Vikran Engineering Share Price: Market Volatility and Investor Outlook in 2025

Vikran Engineering share price has witnessed sharp swings, dropping in recent sessions after early rallies. This blog analyzes the latest stock movements, company fundamentals, and long-term investor outlook.

Table of Contents

Introduction: Infrastructure Stock Under Market Scrutiny

Vikran Engineering’s share price experienced significant volatility during the third quarter of 2025, drawing attention from both institutional and retail investors. The stock declined approximately 7% during pre-open trading on September 30, 2025, marking a notable correction from its mid-year highs.

This analysis examines the recent price movements, operational fundamentals, and sector dynamics affecting Vikran Engineering. The article provides fact-based insights into the company’s financial position and market outlook. All information is sourced from official market data, company filings, and verified financial reports.

Market participants have expressed varying opinions about whether this correction represents a temporary consolidation or signals deeper operational challenges. Understanding these dynamics requires examining multiple factors including company performance, sector trends, and macroeconomic conditions.

Recent Share Price Performance: September 2025 Analysis

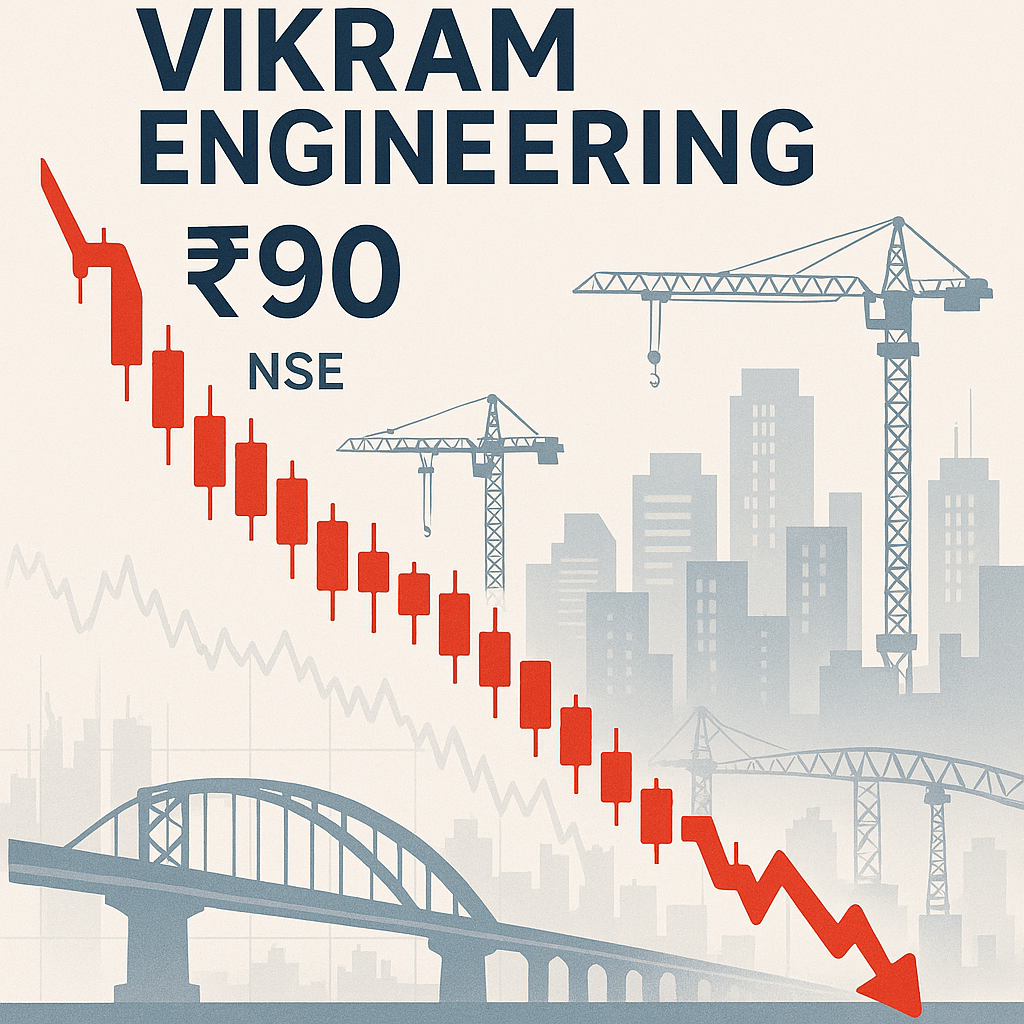

Pre-Open Trading Session Weakness

The trading session on September 30, 2025, opened with significant selling pressure. The stock declined nearly 7% to approximately ₹90 during early trading hours. This marked a substantial retreat from recent trading ranges established during mid-2025.

Market data indicated heavy sell orders during the pre-open session. Trading volumes increased substantially compared to previous sessions. The sharp decline suggested institutional repositioning rather than retail-driven movements.

Several factors contributed to the downward pressure. Profit-booking by investors who entered at lower levels played a significant role. Global market sentiment toward emerging market small-cap stocks also influenced trading activity.

Intraday Price Movement Patterns

Throughout the September 30 session, the stock fluctuated between ₹88 and ₹93. Support emerged at lower price levels as value-focused buyers entered the market. The volatility index for the counter increased, reflecting heightened uncertainty.

Technical analysts established a near-term trading range of ₹85–₹105 for the stock. The ₹90 level assumed importance as a psychological support zone. Market participants monitored price action around this level for directional cues.

Trading data showed divergent behavior between investor categories. Retail participation remained robust despite price weakness. Institutional investors adopted a more cautious stance, waiting for greater clarity on operational metrics.

Year-to-Date Price Trajectory

Vikran Engineering began 2025 trading in the ₹65-₹70 range following subdued performance in late 2024. The stock climbed steadily through the first quarter as infrastructure sector sentiment improved. Government spending announcements and order flow visibility supported the upward movement.

