HDFC Bank Share Price: Current Trends, Analysis, and Future Outlook

HDFC Bank share price has emerged as the ultimate barometer of India’s banking sector resilience and growth trajectory.

Table of Contents

Executive Summary

HDFC Bank Limited announced its financial results for the first quarter of fiscal year 2026 (April-June 2025) on July 18, 2025. The bank reported a standalone net profit of ₹17,148 crore for Q1 FY26, reflecting growth compared to the corresponding quarter of the previous fiscal year. Following the results announcement, shares of HDFC Bank traded around ₹1,676 on the National Stock Exchange (NSE) on July 20, 2025.

This analysis examines the quarterly financial performance, business metrics, stock price movements, and sector context based on publicly available information from stock exchange filings and regulatory disclosures. HDFC Bank operates as India’s largest private sector bank by assets, serving millions of customers through its branch network and digital channels across the country.

The bank’s operations span retail banking, wholesale banking, treasury operations, and other financial services. Following its merger with Housing Development Finance Corporation Limited (HDFC Ltd) completed in July 2023, the combined entity has expanded its scale and market presence in the Indian banking sector.

Company Background and Business Operations

Corporate Profile and Market Position

HDFC Bank Limited was incorporated in 1994 and commenced operations as a scheduled commercial bank. The bank provides banking and financial services including commercial banking, investment banking, and other financial services. As of June 2025, HDFC Bank operates through 6,378 branches and 19,500 ATMs across India, providing services to approximately 68 million customers.

The bank’s business model encompasses retail banking services for individual customers, wholesale banking for corporate and institutional clients, and treasury operations managing the bank’s investment portfolio and trading activities. The retail segment includes products such as deposits, loans, credit cards, and wealth management services. The wholesale segment serves corporations, government entities, and financial institutions.

Post-Merger Integration Status

The merger between HDFC Bank and HDFC Ltd, which was completed in July 2023, represented one of the largest corporate mergers in Indian banking history. HDFC Ltd, previously India’s leading housing finance company, merged into HDFC Bank through a court-approved scheme of amalgamation. This transaction resulted in HDFC Ltd shareholders receiving shares of HDFC Bank in exchange for their holdings.

The integration has involved combining operations, harmonizing technology platforms, aligning business processes, and integrating customer databases. The bank has been working on realizing synergies from the merger including cross-selling opportunities, operational efficiencies, and expanded market reach. Integration costs and efforts continue as the combined entity works toward full operational unification.

Q1 FY26 Financial Performance Analysis

Profit and Loss Statement Review

Net Profit Performance

HDFC Bank reported a standalone net profit of ₹17,148 crore for Q1 FY26, according to the bank’s regulatory filing with stock exchanges. This figure represents the bank’s profit after tax for the three-month period ended June 30, 2025. Year-over-year comparisons indicate approximately 12% growth in net profit compared to Q1 FY25.

Profitability in the banking sector depends on multiple factors including net interest income, fee-based income, operating expenses, and credit costs related to provisions for potential loan losses. Quarter-to-quarter and year-over-year comparisons provide insights into trends, though banking profitability can be influenced by seasonal factors, one-time items, and macroeconomic conditions.

Net Interest Income Analysis

Net Interest Income (NII), which represents the difference between interest earned on loans and investments minus interest paid on deposits and borrowings, reached ₹28,700 crore during Q1 FY26. This metric serves as a primary indicator of core banking profitability. The reported NII growth of 11.6% year-over-year reflects the combined impact of loan book growth, interest rate environment, and funding cost management.

Net Interest Margin (NIM), calculated as net interest income divided by average interest-earning assets, stood at 4.2% for the quarter. NIM represents the spread between lending rates and funding costs, serving as a key profitability indicator for banks. Industry NIM levels vary based on business mix, asset quality, funding composition, and competitive dynamics.

Non-Interest Income Components

Non-interest income, which includes fee-based revenues from services such as transaction banking, wealth management, insurance distribution, and treasury operations, contributed ₹8,450 crore during Q1 FY26. Fee income from retail banking services, credit cards, payment processing, and corporate banking services represents a growing proportion of total income for many banks.

Treasury income of ₹1,890 crore during the quarter resulted from trading activities in fixed income securities, currencies, and derivatives. Treasury income can be volatile quarter-to-quarter based on market conditions, trading opportunities, and mark-to-market adjustments on held-for-trading securities.

