will Airtel implement additional price increases in 2025?

Industry analysts predict potential tariff increases of 10-20% during late 2025, with specific projections suggesting possible adjustments around December 2025 based on historical pricing patterns and ongoing cost pressures. Such increases would reflect continuing infrastructure investment requirements, spectrum costs from government auctions, and operational expense pressures including energy costs and network maintenance. While specific timing and magnitude remain uncertain, the broader trend toward higher ARPU levels across the industry suggests continued pricing evolution. Subscribers should anticipate potential budget impacts from future adjustments and evaluate their telecommunications spending patterns accordingly.

What benefits justify higher-priced plans beyond basic connectivity?

Premium Airtel plans integrate comprehensive digital services ecosystems beyond traditional telecommunications functionality. The Rs 449 plan includes Apple Music subscriptions valued separately at hundreds of rupees annually, access to 22 OTT platforms that would cost significantly more as standalone subscriptions, and Perplexity AI integration for advanced search capabilities. Higher-tier plans often provide enhanced network priority during congestion, superior customer support with faster response times, and early access to new technologies like 5G in newly covered areas. These value-added services aim to justify premium pricing by delivering integrated digital lifestyle solutions rather than simply voice and data connectivity.

How can subscribers optimize expenses while maintaining service quality?

Optimization requires systematic usage analysis using operator apps to determine actual data and calling requirements, avoiding overprovision of unused features. Users should evaluate whether OTT-bundled plans provide savings compared to separate subscriptions based on actual content consumption patterns. Regular comparison of offerings across operators helps identify optimal value as plans and pricing evolve. Family plans or multi-SIM arrangements may offer discounts for households with multiple connections. Wi-Fi availability at home and work can significantly reduce mobile data requirements, potentially enabling selection of lower-allocation plans. Annual plans sometimes provide cost savings compared to monthly recharges, though at the expense of flexibility to switch providers if better offers emerge.

Conclusion: Navigating the Evolving Telecommunications Landscape

Airtel’s discontinuation of the Rs 249 prepaid plan on August 20, 2025, represents a significant shift in India’s telecommunications market structure. This pricing adjustment reflects broader industry trends toward sustainable revenue levels necessary for continued infrastructure investment and service quality maintenance. The move affects millions of budget-conscious subscribers who must now evaluate alternative plans matching their usage patterns and financial constraints.

The telecommunications sector’s evolution toward higher ARPU levels stems from legitimate cost pressures including 5G deployment, spectrum acquisition expenses, and infrastructure maintenance requirements. Operators require adequate revenue generation to justify continued investment in network quality and technology advancement. The pricing convergence across major operators suggests the market has transitioned from price-based competition to differentiation through network quality and value-added services.

Subscribers navigating this evolving landscape should conduct thorough analysis of their actual usage patterns to identify optimal plans. Comparing offerings across operators, considering total value beyond basic connectivity, and employing cost management strategies can help optimize telecommunications expenses. While pricing increases create budget pressures, particularly for lower-income segments, understanding available alternatives enables informed decision-making.

The telecommunications market will likely continue evolving with potential additional pricing adjustments anticipated later in 2025. Subscribers should monitor official operator communications and industry developments to adapt their telecommunications strategies accordingly. Making informed decisions based on actual usage requirements rather than assumptions enables effective management of telecommunications expenses while maintaining necessary connectivity.

About the Author

Nueplanet is a business and technology journalist specializing in telecommunications industry analysis and consumer technology trends in India. With extensive experience covering the telecom sector, Nueplanet provides fact-based reporting on market developments, regulatory changes, and technology evolution affecting Indian consumers and businesses.

Nueplanet is committed to delivering accurate, verified information from official sources including regulatory filings, company announcements, and industry data published by authoritative agencies. All analysis draws exclusively on publicly available information to ensure transparency and reliability. The content aims to inform subscribers about market developments without providing investment advice or promotional recommendations.

Published: August 21, 2025

Last Updated: August 21, 2025

Disclaimer: This article provides factual analysis based on publicly available information from official sources including Airtel’s communications, TRAI regulatory reports, and verified industry data. Plan details, pricing, and availability are subject to change by operators. Readers should verify current information on Airtel’s official website before making purchase decisions. This content does not constitute financial or investment advice.

Helpful Resources

ET Telecom: Pay More for Data as Telcos Phase Out Entry-Level Plans

Times of India: Airtel Expands Apple Music Free Subscription

Call to Action

With Airtel discontinuing its ₹249 plan and revising entry-level packs, users need to review their options to get the best value. Stay updated on Airtel recharge plan changes, competitive pricing, and perks by following NuePlanet.com.

Latest Posts

- RPower Share Price: Reliance Power Stock Gains Over 10% in Two Days

- Patel Retail: IPO Subscription Trends and Market Buzz

- SEBI: Strengthening India’s Primary Market with Bold Reforms

- Jupiter Wagons Share Price: Strong Order Win Sparks Investor Interest

- Exide Share Price: Market Outlook and Key Growth Drivers

Post Comment