By April 2025, the counter breached the ₹80 mark with improving technical indicators. Momentum accelerated through May and June, with the stock reaching highs near ₹110 during mid-year. Infrastructure stocks broadly outperformed benchmark indices during this period.

July and August brought consolidation as concerns about rising input costs emerged. The September correction represented both a technical retracement and a fundamental reassessment. Market participants evaluated growth prospects in light of margin pressure across the engineering sector.

Company Overview: Vikran Engineering Fundamentals

Business Operations and Market Position

Vikran Engineering operates in India’s infrastructure and engineering services sector. The company executes projects across civil, mechanical, and structural engineering categories. Its client base includes both government agencies and private sector entities.

The company maintains a diversified project portfolio spanning multiple verticals. Active operations include road construction, structural projects, and specialized mechanical installations. Project scale ranges from highway construction to industrial plant installations.

As a mid-cap engineering firm, Vikran Engineering occupies a strategic market position. The company is large enough to bid on substantial projects while remaining nimble enough to adapt quickly. This positioning appeals to growth-oriented investors seeking infrastructure exposure.

Operational Strengths and Capabilities

The company benefits from government infrastructure development initiatives. Massive allocations toward highways, railways, and urban development create sustained demand visibility. Programs like the National Infrastructure Pipeline support multi-year growth prospects.

Vikran Engineering has demonstrated execution capabilities on awarded contracts. The company manages resource mobilization, subcontractor coordination, and regulatory compliance effectively. Successful project completion has helped secure repeat business in certain segments.

Regional expertise provides competitive advantages in specific geographic markets. Local knowledge of regulatory environments, labor markets, and supplier networks impacts project profitability. Established relationships with regional authorities facilitate smoother project execution.

Financial Challenges and Risk Factors

Margin pressure remains a persistent concern for the company. EBITDA margins hover around 10%, leaving limited cushion for cost fluctuations. Thin margins make the business vulnerable to input cost escalation and execution challenges.

Debt levels are elevated compared to sector peers. The debt-to-equity ratio exceeds 1.5x, reflecting substantial borrowing for working capital and equipment investments. Rising interest rates through 2024 and 2025 have increased debt servicing costs proportionally.

Working capital requirements remain intensive due to project financing needs. Companies must fund ongoing expenses while awaiting milestone-based payments from clients. Government projects often involve payment delays that strain cash flows.