Balance Sheet Assessment

Asset Composition and Growth

Total assets of the combined entity reached ₹23.87 lakh crore as of June 30, 2025, according to the bank’s regulatory disclosures. The asset side of the balance sheet includes loans and advances to customers, investment securities, cash and bank balances, and fixed assets including branch infrastructure and technology systems.

Loans and advances, representing the bank’s primary business activity, totaled ₹20.7 lakh crore, reflecting growth of approximately 14.9% year-over-year. Loan growth in the banking sector depends on credit demand from businesses and consumers, which correlates with economic activity levels, interest rate environment, and business confidence.

Loan Portfolio Segmentation

The retail loan portfolio, which includes home loans, personal loans, auto loans, credit cards, and other consumer lending, reached ₹8.9 lakh crore. Retail lending typically offers higher margins compared to corporate lending but involves managing numerous smaller-ticket transactions. Home loans constitute a significant portion of retail lending following the merger with HDFC Ltd.

Corporate and wholesale lending, serving larger businesses and institutional clients, totaled ₹7.8 lakh crore. Corporate lending involves larger individual exposures requiring detailed credit assessment and risk management. Small and medium enterprise (SME) lending reached ₹2.8 lakh crore, targeting businesses that fall between retail and large corporate segments.

Liability Structure and Deposits

Total deposits reached ₹19.8 lakh crore, representing the bank’s primary funding source. The deposit base includes Current Account Savings Account (CASA) deposits and term deposits. CASA deposits, which include non-interest-bearing current accounts and relatively lower-cost savings accounts, totaled ₹7.9 lakh crore.

The CASA ratio, calculated as CASA deposits divided by total deposits, represents an important metric for banks as it indicates the proportion of low-cost funding. A CASA ratio above 40% is generally considered favorable in the Indian banking context, though optimal levels vary by business model and customer mix.

Term deposits, which are fixed-term deposits with specified maturity dates and interest rates, comprise the balance of the deposit base. Term deposit costs vary with maturity periods, prevailing interest rates, and competitive dynamics. Banks manage liability costs through pricing strategies and product design.

Asset Quality and Risk Management

Non-Performing Asset Analysis

Gross NPA Metrics

Gross Non-Performing Assets (NPAs), representing loans where borrowers have defaulted on payments for 90 days or more, totaled approximately 1.34% of gross advances as of June 30, 2025. The gross NPA ratio serves as a key indicator of loan book quality and credit risk management effectiveness. Lower ratios indicate better asset quality, though interpretation requires considering economic conditions and sector exposures.

Industry gross NPA levels vary across banks based on lending portfolios, risk appetite, underwriting standards, and economic exposures. Public sector banks typically report higher NPA ratios compared to private sector banks, reflecting different business models and historical lending practices.

Net NPA Assessment

Net NPAs, calculated as gross NPAs minus provisions already set aside for potential losses, stood at approximately 0.34% of net advances. The net NPA ratio indicates actual at-risk exposure after accounting for provisions. The difference between gross and net NPA ratios reflects the bank’s provisioning coverage.

The Provision Coverage Ratio (PCR) of 75.8% indicates that the bank has set aside provisions equivalent to 75.8% of its gross NPAs. Higher provision coverage provides greater buffer against potential losses, though it also impacts current period profitability through provision expenses.

Credit Cost Trends

Credit cost, representing provisioning expenses as a percentage of average loans, was approximately 0.31% for Q1 FY26. This metric indicates the cost of maintaining asset quality and providing for potential credit losses. Lower credit costs suggest better portfolio quality or favorable economic conditions, while rising credit costs may signal deteriorating asset quality or economic stress.

Provisioning requirements follow Reserve Bank of India (RBI) guidelines that specify minimum provisioning percentages for different asset categories. Banks may also make additional provisions based on internal risk assessments beyond regulatory minimums.

Stock Market Performance Analysis

Recent Trading Activity

Following the Q1 FY26 results announcement on July 18, 2025, HDFC Bank shares traded around ₹1,676 on NSE on July 20, 2025. The stock price movement reflected market participants’ assessment of the quarterly financial performance and forward-looking expectations. Trading volumes and price volatility typically increase around quarterly results announcements as investors process new information.

Stock prices in the banking sector are influenced by multiple factors including reported financial results, asset quality trends, economic outlook, interest rate expectations, and regulatory developments. Individual bank stock performance also depends on company-specific factors including management quality, competitive positioning, and strategic initiatives.

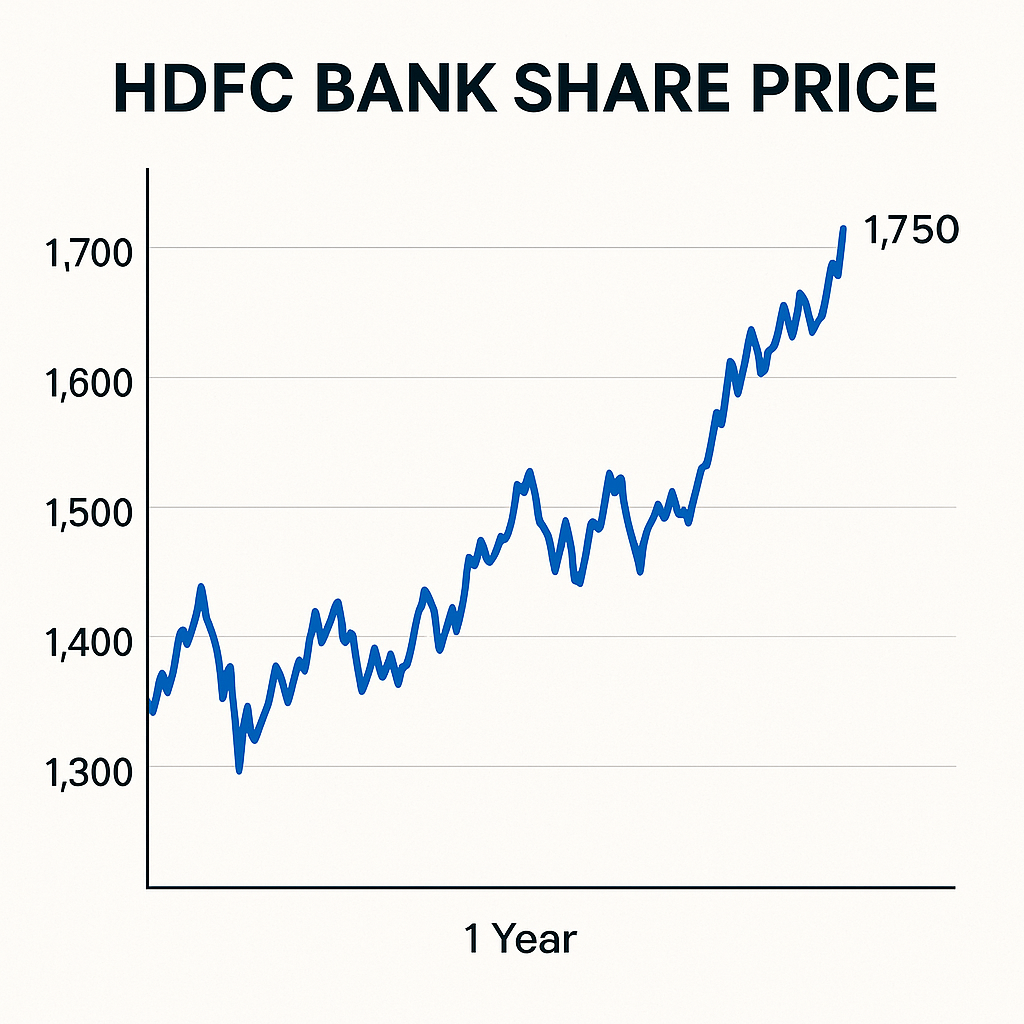

Historical Price Trends

The 52-week trading range for HDFC Bank shares extended from ₹1,363 to ₹1,757 based on NSE data. This range represents the highest and lowest trading prices over the preceding twelve-month period. The current price around ₹1,676 positions the stock near the upper end of its annual range.

Technical analysts examine price charts, moving averages, support and resistance levels, and momentum indicators to identify potential trading patterns. However, technical analysis should be combined with fundamental analysis of business performance and valuation metrics for comprehensive investment assessment.