The stock exhibits sharp price swings exceeding movements justified by fundamental developments. This volatility reflects speculative trading activity and limited free float. Long-term investors must endure significant drawdowns even during periods of adequate business performance.

Recent Operational Developments

Through the first three quarters of 2025, the company demonstrated double-digit revenue growth. Project execution across the existing order book drove top-line expansion. Several meaningful contracts were secured during this period.

New contract wins included road construction projects in tier-2 cities and mechanical installation work for industrial clients. Order inflow roughly matched revenue recognition rates. The order book remained stable or expanded modestly during this period.

Profitability lagged revenue growth due to cost pressures. Rising prices for steel, cement, and fuel compressed operating margins. Increased financing costs further impacted net income. Management implemented cost-control initiatives to address these challenges.

Infrastructure Sector Context: 2025-2026 Outlook

Government Capital Expenditure Trends

The Union Budget for fiscal year 2025-26 maintained substantial allocations for infrastructure development. Capital expenditure commitments reached historic levels. Government focus spans roads, railways, ports, airports, and urban infrastructure.

State governments similarly increased infrastructure spending, broadening opportunities beyond central projects. Multiple states announced dedicated infrastructure funds and expedited project approvals. This creates sustained demand for engineering and construction services.

Budget documents indicate continued priority for infrastructure development in upcoming fiscal years. Multi-year project pipelines provide visibility for engineering firms. However, actual spending rates and project execution timelines remain subject to various factors.

Private Sector Investment Activity

Private sector infrastructure participation has accelerated across multiple categories. Industrial expansion, warehouse construction driven by e-commerce growth, and renewable energy installations require substantial engineering services. Data center development has emerged as a new demand driver.

This diversification reduces sector dependence on government spending cycles. Engineering firms access alternative revenue channels with potentially different risk-reward profiles. Private sector projects often involve faster decision-making but may carry different payment terms.

Corporate capital expenditure announcements suggest sustained private investment momentum. Manufacturing expansion linked to production incentive schemes creates additional infrastructure requirements. Logistics network upgrades to support supply chain efficiency represent another growth area.

Renewable Energy Infrastructure Development

India’s renewable energy targets have unleashed significant investment in solar parks and wind farms. Associated transmission infrastructure requires substantial engineering services. Firms with capabilities in these segments access high-growth opportunities.

Renewable energy projects typically involve different technical requirements compared to traditional construction. Grid integration, specialized equipment installation, and technology deployment create demand for new skill sets. Engineering firms expanding into these areas position themselves for future growth.

Government policies supporting renewable energy deployment remain consistent across political administrations. International climate commitments reinforce India’s renewable energy trajectory. This provides long-term visibility for infrastructure investments in the energy sector.

Sector Headwinds and Risk Factors

Raw material cost inflation has severely squeezed margins across the engineering sector. Steel, cement, aluminum, and petroleum product prices remained elevated through 2025. While some contracts include escalation clauses, many firms absorbed substantial cost increases.

The global commodity cycle and supply chain dynamics create uncertainty around input cost trajectories. Engineering firms lack pricing power to fully pass through cost increases. Competitive bidding dynamics limit ability to negotiate favorable terms.

Rising interest rates have increased borrowing costs for leveraged engineering companies. The monetary tightening cycle implemented through 2024 and maintained into 2025 directly impacts profitability. Companies with elevated debt burdens face acute pressure as refinancing occurs at higher rates.

Intense competition erodes project economics across the sector. Government tenders often see aggressive bidding that compresses margins to minimal levels. While winning bids supports capacity utilization, project economics sometimes barely cover costs when execution challenges emerge.

Technical Analysis: Chart Patterns and Key Levels

Support and Resistance Zones

Technical analysts have identified the ₹85-₹88 range as primary support. This zone represents a confluence of factors including prior consolidation, the 200-day moving average, and Fibonacci retracement levels. Sustained breaks below ₹85 would likely trigger additional selling pressure.

Immediate resistance appears near ₹105-₹108, representing recent consolidation highs. Decisive breakouts above this level, sustained over multiple sessions, could trigger renewed upward momentum. Beyond ₹108, the next meaningful resistance doesn’t appear until ₹120.

The current price zone around ₹90-₹92 has emerged as an important intermediate level. How the stock behaves around this level provides important clues about near-term direction. Market participants actively defend this level through buying support.

Technical Indicator Signals

The 50-day moving average has crossed below the 100-day moving average, creating a short-term bearish crossover pattern. However, the 200-day moving average continues to slope upward. The stock remains above this longer-term trendline.

The Relative Strength Index (RSI) declined from overbought territory above 70 to current readings around 45-50. This indicates selling momentum has moderated. The stock may be approaching oversold conditions that could attract value buyers.

Trading volumes surged during the September correction, indicating genuine participation rather than thin, low-volume decline. High-volume selling often represents capitulation that exhausts near-term supply. Analysts monitor volume patterns for reversal signals.

Chart analysis reveals a rising wedge pattern formed during the mid-2025 rally. The recent breakdown from this pattern reached typical measured move objectives. Formation of a base pattern over coming weeks would provide increased confidence.

Short-Term Trading Range Outlook

Based on current technical indicators, the stock will likely trade within the ₹85-₹105 range over the next 4-6 weeks absent major catalysts. Breakouts from this range in either direction would carry significant implications for medium-term trajectory.

Traders monitor for reversal patterns near support levels or breakdown confirmation if support fails. Volume trends provide important confirmation of price movements. Declining volume on continued weakness would suggest seller exhaustion.

Options trading activity has increased notably, with both call and put volumes rising. Elevated implied volatility reflects market expectations for ongoing price fluctuations. This creates opportunities for options strategies but signals continued uncertainty.

Investor Sentiment Analysis: Divergent Perspectives

Retail Investor Positioning

Retail investor forums and brokerage call volumes indicate sustained enthusiasm among individual investors. Many retail participants view the correction as an accumulation opportunity. They reason that long-term infrastructure growth stories remain intact.

Retail investors cite several supporting arguments. Government infrastructure spending will continue driving revenue growth. The company’s order book provides visibility into future quarters. Previous momentum demonstrates market recognition of potential.

Social media discussions reveal many retail holders are maintaining or adding to positions during the correction. This conviction has manifested in elevated trading volumes even as prices declined. Retail demand has provided support that might have otherwise seen the stock fall further.

Trading data shows substantial buy orders emerging at lower price levels. The retail community’s willingness to “buy the dip” reflects confidence in eventual recovery. However, it remains uncertain whether this demand can absorb continued institutional selling.

Institutional Investor Caution

Fund managers and institutional analysts express several concerns tempering near-term outlook. Primary among these is margin pressure stemming from raw material inflation and competitive bidding dynamics. Thin margins leave little room for error.

Elevated debt burden troubles institutional analysts. Rising interest costs pressure profitability and limit financial flexibility. Institutions prefer waiting for greater clarity on quarterly results before committing significant capital.

The upcoming quarterly announcement will be scrutinized closely for insights into margin trends, order book quality, and debt levels. Management commentary on outlook will influence institutional positioning. Many institutions prefer remaining on the sidelines until this information is available.

The institutional-retail divergence creates interesting market dynamics. If institutional investors become more constructive following quarterly results, their buying could provide powerful upward momentum. Conversely, continued institutional caution might limit upside even with strong retail demand.

Speculative Trading Activity

Beyond fundamental investors, Vikran Engineering attracts attention from short-term traders. Substantial daily price swings create opportunities for momentum trading, swing trading, and intraday participation. Profit potential exists regardless of fundamental direction.

This speculative interest contributes to trading volumes and liquidity. However, it also amplifies price swings beyond what fundamental developments alone might justify. Long-term investors must recognize that short-term price action may be driven more by technical factors.

The elevated speculative component means price movements may not always correlate directly with company announcements or sector developments. Understanding this dynamic helps investors maintain perspective during volatile periods.

Analyst Perspectives: Range of Views

Bullish Analyst Arguments

Analysts maintaining positive ratings emphasize several compelling aspects. The company enters the final quarter of 2025 with a healthy order book providing visibility into revenue for 12-18 months. Executed properly, these projects should generate steady cash flows.