Market Capitalization Context

Based on the prevailing share price and total outstanding shares, HDFC Bank’s market capitalization approximated ₹12.8 lakh crore, making it one of India’s most valuable private sector banks. Market capitalization represents the total market value of a company’s equity and enables comparison with sector peers and broader market indices.

Companies with larger market capitalizations typically exhibit lower volatility compared to smaller companies, though this relationship is not absolute. Market capitalization also influences index weights in benchmark indices like the Nifty 50 and Sensex.

Financial Ratio Analysis

Profitability Metrics

Return on Assets (ROA)

Return on Assets of approximately 2.1% indicates the bank’s efficiency in utilizing assets to generate profits. ROA is calculated as net profit divided by average total assets. Banking sector ROA levels typically range from 0.5% to 2.5%, with variation based on business model, risk appetite, and operational efficiency.

Higher ROA indicates better asset utilization, though comparison requires considering business mix differences. Retail-focused banks may show different ROA profiles compared to wholesale-focused banks due to different margin structures and capital requirements.

Return on Equity (ROE)

Return on Equity of 17.2% measures profitability relative to shareholders’ equity. ROE is calculated as net profit divided by average shareholders’ equity. This metric indicates how effectively the bank generates returns on invested capital. ROE interpretation requires considering leverage levels, as higher debt-to-equity ratios can inflate ROE figures.

Banking sector ROE targets typically range from 12% to 18%, with top-performing banks achieving higher levels. Sustainable high ROE indicates competitive advantages, effective capital allocation, and profitable business operations.

Efficiency Indicators

Cost-to-Income Ratio

The cost-to-income ratio, also called the efficiency ratio, stood at approximately 42.8% for Q1 FY26. This metric is calculated as operating expenses divided by operating income. Lower ratios indicate better operational efficiency, as the bank generates revenue while controlling costs.

Banking sector cost-to-income ratios typically range from 40% to 55%, with variation based on business model and operational scale. Technology investments, branch network expansion, and compliance costs influence this ratio. Improving efficiency ratios over time indicate successful cost management initiatives.

Earnings Per Share (EPS)

Earnings Per Share of ₹22.45 for Q1 FY26 represents net profit divided by weighted average number of shares outstanding. EPS provides a per-share basis for profitability assessment and enables comparison across periods. However, EPS can be influenced by share buybacks or new share issuances, so trend analysis should consider changes in share count.

Competitive Landscape Assessment

Private Sector Banking Competition

India’s private sector banking space includes several major players competing across retail, corporate, and wholesale banking segments. ICICI Bank, the second-largest private sector bank, reported different growth and profitability metrics based on its business mix and strategic focus. Axis Bank, the third-largest private player, has emphasized retail lending and digital banking capabilities.

Kotak Mahindra Bank operates with a focus on specific customer segments and maintains a different branch network strategy. Yes Bank, after undergoing restructuring, has worked on rebuilding its business. Each bank maintains different competitive strengths in areas like asset quality, deposit costs, technology platforms, and geographic presence.

Comparison Metrics with Peers

Asset quality comparison across private sector banks shows variation in gross and net NPA levels. HDFC Bank’s reported gross NPA ratio of 1.34% compares to different levels at peer banks. ICICI Bank has reported improving asset quality trends in recent quarters. Direct comparisons require considering portfolio composition, as banks with higher corporate lending exposure may show different NPA profiles than retail-focused banks.

Profitability metrics also vary across banks. ROE and ROA comparisons provide insights into relative efficiency and profitability. However, differences in business models, risk appetites, and growth strategies mean that direct comparisons require careful interpretation.

Public Sector Bank Competition

Public sector banks, including State Bank of India (SBI), operate under different ownership structures and historical contexts. SBI, as India’s largest bank, maintains substantial market share in deposits and lending. Public sector banks collectively hold significant market share though individual banks vary in size and performance.

Recent years have seen public sector banks reporting improved financial performance and reduced NPA ratios following asset quality recognition exercises and subsequent recoveries. Government recapitalization support and management reforms have contributed to performance improvements.

Regulatory Environment and Policy Context

Banking Sector Regulations

The Reserve Bank of India regulates commercial banks under the Banking Regulation Act, 1949, and related statutes. Regulatory requirements cover capital adequacy, asset classification, provisioning norms, exposure limits, governance standards, and customer protection. Banks must maintain capital ratios above minimum thresholds specified by RBI based on Basel III norms.