Structural drivers supporting infrastructure spending remain powerful and multi-year in nature. Regardless of near-term volatility, fundamental demand for infrastructure development creates sustained opportunities. Government commitment appears consistent across political cycles.

The recent price decline has brought valuations to more reasonable levels compared to mid-2025 peaks. Bulls argue current prices offer attractive risk-reward for investors taking 2-3 year views. Margin improvement could significantly boost profitability.

Optimistic analysts believe management has opportunities to enhance margins through better project selection and improved execution efficiency. As a mid-sized player, the company has runway to gain market share through successful execution that builds reputation.

Bearish Analyst Concerns

Analysts maintaining cautious ratings cite several significant risks. Elevated leverage represents a structural concern that won’t be quickly resolved. High debt servicing costs will continue suppressing profitability. Any operational setbacks could create acute financial pressure.

In the highly competitive government contracting environment, engineering firms lack ability to pass through cost increases. Bears argue continued input cost inflation will further compress already-thin margins. Some projects may approach break-even profitability.

Infrastructure projects involve inherent complexity and uncertainty. Delays, cost overruns, regulatory challenges, and coordination difficulties create execution risks. Even a few problematic projects could significantly impact overall profitability given the concentrated order book.

Despite the recent correction, bearish analysts argue valuation multiples remain elevated relative to the risk profile. The market continues pricing in optimistic assumptions about growth and margin expansion that may not materialize.

Consensus View and Price Targets

Synthesizing the range of analyst opinions reveals a “neutral to cautiously positive” consensus heading into late 2025. Most analysts recommend a selective approach. The stock is appropriate for investors with medium-to-long-term horizons who understand inherent volatility.

Price targets vary considerably based on different assumptions. The range of 12-month price targets spans from ₹80 on the bearish end to ₹130 among bulls. The median centers around ₹100-₹105. This wide range reflects genuine uncertainty.

Recommendations generally fall into “Hold” or “Accumulate” categories rather than strong “Buy” or “Sell” ratings. Analysts see merit in the long-term story but want evidence of improving fundamentals before recommending aggressive positioning.

Financial Performance: Detailed Metrics

Revenue Growth Analysis

Through the first three quarters of fiscal 2025, Vikran Engineering delivered revenue growth in the 15-18% range compared to the prior year period. This expansion was driven primarily by execution of projects awarded in 2024 and early 2025.

Revenue growth reflects improving capacity utilization as the company ramped up operations across multiple project sites. Order inflow remained reasonably healthy, with new contract wins roughly matching revenue recognition pace. The order book remained stable or expanded modestly.

Road construction projects contributed the largest revenue share, followed by structural engineering work and mechanical installations. Geographic diversification improved somewhat, though concentration remains in key states where the company has established operations.

Profitability Margin Trends

EBITDA margins hovered around 9-10% through 2025, representing modest compression from the 11-12% range achieved in 2024. This erosion reflects multiple factors affecting cost structure and pricing realization.

Input cost inflation exceeded protection provided by escalation clauses in many contracts. The company absorbed cost increases to maintain project commitments. Competitive bidding on new projects resulted in accepting some lower-margin work to maintain operational momentum.

Operating profit margins faced similar pressure, declining from approximately 7% to around 6% of revenue. The reduction stems from both gross margin compression and increased fixed costs associated with business expansion.

Net profit margins were particularly squeezed, dropping to the 3-4% range from previous levels of 5-6%. The primary driver has been increased interest expense stemming from higher debt levels and elevated interest rates.

Balance Sheet Structure

Total assets have grown in line with business expansion. Increases in fixed assets reflect equipment investments. Growth in current assets is driven by inventory and receivables tied to active projects.

Debt levels have increased more rapidly than equity, resulting in a rising debt-to-equity ratio exceeding 1.5x. This compares to sector peer averages around 1.0-1.2x, indicating elevated leverage. The debt composition includes term loans and working capital facilities.