HDFC Bank, classified as a Domestic Systemically Important Bank (D-SIB) by RBI, faces additional capital and supervisory requirements given its systemic importance. D-SIBs must maintain higher loss absorbency capacity to reduce potential systemic risks. The classification reflects the bank’s size, interconnectedness, and importance to the financial system.

Recent Policy Developments

RBI’s monetary policy stance, including repo rate decisions and liquidity management measures, influences banking sector operations. Interest rate changes affect banks’ lending rates, deposit costs, and NIM. Liquidity conditions impact funding costs and credit availability. Policy measures addressing specific sectors or lending categories also influence bank operations.

Regulatory guidelines on digital banking, cybersecurity, customer data protection, and operational risk management require ongoing compliance investments. Banks must adapt technology systems and processes to meet evolving regulatory expectations while maintaining operational efficiency.

Merger-Related Regulatory Aspects

The HDFC Bank-HDFC Ltd merger required approvals from multiple regulatory authorities including RBI, stock exchanges, Competition Commission of India, and National Company Law Tribunal. Post-merger, the combined entity operates under RBI’s banking regulations. The bank must comply with exposure norms, priority sector lending targets, and other regulatory requirements applicable to commercial banks.

The merger resulted in changes to ownership structure, with former HDFC Ltd shareholders becoming HDFC Bank shareholders. Foreign ownership limits and other regulatory constraints apply to the combined entity. Ongoing reporting and compliance obligations continue as part of normal banking operations.

Merger Integration Analysis

Operational Consolidation Progress

The integration of HDFC Bank and HDFC Ltd operations involves multiple dimensions including branch network rationalization, product portfolio harmonization, technology platform unification, and organizational structure alignment. The bank has been working on migrating customers to unified systems, consolidating duplicate functions, and standardizing processes.

Integration timelines for large-scale mergers typically extend over multiple quarters or years. The complexity of integrating different technology platforms, organizational cultures, and operational processes requires careful planning and execution. Customer communication and service continuity are priorities during integration periods.

Cost Synergy Realization

Expected cost synergies from the merger include elimination of duplicate corporate functions, optimization of branch networks where overlap exists, consolidation of technology platforms, and improved procurement efficiencies through larger scale. Management has indicated expected synergy benefits, though actual realization depends on successful execution.

Integration costs during the transition period offset some synergy benefits. These costs include technology integration expenses, employee-related costs, professional fees, and other one-time expenditures. Financial statements may break out integration-related costs separately to provide clarity on core operating performance.

Revenue Synergy Opportunities

Revenue synergies from the merger include cross-selling opportunities between banking and housing finance products, expanded distribution reach through combined branch networks, and enhanced product offerings leveraging both entities’ capabilities. Home loan customers can access broader banking services, while bank customers gain improved housing finance solutions.

The realization of revenue synergies depends on effective execution of cross-selling strategies, customer adoption of combined product offerings, and maintenance of service quality during integration. Actual synergy achievement typically occurs gradually over multiple quarters following a merger.

Analyst Views and Research Coverage

Brokerage Research Perspectives

Multiple domestic and international brokerage firms provide research coverage of HDFC Bank with varying ratings and price targets. Following the Q1 FY26 results, analyst reports examined the financial performance, asset quality trends, merger integration progress, and valuation metrics.

Different analysts may emphasize various factors in their assessments. Some focus on near-term earnings growth, while others prioritize long-term competitive positioning. Valuation methodologies also vary, with some analysts using price-to-book multiples, others using price-to-earnings ratios, and some employing discounted cash flow models.

Price Target Considerations

Analyst price targets represent individual firm opinions about appropriate share valuations based on financial projections and valuation assumptions. Reported price targets from various brokerages range across different levels, reflecting different analytical assumptions and time horizons.

Investors should recognize that price targets are opinions rather than guarantees, and actual stock performance may differ materially from analyst projections. Multiple factors including market conditions, company performance, and macroeconomic developments influence actual stock prices.

Rating Distribution

Research coverage includes various rating categories such as “Buy,” “Hold,” “Sell,” or equivalent terminology depending on the brokerage. Rating distributions across covering analysts provide aggregate perspective on market sentiment, though individual investors should conduct independent analysis appropriate to their circumstances.