Interest coverage ratios have declined as EBIT growth lagged the increase in interest expense. Current interest coverage stands at approximately 3-4x. The company can service debt from operating profits but has limited cushion if profitability deteriorates.

Working capital remains elevated relative to revenue. Debtor days extend beyond 90 in some periods as customer payment cycles stretch. Management focuses on accelerating collections and negotiating better payment terms on new contracts.

Cash Flow Generation

Operating cash flows have been positive but modest due to limited profitability and working capital expansion. The company invested significantly in capital expenditures to support growth. This resulted in negative free cash flow in some quarters.

Financing cash flows show net debt drawdowns to fund working capital and capex requirements exceeding operating cash generation. This reliance on external financing highlights the importance of maintaining strong banking relationships.

Management has communicated intentions to focus on free cash flow improvement through better project selection, working capital management, and moderated capex. However, achieving positive free cash flow consistently will require margin expansion or slower growth.

Risk Assessment: Key Factors to Consider

Project Execution Risks

Infrastructure projects involve inherent complexity and uncertainty. Delays in obtaining approvals, encountering unexpected site conditions, or coordinating with multiple stakeholders can extend timelines. For Vikran Engineering, troubled projects could meaningfully impact profitability.

The company’s modest scale compared to large infrastructure firms means less financial cushion to absorb setbacks. A major project facing significant cost overruns or client disputes could create acute cash flow pressure.

Financial Leverage Concerns

Elevated debt burden represents the most significant financial risk. Should operating performance deteriorate, fixed debt servicing obligations could quickly consume cash flows. This creates potential financial distress scenarios.

Further interest rate increases or difficulty refinancing debt at acceptable rates could exacerbate pressure. The company’s ability to deleverage depends on generating positive free cash flows, which has proven challenging given working capital requirements.

In worst-case scenarios involving acute cash flow pressures, the company might be forced to dilute equity holders, sell assets at disadvantageous terms, or restructure operations in ways that impair long-term value.

Market Volatility Exposure

As a mid-cap infrastructure stock, Vikran Engineering remains vulnerable to sharp market corrections. During risk-off periods, mid-cap stocks often experience liquidity-driven selling that drives prices below fundamental values.

Broader infrastructure sector sentiment heavily influences stock performance. Shifts in government policy priorities, fiscal constraints limiting infrastructure spending, or sector-wide margin concerns could weigh on valuations regardless of individual company fundamentals.

Limited free float and presence of speculative traders amplifies volatility in both directions. Investors must be prepared to endure substantial drawdowns even if the long-term investment thesis remains intact.

Policy and Regulatory Changes

Changes in government infrastructure policy, tendering procedures, or payment terms could materially impact business prospects. New environmental regulations, stricter safety requirements, or changes to contract terms could affect project economics.

Shifts in political priorities following elections or fiscal challenges could result in project cancellations, funding delays, or reduced infrastructure allocations. While the broad infrastructure trend appears durable, near-term spending volatility is possible.

Competitive Pressure

The infrastructure sector continues attracting new entrants and capacity expansion by existing players. Increased competition could further pressure margins as companies bid aggressively to secure work.

Vikran Engineering’s ability to maintain or grow market share without sacrificing profitability depends on differentiation through execution quality, client relationships, or specialized capabilities. Commodity-like bidding dynamics limit pricing power.

Long-Term Investment Considerations

Structural Growth Drivers

India’s infrastructure gap remains substantial despite years of increased investment. The country requires massive additional spending on transportation, urban infrastructure, power systems, and industrial facilities. This multi-decade investment cycle creates sustained demand.

Government commitment to infrastructure spending appears consistent based on consecutive budgets with increased capital expenditure allocations. This provides confidence that demand will remain robust over extended periods.

Emerging segments like renewable energy infrastructure, data centers, and logistics facilities represent high-growth areas. Vikran Engineering’s ability to expand into newer segments could unlock additional growth avenues beyond traditional construction.

Path to Profitability Improvement

For the investment thesis to materialize, Vikran Engineering must demonstrate ability to expand margins and generate sustainable free cash flows. Several potential paths exist for achieving this objective.

Project mix optimization toward higher-margin specialized projects could improve overall profitability. This requires developing differentiated capabilities and accepting slower growth in exchange for better economics.