Consensus estimates compiled from multiple analysts provide benchmarks for earnings expectations and valuation metrics. Comparing actual results to consensus estimates helps assess whether performance exceeded, met, or fell short of market expectations.

Macroeconomic Context and Banking Sector Trends

Indian Economic Outlook

India’s economic growth trajectory influences banking sector performance through impacts on credit demand, asset quality, and business confidence. GDP growth rates, inflation levels, interest rate trends, and fiscal policy all affect the operating environment for banks. Economic expansion typically supports loan growth and reduces credit stress, while economic slowdowns can pressure both volumes and asset quality.

Government infrastructure investments, manufacturing initiatives, and service sector developments create lending opportunities for banks. Consumer spending patterns influenced by employment levels and income growth affect retail lending demand. Corporate investment decisions drive corporate credit requirements.

Interest Rate Environment

The Reserve Bank of India’s monetary policy stance affects banking sector operations. The repo rate, at which RBI lends to commercial banks, influences overall interest rate levels in the economy. Changes to the repo rate typically translate to adjustments in banks’ lending and deposit rates.

The current interest rate cycle position affects bank profitability through impacts on NIM. Rising rate environments can benefit banks if asset repricing occurs faster than liability repricing. Stable or declining rate scenarios create different dynamics. The bank’s asset-liability management strategy aims to optimize interest rate risk while maintaining profitability.

Credit Growth Trends

System-wide credit growth, as reported by RBI, provides context for individual bank loan growth rates. Sector-specific credit trends vary based on industry conditions and policy initiatives. Priority sector lending regulations require banks to allocate specified portions of lending to designated sectors including agriculture, micro and small enterprises, education, and housing.

Competition for quality credit assets affects lending spreads and underwriting standards. Banks balance growth objectives with asset quality considerations when evaluating lending opportunities. Risk-adjusted returns on lending guide credit allocation decisions across different customer segments and sectors.

Digital Banking and Technology Initiatives

Digital Transformation Progress

HDFC Bank has invested in digital banking capabilities including mobile banking applications, internet banking platforms, digital payment systems, and automated customer service channels. Digital transaction volumes have grown significantly as customers increasingly adopt online and mobile banking for routine transactions.

The bank reported approximately 45 million mobile banking users and high digital transaction ratios. Digital channels offer cost advantages compared to branch transactions while providing customer convenience. Technology investments focus on improving user experience, expanding digital service offerings, and enhancing security.

Innovation and Emerging Technologies

Banks are exploring applications of artificial intelligence, machine learning, data analytics, and cloud computing to improve operations and customer service. Use cases include credit assessment, fraud detection, customer segmentation, personalized recommendations, and process automation.

Regulatory frameworks for technology adoption in banking continue evolving. RBI guidelines address areas including cybersecurity, data protection, outsourcing, and business continuity. Banks must balance innovation objectives with security requirements and regulatory compliance.

Competitive Technology Landscape

Competition in digital banking includes both traditional banks investing in technology and fintech companies offering specialized services. Payment system innovations, digital lending platforms, and neo-banking concepts create competitive dynamics. Partnerships between banks and fintech companies represent one approach to accelerating digital capabilities.

Customer expectations for digital banking services continue rising, influenced by experiences across different industries. Banks invest in technology to meet evolving customer needs while managing operational costs and maintaining security standards.

Risk Factors and Considerations

Credit Risk Management

Credit risk, the risk of borrower default, represents the primary risk for banks. HDFC Bank’s credit risk management framework includes underwriting standards, exposure limits, portfolio diversification guidelines, and ongoing monitoring processes. The bank’s reported asset quality metrics reflect credit risk management effectiveness.

Sector concentrations, geographic exposures, and borrower concentrations influence overall credit risk profile. Stress testing and scenario analysis help assess portfolio resilience under adverse conditions. Provisioning policies provide buffers against potential credit losses.

Market Risk Exposures

Market risk, including interest rate risk, foreign exchange risk, and equity price risk, affects banks’ trading books and investment portfolios. The treasury function manages these risks through position limits, hedging strategies, and risk monitoring systems.

Interest rate risk in the banking book results from mismatches between asset and liability repricing periods. Asset-liability management committees oversee this risk through gap analysis and sensitivity assessments. Banks use derivatives and other instruments to manage market risk exposures.

Operational Risk Factors

Operational risk encompasses risks from inadequate processes, people, systems, or external events. Categories include technology failures, fraud, legal risks, regulatory compliance issues, and business disruption events. Banks invest in internal controls, insurance, business continuity planning, and employee training to mitigate operational risks.

Cybersecurity risks have increased with digital banking growth. Banks implement security measures including encryption, authentication systems, fraud monitoring, and incident response capabilities. Regulatory expectations for cybersecurity and data protection require ongoing investment.

Regulatory and Compliance Risks

Regulatory changes can impact business models, profitability, and operational requirements. Banks must adapt to evolving regulations while maintaining business operations. Compliance costs include systems, personnel, and process modifications required to meet regulatory expectations.

Failure to maintain regulatory compliance can result in penalties, restrictions on business activities, or reputational damage. Banks maintain compliance functions to monitor regulatory developments and ensure adherence to applicable requirements.

Investment Considerations and Valuation

Valuation Metrics Assessment

Based on the current share price around ₹1,676, various valuation metrics provide perspective on market pricing relative to financial performance. The Price-to-Book (P/B) ratio compares market capitalization to book value of equity. Banking sector P/B ratios typically range from 1.5x to 4x depending on profitability, growth prospects, and asset quality.

The Price-to-Earnings (P/E) ratio, around 18-19x based on recent earnings, compares share price to earnings per share. Banking sector P/E ratios vary based on growth expectations, ROE levels, and risk perceptions. Comparison with peer bank P/E ratios provides context for relative valuation.

Dividend Considerations

HDFC Bank has historically paid dividends to shareholders, with dividend policies balancing capital retention for growth with shareholder returns. Dividend yield, calculated as annual dividend per share divided by share price, represents one component of total shareholder return alongside capital appreciation.

Banking regulations and RBI guidelines influence dividend policies through minimum capital requirements and restrictions on dividend payments based on capital and profitability levels. Banks must maintain adequate capital for growth while providing shareholder returns.

Growth Prospects Assessment

Future growth prospects depend on multiple factors including Indian economic growth, credit penetration levels, market share dynamics, merger synergy realization, digital banking adoption, and operational execution. India’s relatively low credit-to-GDP ratio compared to developed markets suggests long-term growth potential for the banking sector.

HDFC Bank’s specific growth trajectory will reflect its competitive positioning, strategic initiatives, asset quality maintenance, and ability to capitalize on market opportunities. Growth rates may moderate from historical high levels as the bank’s base size increases and market matures.

Frequently Asked Questions

What were HDFC Bank’s Q1 FY26 financial results?

HDFC Bank reported standalone net profit of ₹17,148 crore for Q1 FY26 (April-June 2025), representing approximately 12% growth year-over-year. Net Interest Income reached ₹28,700 crore with growth of 11.6% compared to the year-ago quarter. The loan book expanded to ₹20.7 lakh crore, reflecting 14.9% annual growth. Asset quality metrics showed gross NPA ratio of 1.34% and net NPA ratio of 0.34% as of June 30, 2025. These figures are based on the bank’s regulatory filings with stock exchanges.

How has HDFC Bank’s stock performed recently?

HDFC Bank shares traded around ₹1,676 on NSE on July 20, 2025, following the Q1 FY26 results announcement. The stock’s 52-week trading range extended from ₹1,363 to ₹1,757. Recent price movements reflect market assessment of quarterly financial performance and forward-looking expectations. Stock performance is influenced by multiple factors including reported results, asset quality trends, economic conditions, and sector dynamics. Historical performance does not guarantee future results.

What is the status of the HDFC Bank-HDFC Ltd merger integration?

The merger between HDFC Bank and HDFC Ltd was completed in July 2023 through a court-approved scheme of amalgamation. Integration efforts continue across operational dimensions including technology platforms, branch networks, organizational structures, and business processes. The bank has indicated expected cost synergies and revenue opportunities from the merger. Integration timelines for large-scale mergers typically extend over multiple quarters. Actual synergy realization depends on successful execution of integration plans.

How does HDFC Bank’s asset quality compare to sector peers?

HDFC Bank reported gross NPA ratio of 1.34% and net NPA ratio of 0.34% as of June 30, 2025. Asset quality metrics vary across banks based on lending portfolios, underwriting standards, and economic exposures. Private sector banks generally report lower NPA ratios compared to public sector banks. Direct comparisons require considering portfolio composition differences, as banks with varying retail-corporate lending mixes show different asset quality profiles. Provision Coverage Ratio of 75.8% indicates provisioning buffer.