Operational efficiency gains through improved project management, waste reduction, and technology leverage could modestly enhance margins. Even incremental improvements compound meaningfully when starting from thin margins.

Scale benefits may emerge as revenue grows. Certain fixed costs should be absorbed across a larger base, improving operating leverage. Additional scale may enhance bargaining power with suppliers and contract negotiation ability.

Debt reduction through disciplined capital allocation and prioritizing cash flow generation would meaningfully reduce interest expense. This requires sustained focus on deleveraging rather than aggressive growth.

Scenario Analysis

Bull case scenario assumes successful order book execution, margin stabilization and gradual improvement, and balance sheet deleveraging. In this scenario, the stock could potentially reach ₹140-₹160 within 2-3 years.

Base case scenario envisions modest growth with relatively stable margins and debt levels remaining elevated but manageable. This suggests the stock ranges between ₹90-₹120 over the next 2-3 years with continued volatility.

Bear case scenario involves execution challenges, further margin compression, intensifying debt pressures, and souring sentiment. In this outcome, the stock could decline to ₹65-₹75, testing 2024 lows.

Investment Suitability Profile

Vikran Engineering is most appropriate for investors with medium-to-long-term investment horizons of 3-5 years minimum. High risk tolerance and ability to withstand 30-40% peak-to-trough volatility is essential.

Conviction in India’s infrastructure growth story is required. Understanding of engineering sector dynamics and inherent challenges helps maintain perspective. Discipline to maintain positions through volatility when fundamental thesis remains intact is crucial.

The stock is generally not suitable for conservative investors seeking stable returns, those with short-term time horizons, or investors uncomfortable with leverage-related risks. Current income seekers should note the company retains earnings for growth rather than paying dividends.

Conclusion: Balanced Assessment of Opportunity and Risk

The Vikran Engineering share price correction during September 2025 represents a meaningful test for the stock and its investor base. The decline forced a reassessment of valuations and brought attention to challenges facing mid-cap infrastructure companies.

Beneath near-term volatility lies a company positioned within India’s structural infrastructure growth theme. Infrastructure development will continue driving demand for engineering services throughout this decade. Well-managed firms have opportunities to build substantial value over time.

For Vikran Engineering specifically, the investment case hinges on execution, debt management, and gradual margin improvement. The company possesses a reasonable order book, established client relationships, and diversified capabilities across multiple project types.

However, thin margins, elevated leverage, and intense competition create legitimate risks that require careful evaluation. Investors must approach Vikran Engineering as a high-risk, high-reward proposition suited only for those with appropriate risk tolerance and time horizons.

The stock will likely continue experiencing sharp volatility driven by company-specific developments and broader sector sentiment. Those who can maintain discipline through this volatility while monitoring fundamental progress may find opportunities for long-term value creation.

Frequently Asked Questions (FAQs)

What caused the Vikran Engineering share price to decline 7% in September 2025?

The decline resulted from multiple factors including heavy profit-booking by investors who entered at lower levels, negative global cues affecting emerging market small-cap stocks, and sector-wide volatility across engineering and infrastructure counters. Pre-open trading showed substantial sell orders from institutional players repositioning portfolios. The correction represented both a technical retracement from elevated mid-year levels and a fundamental reassessment of growth prospects amid margin pressure concerns across the engineering sector.

What is Vikran Engineering’s current financial position and debt level?

Vikran Engineering’s debt-to-equity ratio exceeds 1.5x, which is higher than sector peer averages of 1.0-1.2x. The company’s interest coverage ratio stands at approximately 3-4x, indicating it can service debt from operating profits but has limited cushion. Rising interest rates through 2024 and 2025 have increased debt servicing costs, impacting net profit margins which have compressed to the 3-4% range. The elevated debt burden represents a significant financial risk, particularly if operating performance deteriorates or interest rates increase further.

How does Vikran Engineering compare to other mid-cap infrastructure companies?