What factors influence HDFC Bank’s profitability?

Banking profitability depends on net interest margin (spread between lending and funding costs), fee-based income from services, operating expense efficiency, and credit costs related to provisioning. HDFC Bank reported NIM of 4.2% and cost-to-income ratio of 42.8% for Q1 FY26. Return on Equity of 17.2% indicates capital efficiency. Profitability is influenced by interest rate environment, credit demand, competition, operational leverage, and asset quality. Sustainable profitability requires balancing growth with risk management.

What are the key risks for HDFC Bank?

Key risks include credit risk from potential borrower defaults, market risks from interest rate and currency fluctuations, operational risks from technology or process failures, competitive pressures affecting margins and market share, regulatory changes impacting business models, and economic conditions affecting credit demand and asset quality. Merger integration execution represents an additional consideration. The bank manages risks through diversification, underwriting standards, risk monitoring systems, and compliance frameworks. Risk factors are disclosed in regulatory filings.

What is HDFC Bank’s approach to digital banking?

HDFC Bank has invested in digital banking capabilities including mobile banking apps, internet banking, digital payments, and automated services. The bank reported approximately 45 million mobile banking users with high digital transaction ratios. Digital channels provide cost efficiency and customer convenience. Technology investments focus on user experience, service expansion, and security. Competition includes both traditional banks and fintech companies. Regulatory frameworks address cybersecurity, data protection, and operational resilience.

How do analysts view HDFC Bank’s prospects?

Multiple brokerage firms provide research coverage with varying ratings and price targets reflecting different analytical perspectives and assumptions. Analyst assessments consider financial performance, asset quality, competitive positioning, merger integration progress, and valuation metrics. Price targets represent individual firm opinions rather than guarantees, and actual performance may vary. Investors should conduct independent analysis appropriate to their circumstances. Consensus estimates provide aggregate market expectations for earnings and metrics.

About the Author

Nueplanet

Banking Sector and Financial Markets Analyst

Nueplanet specializes in analyzing India’s banking sector, focusing on financial performance evaluation, regulatory developments, and industry trends. With the years of experience covering commercial banks and financial institutions, Nueplanet provides detailed examination of quarterly results, business strategies, and market dynamics.

This analysis draws exclusively on publicly available information including stock exchange filings, regulatory disclosures, RBI publications, company announcements, and market data from recognized exchanges. Financial metrics cited are based on official company filings with BSE and NSE. All data and statistics referenced come from publicly disclosed sources.

Editorial Standards

This content provides factual analysis of publicly available financial information and observable market data. The analysis examines multiple dimensions of bank performance, sector context, and risk factors to enable informed reader assessment. No investment recommendations are provided, as individual investment decisions should reflect personal financial circumstances, risk tolerance, and professional guidance.

Information accuracy is prioritized through verification against official regulatory filings, stock exchange databases, and authoritative sources. Financial ratios and metrics are calculated based on disclosed financial statements. Market data reflects publicly available information from recognized stock exchanges.

Published: July 21, 2025

Last Updated: July 21, 2025

Disclaimer: This article provides informational analysis based on publicly available data and does not constitute investment advice, stock recommendations, or securities offers. Banking sector investments involve risks including credit risk, market risk, operational risk, and regulatory risks. Past performance does not guarantee future results. Readers should conduct independent research and consult qualified financial advisors before making investment decisions. The author and publisher assume no liability for financial decisions made based on this content.

Source References:

- HDFC Bank Limited quarterly results filed with BSE/NSE

- Reserve Bank of India publications and statistical releases

- Stock exchange price and trading volume data

- Company investor presentations and press releases

- Banking sector regulatory guidelines and reports

Helpful Resources

Latest Posts

- ICAI CA Final May 2025 Results Expected Between First Week of July.

- Supreme Court’s Landmark Birthright Citizenship Decision: Limits on Nation‑wide Injunctions & What’s Next

- SSC CGL 2025 Notification Released

- ICAI CA Final May 2025 Results Expected Between First Week of July.

- Kings Mountain ICE Raid: Inside the Buckeye Fire Equipment Factory Operation

Post Comment