Vikran Engineering operates as a mid-cap engineering firm with diversified capabilities across civil, mechanical, and structural engineering projects. The company’s EBITDA margins hover around 9-10%, which is comparable to other mid-cap players facing similar margin pressures. However, its debt-to-equity ratio exceeding 1.5x is higher than many sector peers. The company benefits from government infrastructure spending like competitors but faces similar challenges including intense bidding competition, input cost inflation, and working capital intensity. Its strategic positioning allows bidding on substantial projects while maintaining operational flexibility.

What are the key support and resistance levels for Vikran Engineering stock?

Technical analysts have identified primary support in the ₹85-₹88 range, representing a confluence of the 200-day moving average, prior consolidation levels, and Fibonacci retracement points. Immediate resistance appears near ₹105-₹108, representing recent consolidation highs. The current price zone around ₹90-₹92 serves as an important intermediate level. Analysts suggest a near-term trading range of ₹85-₹105 over the next 4-6 weeks absent major catalysts. A sustained break below ₹85 could trigger additional selling pressure toward ₹75-₹80, while a decisive move above ₹105 might signal renewed upward momentum toward ₹120.

What is the analyst consensus on Vikran Engineering’s future outlook?

The analyst community presents a “neutral to cautiously positive” consensus heading into late 2025. Most analysts recommend a selective approach, suggesting the stock is appropriate for investors with medium-to-long-term horizons. Twelve-month price targets range from ₹80 on the bearish end to ₹130 among bulls, with a median around ₹100-₹105. Recommendations generally fall into “Hold” or “Accumulate” categories rather than strong “Buy” or “Sell” ratings. Analysts want to see evidence of improving fundamentals, particularly margin trends and debt reduction, before recommending aggressive positioning.

How does government infrastructure spending impact Vikran Engineering?

Government infrastructure spending creates sustained demand visibility for Vikran Engineering. The Union Budget for fiscal 2025-26 maintained substantial allocations for infrastructure development, with capital expenditure reaching historic levels. Government focus on roads, railways, ports, airports, and urban infrastructure directly benefits engineering firms. Programs like the National Infrastructure Pipeline provide multi-year project visibility. However, the company faces challenges including competitive bidding that compresses margins, potential payment delays on government projects, and execution risks involving regulatory approvals and coordination with multiple agencies.

What are the main risks investors should consider before investing in Vikran Engineering?

Key risks include elevated debt burden with limited financial flexibility, persistent margin pressure due to thin profitability and competitive bidding, project execution risks involving delays and cost overruns, working capital intensity requiring sustained cash flow management, and significant stock price volatility driven by speculative trading. Additional risks involve input cost inflation that cannot be fully passed through to clients, dependence on government infrastructure spending cycles, potential policy or regulatory changes affecting project economics, and intense sector competition eroding pricing power. The stock is suitable only for investors with high risk tolerance and long-term horizons.

What factors could drive Vikran Engineering’s share price higher in the future?

Potential positive catalysts include successful execution on the existing order book demonstrating operational capabilities, gradual margin improvement through better project selection and operational efficiency, progress on balance sheet deleveraging reducing interest expense burden, securing new high-value contracts expanding the order book, expansion into higher-margin segments like renewable energy infrastructure, and positive sector sentiment driven by increased government infrastructure allocations. Institutional investor interest following strong quarterly results could provide upward momentum. However, realizing these catalysts requires sustained operational performance and favorable sector dynamics over multiple quarters.

About the Author

Nueplanet

Nueplanet is a financial content analyst specializing in Indian equity markets, with particular focus on infrastructure and engineering sector companies. With the years of experience covering mid-cap stocks and analyzing market trends, Nueplanet provides fact-based analysis sourced from official company filings, stock exchange data, and verified financial reports.

This analysis is based on publicly available information from reliable sources including NSE, BSE, company financial statements, and official market data as of October 2025. The author is committed to accuracy, transparency, and providing neutral, informative content to help investors understand market dynamics and make informed decisions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice, recommendation, or solicitation to buy or sell any securities. Investors should conduct their own research and consult with qualified financial advisors before making investment decisions. Past performance does not guarantee future results. All investments carry risks including potential loss of principal.

Published: September 03, 2025

Last Updated: September 03, 2025

Post Comment